P11d B Form 21 PDF

What is the P11d B Form 21 PDF

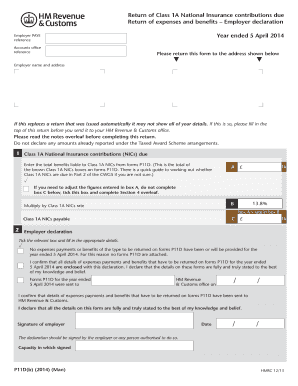

The P11d B form is a crucial document used in the United States for reporting benefits and expenses provided to employees. This form captures details about taxable benefits that employers must report to the Internal Revenue Service (IRS). The P11d B form 21 PDF serves as a standardized format that simplifies the process of documenting these benefits, ensuring compliance with tax regulations. It is essential for both employers and employees to understand the implications of this form, as it directly affects tax liabilities and reporting obligations.

How to use the P11d B Form 21 PDF

Using the P11d B form 21 PDF involves several steps to ensure accurate completion and submission. First, download the form from a reliable source. Next, gather all necessary information regarding employee benefits and expenses. Carefully fill out the form, ensuring that all fields are completed accurately to avoid discrepancies. Once completed, review the form for any errors before submitting it to the IRS. It is advisable to keep a copy for your records, as this may be required for future reference or audits.

Steps to complete the P11d B Form 21 PDF

Completing the P11d B form 21 PDF requires attention to detail. Follow these steps:

- Download the form from a trusted source.

- Gather information on all employee benefits provided during the tax year.

- Fill in the employee details, including name, address, and Social Security number.

- Document the nature of the benefits and their corresponding values.

- Review the completed form for accuracy.

- Submit the form to the IRS by the specified deadline.

Legal use of the P11d B Form 21 PDF

The P11d B form 21 PDF is legally binding when completed according to IRS guidelines. It must accurately reflect the benefits provided to employees to ensure compliance with tax laws. Failure to report these benefits can lead to penalties and legal repercussions for the employer. Additionally, electronic signatures on the form are recognized as valid under the Electronic Signatures in Global and National Commerce Act (ESIGN), provided that all legal requirements are met.

Filing Deadlines / Important Dates

Timely filing of the P11d B form is crucial to avoid penalties. The IRS typically sets specific deadlines for submission each tax year. Employers should be aware of these dates to ensure compliance. Generally, the form must be filed by the end of the tax year, with extensions available under certain conditions. Keeping track of these deadlines helps maintain good standing with tax authorities and avoids unnecessary fines.

Required Documents

To complete the P11d B form 21 PDF, several documents are necessary. Employers should gather:

- Employee records detailing benefits provided.

- Financial statements reflecting expenses related to employee benefits.

- Any previous tax forms that may influence the current reporting.

Having these documents on hand ensures a smooth completion process and helps prevent errors.

Quick guide on how to complete p11d b form 2020 21 pdf

Complete P11d B Form 21 Pdf easily on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly, without any delays. Manage P11d B Form 21 Pdf on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign P11d B Form 21 Pdf effortlessly

- Locate P11d B Form 21 Pdf and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign P11d B Form 21 Pdf and ensure effective communication at every stage of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the p11d b form to print?

The p11d b form to print is a document that employers must submit to the HMRC, detailing the taxable benefits provided to employees. This form is crucial for accurate tax assessments and should be filled out correctly to avoid potential penalties.

-

How can I obtain a p11d b form to print?

You can easily obtain a p11d b form to print by visiting the official HMRC website or by using streamlined document solutions such as airSlate SignNow. With our service, you can access the form quickly and ensure it is filled out correctly.

-

Can airSlate SignNow help in completing the p11d b form to print?

Yes, airSlate SignNow provides tools to assist users in filling out the p11d b form to print efficiently. Our platform features customizable templates and eSignature capabilities, making the process seamless and user-friendly.

-

Is there a cost associated with using airSlate SignNow for the p11d b form to print?

While airSlate SignNow offers competitive pricing, specific costs depend on the plan you choose. Our cost-effective solution ensures you receive the best value for managing documents like the p11d b form to print without breaking your budget.

-

What are the benefits of using airSlate SignNow for the p11d b form to print?

Using airSlate SignNow for the p11d b form to print offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our intuitive platform simplifies the completion and submission process, allowing you to focus on your core business activities.

-

Does airSlate SignNow integrate with other software for the p11d b form to print?

Absolutely! airSlate SignNow offers various integrations with popular software to streamline your workflow. This means you can easily manage your p11d b form to print alongside other business processes without hassle.

-

How secure is airSlate SignNow for handling the p11d b form to print?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies and secure cloud storage to ensure your p11d b form to print and other sensitive documents are protected against unauthorized access.

Get more for P11d B Form 21 Pdf

- Revocation of anatomical gift donation tennessee form

- Tn termination form

- Newly widowed individuals package tennessee form

- Employment interview package tennessee form

- Employment employee personnel file package tennessee form

- Assignment of mortgage package tennessee form

- Assignment of lease package tennessee form

- Lease purchase agreements package tennessee form

Find out other P11d B Form 21 Pdf

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself