Np1 Form

What is the NP1 Form

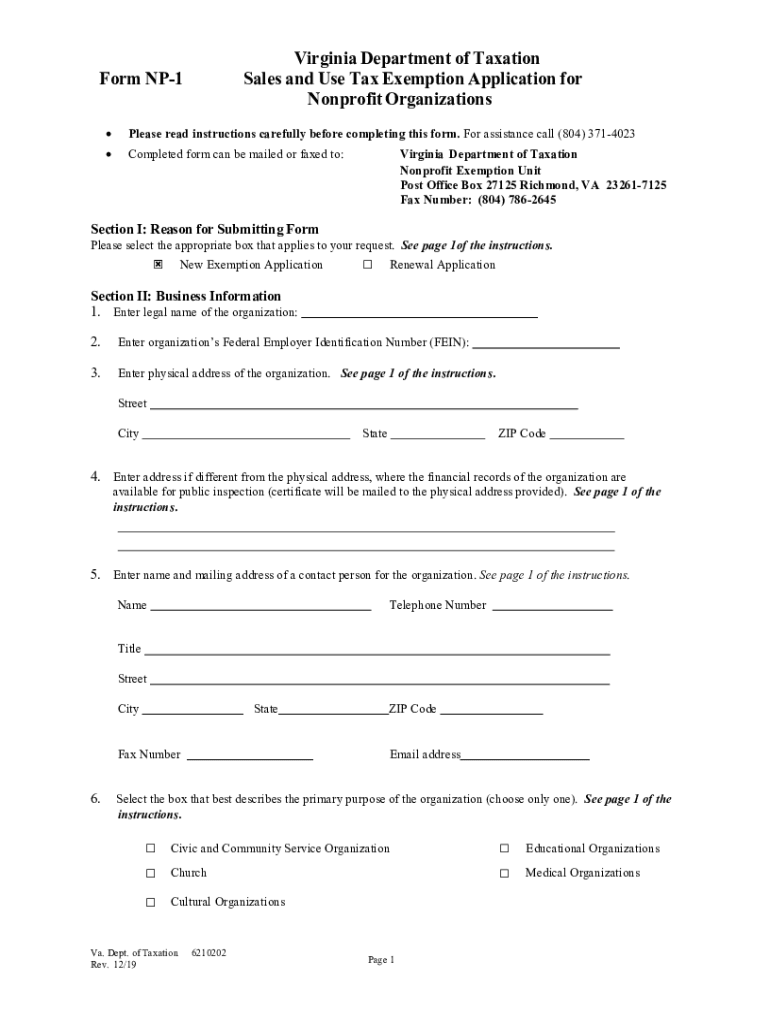

The NP1 form, also known as the Virginia NP1 form, is a crucial document used for sales tax exemption in Virginia. This form is primarily utilized by businesses and organizations that qualify for tax-exempt status under specific criteria set by the Virginia Department of Taxation. The NP1 form serves to establish that the entity is not liable for paying sales tax on certain purchases, which can significantly impact budgeting and financial planning.

How to Use the NP1 Form

To effectively use the NP1 form, individuals or organizations must first ensure they meet the eligibility criteria for tax exemption in Virginia. After confirming eligibility, the form should be filled out accurately, providing all required information, such as the name of the organization, address, and the nature of the exemption. Once completed, the NP1 form should be presented to vendors at the time of purchase to validate the tax-exempt status.

Steps to Complete the NP1 Form

Completing the NP1 form involves several key steps:

- Gather necessary information about your organization, including legal name and address.

- Identify the specific reason for the tax exemption and ensure it aligns with state regulations.

- Fill out the NP1 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to the appropriate vendor or agency as required.

Legal Use of the NP1 Form

The NP1 form is legally binding when filled out correctly and used in compliance with Virginia tax laws. It is essential for organizations to understand the legal implications of using this form, as improper use can lead to penalties or loss of tax-exempt status. Compliance with all state regulations ensures that the benefits of tax exemption are fully realized.

Required Documents

When completing the NP1 form, certain documents may be required to support the application for tax exemption. These documents can include:

- Proof of the organization’s tax-exempt status, such as a federal tax exemption letter.

- Identification documents for the individual completing the form.

- Any additional documentation that verifies the nature of the exemption.

Form Submission Methods

The NP1 form can be submitted through various methods, depending on the vendor or agency's requirements. Common submission methods include:

- In-person delivery at the point of sale.

- Mailing the completed form to the vendor or agency.

- Some vendors may accept electronic submissions, depending on their policies.

Quick guide on how to complete np1 form

Complete Np1 Form effortlessly on any device

Digital document management has gained traction among corporations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Np1 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and electronically sign Np1 Form with ease

- Locate Np1 Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your document, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate reprinting documents. airSlate SignNow caters to your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign Np1 Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the np1 form in airSlate SignNow?

The np1 form is a specific document used in airSlate SignNow for streamlining the eSigning process. It enables users to collect signatures efficiently and securely, ensuring a smooth workflow for document management.

-

How much does using the np1 form cost with airSlate SignNow?

Pricing for using the np1 form within airSlate SignNow varies based on your subscription plan. We offer different tiers to accommodate the needs of businesses, ensuring you have access to essential features for eSigning, including advanced options related to the np1 form.

-

Can I integrate the np1 form with other software?

Yes, airSlate SignNow allows for seamless integration of the np1 form with various applications. This capability ensures that you can connect your existing software tools and maintain a coherent workflow when managing documents.

-

What are the main features of the np1 form?

The np1 form includes features like customizable templates, tracking capabilities, and secure storage options. These features enhance the overall experience, making it easier for businesses to manage signed documents electronically.

-

How does the np1 form benefit my business?

Using the np1 form can signNowly improve your business's efficiency by reducing paperwork and the time spent on obtaining signatures. With its user-friendly interface, you can expedite your document processes and focus on what matters most.

-

Is the np1 form compliant with legal regulations?

Yes, the np1 form created with airSlate SignNow meets legal compliance standards for electronic signatures. This ensures that all signed documents maintain their legal validity, providing peace of mind for businesses and users.

-

Can I track the status of my np1 form?

Absolutely! airSlate SignNow provides tracking capabilities for the np1 form, allowing you to see when documents have been viewed, signed, or completed. This level of transparency helps you manage deadlines effectively.

Get more for Np1 Form

Find out other Np1 Form

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now