Pension 5 Back Form

What is the Pension 5 Back

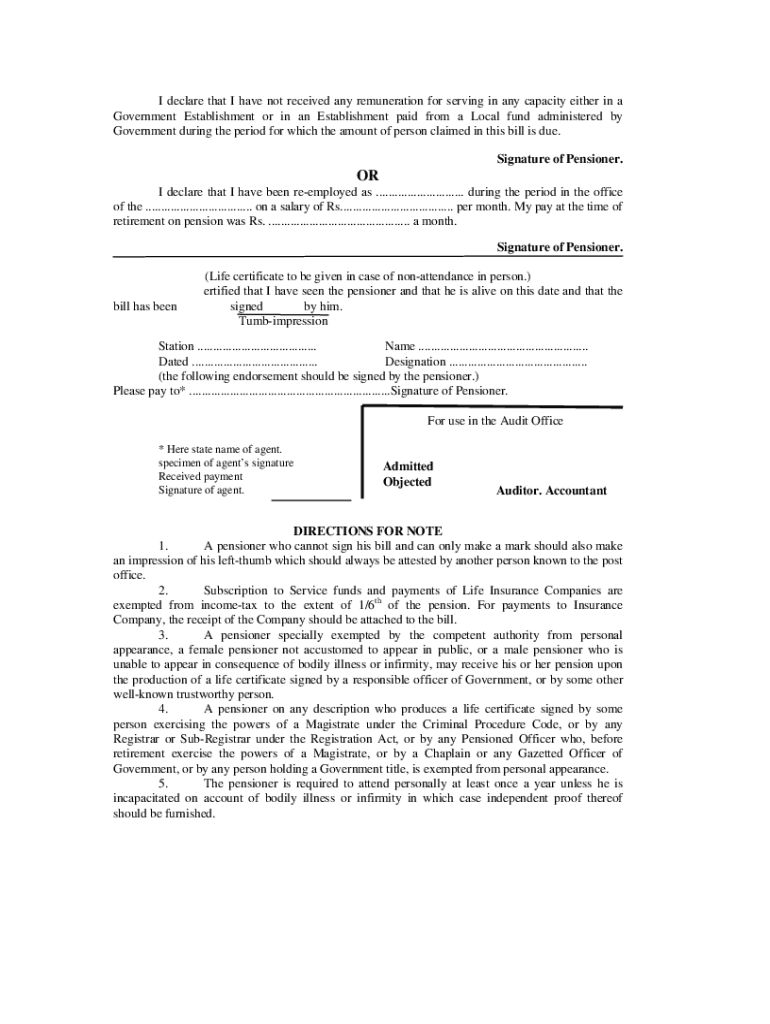

The Pension 5 Back form is a specific document used in the context of pension plans, particularly in the United States. It serves to facilitate the transfer or rollover of pension benefits from one plan to another. This form is essential for individuals who wish to consolidate their retirement savings or change their pension provider. Understanding the purpose and requirements of the Pension 5 Back form is crucial for ensuring that the transfer process is executed smoothly and complies with relevant regulations.

Steps to complete the Pension 5 Back

Completing the Pension 5 Back form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect all relevant details about your current pension plan, including account numbers and provider information.

- Fill out the form: Carefully enter your personal information, including your name, address, and Social Security number, as required.

- Specify the transfer details: Indicate the amount you wish to transfer and the receiving pension plan's information.

- Review the form: Double-check all entries for accuracy to prevent delays in processing.

- Sign and date: Ensure that you sign the form, as an unsigned document may not be accepted.

- Submit the form: Follow the submission guidelines provided by your pension plan, whether online, by mail, or in person.

Legal use of the Pension 5 Back

The legal validity of the Pension 5 Back form hinges on compliance with federal and state regulations governing pension transfers. To be considered legally binding, the form must be completed accurately and signed by the individual initiating the transfer. Using a reliable electronic signature solution, such as airSlate SignNow, can enhance the legal standing of the document by providing a secure and verifiable signature. Additionally, adherence to the ESIGN Act and UETA ensures that electronic signatures are recognized in the same manner as traditional handwritten signatures.

Required Documents

When completing the Pension 5 Back form, certain documents may be required to support your application. These typically include:

- Identification: A government-issued ID, such as a driver's license or passport, to verify your identity.

- Pension plan statements: Recent statements from your current and new pension plans to provide accurate account information.

- Proof of residency: Documentation that confirms your current address, which may include utility bills or bank statements.

Examples of using the Pension 5 Back

There are various scenarios where individuals may utilize the Pension 5 Back form. For instance:

- A person changing jobs may wish to transfer their pension benefits from their previous employer's plan to their new employer's plan.

- An individual seeking to consolidate multiple pension accounts into a single plan for easier management and tracking.

- A retiree may use the form to roll over their pension benefits into an Individual Retirement Account (IRA) to take advantage of different investment options.

Eligibility Criteria

To use the Pension 5 Back form, individuals must meet specific eligibility criteria set forth by their pension plans. Generally, these criteria include:

- Being a participant in a qualified pension plan.

- Meeting any age or service requirements specified by the pension provider.

- Having a vested interest in the pension benefits, meaning the individual has earned the right to the benefits based on their service.

Quick guide on how to complete pension 5 back

Effortlessly Prepare Pension 5 Back on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Pension 5 Back on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Pension 5 Back with Ease

- Locate Pension 5 Back and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Put an end to lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow streamlines all your document management needs with just a few clicks from any device you prefer. Modify and eSign Pension 5 Back and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Pension 5 Back feature in airSlate SignNow?

The Pension 5 Back feature in airSlate SignNow allows users to include a flexible signature option for pension plan documents. This feature ensures compliance and authenticity, making it easier for businesses to manage pension-related documents securely and efficiently.

-

How much does airSlate SignNow's Pension 5 Back service cost?

airSlate SignNow offers competitive pricing plans based on your business needs, including options that utilize the Pension 5 Back feature. Users can choose from monthly or annual subscriptions, and there's even a free trial available to explore all functionalities before committing.

-

What are the key benefits of using airSlate SignNow with Pension 5 Back?

Using airSlate SignNow with the Pension 5 Back feature enhances document security and ensures quick execution of signatures. This leads to improved workflow efficiency and reliability in managing pension documents, ultimately saving time and reducing administrative burdens.

-

Can Pension 5 Back be integrated with other software?

Yes, airSlate SignNow's Pension 5 Back is designed to integrate seamlessly with a variety of software solutions. This includes CRM systems, document management tools, and other applications that help streamline your business processes.

-

Is the Pension 5 Back feature user-friendly?

Absolutely! The Pension 5 Back feature is built with user experience in mind, allowing users to send and eSign pension documents with minimal effort. Its intuitive interface ensures that both tech-savvy and less experienced users can navigate the platform easily.

-

How does airSlate SignNow ensure the security of Pension 5 Back documents?

airSlate SignNow prioritizes security for all documents, including those signed using the Pension 5 Back feature. The platform employs industry-standard encryption methods and complies with regulatory requirements to protect sensitive information throughout the signing process.

-

What types of documents can I use with the Pension 5 Back feature?

The Pension 5 Back feature can be utilized for various pension-related documents, including pension plan enrollment forms, benefit change requests, and more. This versatility ensures that airSlate SignNow can cater to all your document signing needs in the pension sector.

Get more for Pension 5 Back

Find out other Pension 5 Back

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document