Interest Venture Form

What is the assignment venture?

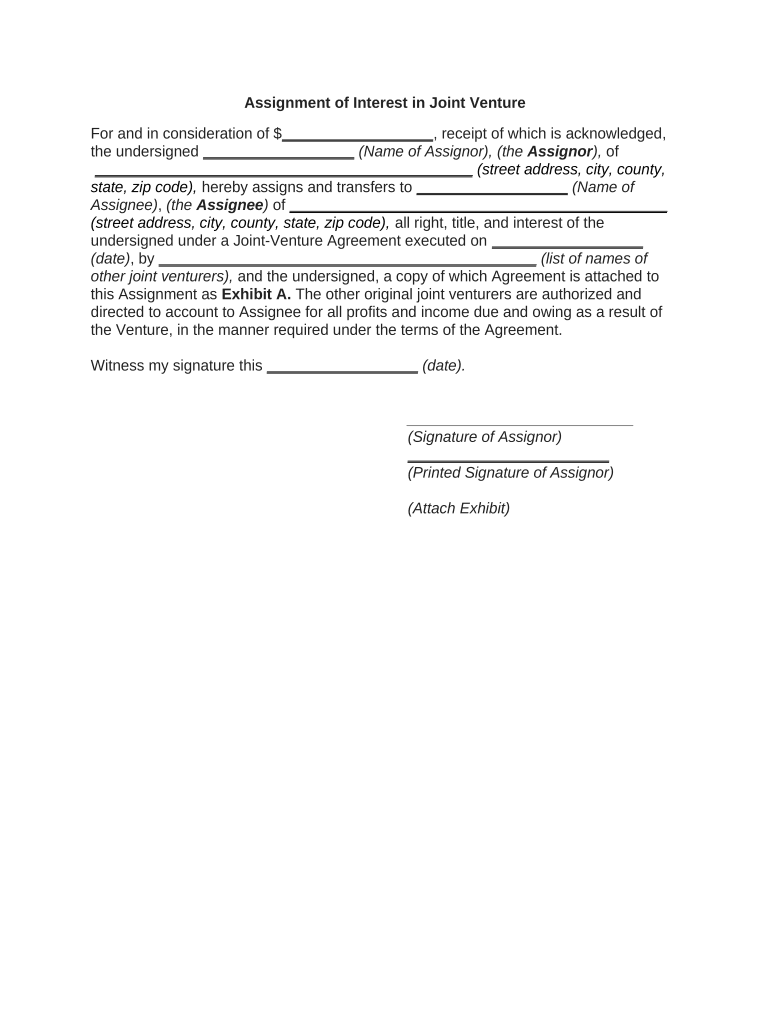

The assignment venture is a legal document that facilitates the transfer of rights or interests from one party to another. It is commonly used in various contexts, such as business agreements, real estate transactions, and financial arrangements. This form outlines the specifics of the assignment, including the parties involved, the nature of the interest being assigned, and any conditions or limitations that apply. Understanding the assignment venture is crucial for ensuring that all parties are aware of their rights and obligations under the agreement.

How to use the assignment venture

Using the assignment venture involves several key steps to ensure that the document is completed accurately and legally. First, identify the parties involved in the assignment and clearly define the interest being transferred. Next, fill out the form with all required information, including the terms of the assignment and any relevant dates. It is essential to have all parties review the document for accuracy before signing. Once completed, the assignment venture should be signed by all parties to make it legally binding.

Steps to complete the assignment venture

Completing the assignment venture requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary information about the parties and the interest being assigned.

- Fill out the assignment venture form, ensuring all fields are completed accurately.

- Review the document for any errors or omissions.

- Have all parties sign the document, either electronically or in person.

- Distribute copies of the signed assignment venture to all parties involved.

Legal use of the assignment venture

The assignment venture is legally valid when it meets specific criteria. To ensure compliance with U.S. law, the document must include the signatures of all parties involved and clearly outline the terms of the assignment. Additionally, it should adhere to relevant state laws governing assignments. Utilizing a reliable electronic signature solution can enhance the legal standing of the document by providing an audit trail and ensuring compliance with regulations such as the ESIGN Act and UETA.

Key elements of the assignment venture

Several key elements must be included in the assignment venture to ensure its effectiveness:

- Parties involved: Clearly identify all parties participating in the assignment.

- Description of the interest: Provide a detailed description of the rights or interests being assigned.

- Terms and conditions: Outline any specific terms or conditions that apply to the assignment.

- Signatures: Ensure that all parties sign the document to validate the assignment.

Examples of using the assignment venture

The assignment venture can be utilized in various scenarios, including:

- Transferring ownership rights in real estate transactions.

- Assigning contractual rights in business agreements.

- Transferring financial interests, such as shares in a company.

Each example highlights the versatility of the assignment venture in facilitating legal transfers of interest across different contexts.

Quick guide on how to complete interest venture

Easily Prepare Interest Venture on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers a suitable environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it digitally. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and seamlessly. Handle Interest Venture on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Easily Edit and eSign Interest Venture

- Locate Interest Venture and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and is as legally binding as a traditional handwritten signature.

- Review the details carefully and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Interest Venture and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment venture and how does airSlate SignNow facilitate it?

An assignment venture refers to the process of assigning tasks and responsibilities within a project. airSlate SignNow simplifies this by allowing users to create, send, and eSign documents efficiently, ensuring that all assignments are executed smoothly and tracked effectively.

-

How much does it cost to use airSlate SignNow for my assignment venture?

Pricing for airSlate SignNow varies based on the plan you choose. Each plan offers features tailored to enhance your assignment venture, making it a cost-effective solution for businesses of all sizes.

-

What features make airSlate SignNow ideal for managing assignment ventures?

airSlate SignNow includes important features like customizable templates, real-time tracking, and automated workflows that streamline the entire assignment venture process. These functionalities ensure collaboration and accountability among team members.

-

Can airSlate SignNow integrate with other tools for my assignment venture?

Yes, airSlate SignNow integrates seamlessly with numerous applications, including CRMs and project management tools. This integration helps you manage your assignment venture more effectively by centralizing your workflow and reducing manual tasks.

-

What are the benefits of using airSlate SignNow for an assignment venture?

Using airSlate SignNow for your assignment venture provides benefits such as increased efficiency, reduced turnaround time for document signing, and enhanced security for sensitive information. These advantages ultimately lead to more successful project completions.

-

Is there a mobile app available for airSlate SignNow to manage assignment ventures on the go?

Yes, airSlate SignNow has a mobile app that allows you to manage your assignment venture from anywhere. The app provides all the essential features, enabling you to send and eSign documents while on the move.

-

How does airSlate SignNow ensure the security of my assignment venture documents?

airSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect your assignment venture documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Interest Venture

Find out other Interest Venture

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now