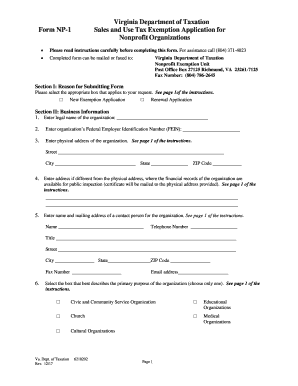

Form NP 1 Sales and Use Tax Exemption Application for Nonprofit Organizations Virginia Form NP 1 Sales and Use Tax Exemption App 2017

What is the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations?

The Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations is a crucial document for nonprofits in Virginia seeking exemption from sales and use tax. This form enables eligible organizations to apply for tax-exempt status, allowing them to purchase goods and services without incurring sales tax. Nonprofits must demonstrate that their activities align with the criteria set forth by the Virginia Department of Taxation to qualify for this exemption.

How to Use the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations

Using the Form NP-1 involves several steps. First, organizations must complete the form accurately, providing necessary details such as the nonprofit's name, address, and federal tax identification number. It is essential to include a description of the organization's activities to establish eligibility. Once completed, the form should be submitted to the Virginia Department of Taxation for review. After approval, the organization will receive a certificate confirming its tax-exempt status.

Steps to Complete the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations

Completing the Form NP-1 requires attention to detail. The following steps outline the process:

- Gather necessary documentation, including the nonprofit's federal tax ID and a description of activities.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the Virginia Department of Taxation.

Eligibility Criteria for the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations

To qualify for the sales and use tax exemption, organizations must meet specific eligibility criteria. Generally, the nonprofit must operate exclusively for charitable, educational, or religious purposes. Additionally, the organization must be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. It is crucial for applicants to provide relevant documentation that supports their eligibility when submitting the Form NP-1.

Required Documents for the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations

When applying for the sales and use tax exemption using Form NP-1, organizations must include several supporting documents. These typically include:

- A copy of the nonprofit's IRS determination letter confirming tax-exempt status.

- Bylaws or articles of incorporation that outline the organization's purpose.

- A detailed description of the activities conducted by the nonprofit.

Form Submission Methods for the Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations

The Form NP-1 can be submitted through various methods. Organizations may choose to file the application online via the Virginia Department of Taxation's website. Alternatively, the completed form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible, depending on the department's current policies and procedures.

Quick guide on how to complete form np 1 sales and use tax exemption application for nonprofit organizations virginia form np 1 sales and use tax exemption

Complete Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App with ease

- Obtain Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form np 1 sales and use tax exemption application for nonprofit organizations virginia form np 1 sales and use tax exemption

Create this form in 5 minutes!

People also ask

-

What is the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations'?

The 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations' is a document that allows nonprofit organizations in Virginia to apply for sales and use tax exemptions. This form helps qualifying nonprofits save money on purchases essential for their operations.

-

How can airSlate SignNow assist with the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations'?

airSlate SignNow simplifies the process of filling out and submitting the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations.' Our platform allows for easy eSigning and document management, making it easier for nonprofits to handle their paperwork efficiently.

-

Is airSlate SignNow suitable for all types of nonprofit organizations applying for Form NP 1?

Yes, airSlate SignNow is designed to cater to various nonprofit organizations that need to submit the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations.' Our user-friendly platform is suitable for small and large nonprofits alike.

-

What features does airSlate SignNow offer for handling the 'Form NP 1'?

airSlate SignNow offers features such as template creation, electronic signatures, and secure document sharing, all of which are invaluable for managing the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations.' These features streamline the application process and enhance collaboration among team members.

-

How much does it cost to use airSlate SignNow for the 'Form NP 1' process?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for nonprofit organizations utilizing the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations.' We offer flexible pricing options tailored to fit your budget.

-

Can airSlate SignNow integrate with other tools for managing nonprofit documents?

Yes, airSlate SignNow offers integrations with various tools that nonprofits may already be using, to enhance the management of their documents, including the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations.' These integrations help streamline workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 'Form NP 1' submission?

Using airSlate SignNow for the 'Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations' provides enhanced security, faster processing times, and improved organization of documents. This can greatly reduce the time spent on administrative tasks, allowing nonprofits to focus on their mission.

Get more for Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App

- Sample letter for request to be relocated form

- Sample letter responses form

- Agreement to design and construct software 497331786 form

- Installation agreement form

- Lease of store in hotel form

- Reservation form 497331789

- License tattoo form

- Private annuity agreement with payments to last for life of annuitant form

Find out other Form NP 1 Sales And Use Tax Exemption Application For Nonprofit Organizations Virginia Form NP 1 Sales And Use Tax Exemption App

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter