Ga Department of Revenue Form 530 2012

What is the Ga Department Of Revenue Form 530

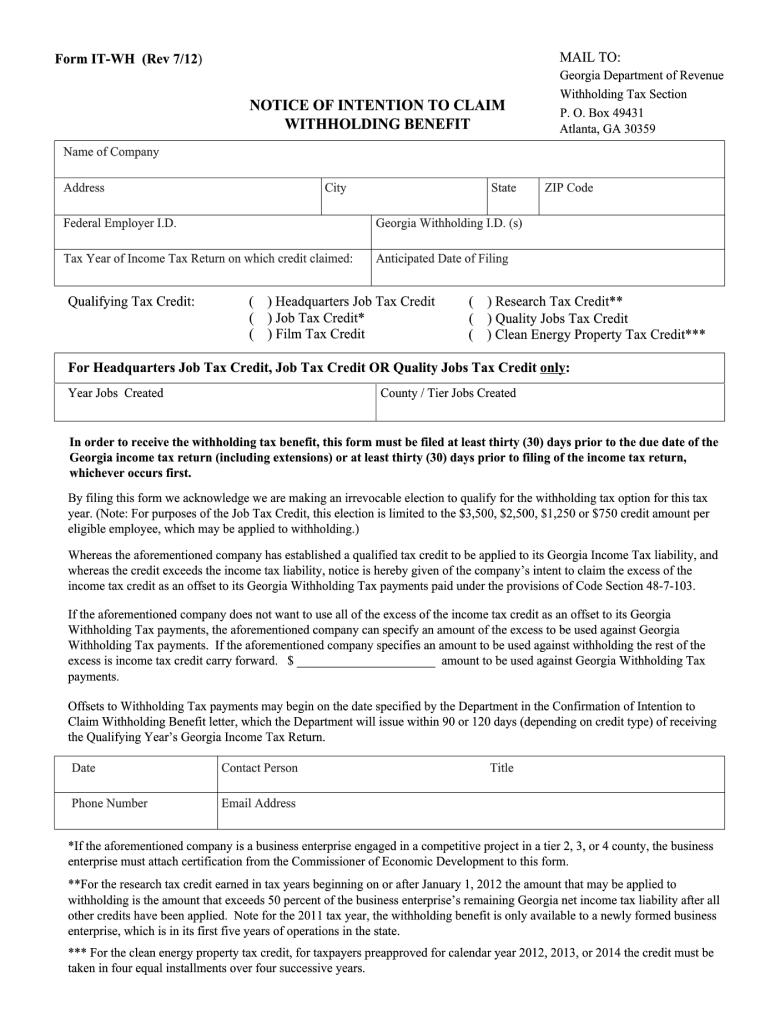

The Ga Department of Revenue Form 530 is a tax form used by individuals and businesses in Georgia to report specific financial information. This form is essential for ensuring compliance with state tax regulations. It typically involves reporting income, deductions, and credits, which are crucial for accurate tax calculations. Understanding the purpose of this form helps taxpayers fulfill their obligations while maximizing potential tax benefits.

How to use the Ga Department Of Revenue Form 530

Using the Ga Department of Revenue Form 530 involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it. This form can be filed electronically or via mail, depending on your preference and the specific requirements set by the Georgia Department of Revenue.

Steps to complete the Ga Department Of Revenue Form 530

Completing the Ga Department of Revenue Form 530 requires a systematic approach. Begin by downloading the latest version of the form from the official website. Next, follow these steps:

- Enter your personal and business information in the designated fields.

- Report your income accurately, including wages, dividends, and any other sources.

- List all applicable deductions and credits to reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ga Department Of Revenue Form 530

The legal use of the Ga Department of Revenue Form 530 is governed by state tax laws. This form must be completed in accordance with the guidelines provided by the Georgia Department of Revenue. Failing to adhere to these regulations can result in penalties or delays in processing. It is crucial for taxpayers to ensure that the form is used correctly to maintain compliance and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Ga Department of Revenue Form 530 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines based on their tax structure. Staying informed about these important dates helps ensure timely submissions and compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Ga Department of Revenue Form 530 can be submitted through various methods. Taxpayers have the option to file online using the Georgia Department of Revenue's e-filing system, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address listed on the form or submitted in person at designated tax offices. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete ga department of revenue form 530

Your assistance manual on how to prepare your Ga Department Of Revenue Form 530

If you’re looking to understand how to finalize and submit your Ga Department Of Revenue Form 530, here are some straightforward instructions on how to simplify tax submission.

To get going, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that allows you to modify, draft, and complete your tax documents with ease. With its editor, you can alternate between text, check boxes, and electronic signatures, and revisit to amend details when necessary. Enhance your tax management with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to finalize your Ga Department Of Revenue Form 530 in just a few minutes:

- Create your account and begin handling PDFs within moments.

- Utilize our directory to locate any IRS tax document; browse through versions and schedules.

- Click Get form to access your Ga Department Of Revenue Form 530 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized electronic signature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please remember that submitting in paper form may lead to increased return errors and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ga department of revenue form 530

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the ga department of revenue form 530

How to generate an electronic signature for your Ga Department Of Revenue Form 530 online

How to generate an electronic signature for the Ga Department Of Revenue Form 530 in Chrome

How to make an electronic signature for signing the Ga Department Of Revenue Form 530 in Gmail

How to create an eSignature for the Ga Department Of Revenue Form 530 straight from your smart phone

How to make an electronic signature for the Ga Department Of Revenue Form 530 on iOS

How to generate an eSignature for the Ga Department Of Revenue Form 530 on Android OS

People also ask

-

What is the Ga Department Of Revenue Form 530?

The Ga Department Of Revenue Form 530 is a tax document used for certain tax purposes in Georgia. It is essential for businesses and individuals to accurately fill out this form to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and manage your Ga Department Of Revenue Form 530 online.

-

How can airSlate SignNow help with the Ga Department Of Revenue Form 530?

airSlate SignNow streamlines the process of completing the Ga Department Of Revenue Form 530 by allowing users to fill out, eSign, and share the document electronically. This reduces the risk of errors and ensures that your form is submitted on time. Additionally, our platform provides templates to simplify form filling.

-

Is there a cost associated with using airSlate SignNow for the Ga Department Of Revenue Form 530?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that fits your budget while gaining access to features that facilitate the handling of the Ga Department Of Revenue Form 530. We also offer a free trial to help you explore our services without any risk.

-

Can I integrate airSlate SignNow with other applications while working on the Ga Department Of Revenue Form 530?

Absolutely! airSlate SignNow supports integration with a variety of applications, making it easy to incorporate the Ga Department Of Revenue Form 530 into your existing workflows. Whether you use CRM systems, document management tools, or cloud storage services, our platform can enhance your productivity.

-

What are the benefits of using airSlate SignNow for the Ga Department Of Revenue Form 530?

Using airSlate SignNow for the Ga Department Of Revenue Form 530 offers several advantages, including increased efficiency, reduced paperwork, and improved document security. Our eSigning solution ensures that your form is legally binding and can be accessed from anywhere, which is especially convenient for busy professionals.

-

How secure is the information entered on the Ga Department Of Revenue Form 530 when using airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption methods to protect your information while completing the Ga Department Of Revenue Form 530. We comply with industry standards to ensure that your data remains confidential and secure throughout the signing process.

-

Do I need any technical skills to use airSlate SignNow for the Ga Department Of Revenue Form 530?

No, you do not need any technical skills to use airSlate SignNow for the Ga Department Of Revenue Form 530. Our user-friendly interface allows anyone to easily navigate the platform, fill out forms, and eSign documents without any hassle, making it accessible for users of all skill levels.

Get more for Ga Department Of Revenue Form 530

Find out other Ga Department Of Revenue Form 530

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe