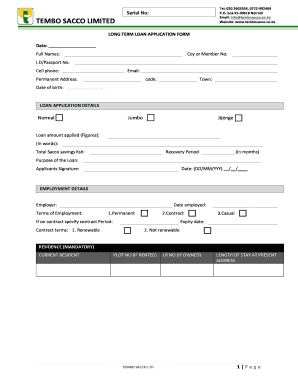

Tembo Sacco Form

What is the Tembo Sacco

The Tembo Sacco is a financial cooperative that provides its members with access to various loan products, including personal loans and savings options. Sacco stands for Savings and Credit Cooperative Organization, which is designed to offer affordable credit to its members while promoting savings habits. Members typically join the Tembo Sacco to benefit from lower interest rates compared to traditional banks, as well as to participate in a community-focused financial model.

Steps to complete the Tembo Sacco

Completing the Tembo loan application form involves several straightforward steps. First, gather all necessary personal and financial information, including identification documents, proof of income, and any other relevant financial statements. Next, access the Tembo loan application form through the Tembo Sacco portal. Fill in the required fields accurately, ensuring that all information matches your supporting documents. After completing the form, review it for any errors before submitting it electronically. Finally, keep a copy of the submitted application for your records.

Eligibility Criteria

To qualify for a Tembo loan, applicants must meet specific eligibility criteria set by the Tembo Sacco. Generally, these criteria include being a registered member of the Sacco, demonstrating a stable source of income, and having a good credit history. Some loan products may also require a minimum savings balance within the Sacco. It is advisable to check the specific requirements for the type of loan you are applying for, as these can vary.

Required Documents

When applying for a Tembo loan, certain documents are typically required to support your application. These may include:

- Valid identification (such as a driver's license or passport)

- Proof of income (such as pay stubs or tax returns)

- Bank statements for the last three to six months

- Any additional documentation requested by the Sacco

Having these documents ready can help streamline the application process and improve your chances of approval.

Form Submission Methods

The Tembo loan application form can be submitted through various methods, ensuring convenience for all applicants. The primary method is online submission via the Tembo Sacco portal, which allows for quick processing. Alternatively, applicants may choose to submit their forms by mail or in person at designated Sacco branches. Each method has its own timeline for processing, so it is important to consider which option best suits your needs.

Legal use of the Tembo Sacco

The Tembo Sacco operates under specific legal frameworks that govern financial cooperatives in the United States. These regulations ensure that the Sacco adheres to standards for transparency, member rights, and fair lending practices. By complying with these laws, the Tembo Sacco can provide a secure and reliable service to its members, making it a trustworthy option for those seeking financial assistance.

Quick guide on how to complete tembo sacco

Complete Tembo Sacco effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Tembo Sacco on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Tembo Sacco with ease

- Locate Tembo Sacco and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to store your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign Tembo Sacco and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tembo loan and how does it work?

A Tembo loan is a financial product designed to help individuals secure funding for various needs. The process involves applying for the loan, where you can specify the amount and purpose. Once approved, funds are disbursed to your account, making it easier to manage your financial responsibilities.

-

What are the benefits of choosing a Tembo loan?

Choosing a Tembo loan offers several benefits, such as fast approval times and competitive interest rates. It can provide you with the flexibility to cover unexpected expenses or investments. With a Tembo loan, you can access funds quickly and efficiently, allowing you to take control of your financial situation.

-

Are there any fees associated with a Tembo loan?

Yes, like most loan products, a Tembo loan may include associated fees such as origination fees or late payment penalties. It's important to review the terms and conditions carefully to understand any costs linked to your loan. By being informed, you can effectively manage your loan and avoid unexpected charges.

-

What documents do I need to apply for a Tembo loan?

To apply for a Tembo loan, you'll typically need to provide personal identification, proof of income, and details about your financial situation. Depending on the lender, additional documentation may be required. Having these documents ready can streamline the application process and increase your chances of approval.

-

How can I repay my Tembo loan?

Repaying your Tembo loan can usually be done through various methods, including online payments, direct bank transfers, or checks. Lenders often provide flexible repayment options to suit your financial situation. Make sure to keep track of your repayment schedule to avoid any penalties or negatively impacting your credit score.

-

Can I get a Tembo loan with bad credit?

Many lenders offer Tembo loans tailored for individuals with bad credit, though terms may vary. Options might include higher interest rates or secured loans, which require collateral. It's advisable to shop around and compare lenders to find the best solution for your specific credit situation.

-

Is the application process for a Tembo loan complicated?

The application process for a Tembo loan is generally straightforward and user-friendly. Many lenders offer online applications that you can complete in just a few minutes. This ensures a quick submission, allowing you to get responses faster and moving closer to securing your funds.

Get more for Tembo Sacco

- Warning of default on commercial lease tennessee form

- Warning of default on residential lease tennessee form

- Landlord tenant closing statement to reconcile security deposit tennessee form

- Name change form 497326877

- Name change notification form tennessee

- Tn statement property form

- Commercial building or space lease tennessee form

- Tennessee relative caretaker legal documents package tennessee form

Find out other Tembo Sacco

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast