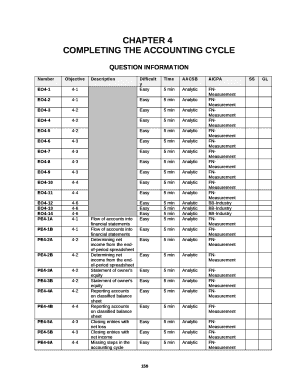

Chapter 4 Accounting Cycle Form

What is the Chapter 4 Accounting Cycle

The chapter 4 accounting cycle refers to a systematic process that businesses follow to record, classify, and summarize financial transactions. This cycle is crucial for maintaining accurate financial records and ensuring compliance with accounting standards. It typically includes steps such as analyzing transactions, journalizing entries, posting to ledgers, and preparing financial statements. Understanding this cycle helps businesses manage their finances effectively and make informed decisions.

Steps to complete the Chapter 4 Accounting Cycle

Completing the chapter 4 accounting cycle involves several key steps:

- Identify Transactions: Recognize and document all financial transactions that impact the business.

- Journalize Entries: Record transactions in the journal, detailing the date, accounts affected, and amounts.

- Post to Ledger: Transfer journal entries to the appropriate accounts in the general ledger.

- Prepare Trial Balance: Compile a trial balance to ensure that debits equal credits.

- Adjust Entries: Make necessary adjustments for accrued and deferred items to reflect accurate financial status.

- Prepare Financial Statements: Generate income statements, balance sheets, and cash flow statements.

- Close Accounts: Close temporary accounts to prepare for the next accounting period.

Legal use of the Chapter 4 Accounting Cycle

The legal use of the chapter 4 accounting cycle is essential for businesses to ensure compliance with financial regulations. Accurate accounting practices help avoid legal issues related to tax reporting and financial disclosures. Businesses must adhere to the Generally Accepted Accounting Principles (GAAP) and relevant federal and state laws. This compliance not only protects the organization but also builds trust with stakeholders and regulatory bodies.

Key elements of the Chapter 4 Accounting Cycle

Several key elements are integral to the chapter 4 accounting cycle:

- Transaction Analysis: Understanding the nature of each transaction and its impact on financial statements.

- Documentation: Maintaining accurate records and supporting documents for all transactions.

- Internal Controls: Implementing procedures to safeguard assets and ensure the integrity of financial reporting.

- Financial Reporting: Preparing timely and accurate financial statements for stakeholders.

Examples of using the Chapter 4 Accounting Cycle

Examples of the chapter 4 accounting cycle in action can vary by industry. For instance, a retail business may track sales transactions daily, while a service-based company might focus on billing clients for services rendered. Each example illustrates how the cycle adapts to different business models, ensuring that financial data is accurately captured and reported for decision-making purposes.

Digital vs. Paper Version

When comparing digital and paper versions of the chapter 4 accounting cycle, digital methods offer several advantages. Digital tools streamline data entry, enhance accuracy, and facilitate easier access to financial records. Additionally, eSignature solutions can be integrated for signing necessary documents electronically, which supports compliance and efficiency. In contrast, paper methods may involve more manual processes and increased risk of errors.

Quick guide on how to complete chapter 4 accounting cycle

Prepare Chapter 4 Accounting Cycle effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Chapter 4 Accounting Cycle on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Chapter 4 Accounting Cycle effortlessly

- Find Chapter 4 Accounting Cycle and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Chapter 4 Accounting Cycle to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the chapter 4 accounting cycle and how does airSlate SignNow help with it?

The chapter 4 accounting cycle involves the steps of recording, classifying, and summarizing financial transactions. airSlate SignNow streamlines this process by allowing businesses to eSign and manage documents digitally, ensuring compliance and accuracy throughout the accounting cycle.

-

How can airSlate SignNow improve the efficiency of the chapter 4 accounting cycle?

By using airSlate SignNow, businesses can automate document workflows related to the chapter 4 accounting cycle. This saves time, reduces errors, and enhances collaboration among team members, allowing for quicker financial reporting and analysis.

-

Is airSlate SignNow cost-effective for managing the chapter 4 accounting cycle?

Yes, airSlate SignNow offers a cost-effective solution for managing the chapter 4 accounting cycle. With flexible pricing plans, companies can choose options that fit their budget while still benefiting from efficient eSignature and document management tools.

-

What features does airSlate SignNow provide for the chapter 4 accounting cycle?

airSlate SignNow provides features such as customizable templates, bulk sending, and automated reminders that facilitate the chapter 4 accounting cycle. These features help ensure documents are processed swiftly and accurately, aiding in timely financial closing.

-

Does airSlate SignNow integrate with accounting software for the chapter 4 accounting cycle?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This integration enhances the chapter 4 accounting cycle by allowing data to flow smoothly between systems, thereby eliminating manual entry and improving overall accuracy.

-

What are the benefits of using airSlate SignNow during the chapter 4 accounting cycle?

Using airSlate SignNow during the chapter 4 accounting cycle offers benefits such as increased productivity and better document management. It also enhances security with advanced eSigning technology, ensuring that sensitive financial documents are protected.

-

Can airSlate SignNow help with compliance in the chapter 4 accounting cycle?

Absolutely, airSlate SignNow helps maintain compliance in the chapter 4 accounting cycle by providing a secure platform for eSigning documents and tracking changes. This ensures that all financial processes adhere to industry regulations and standards.

Get more for Chapter 4 Accounting Cycle

Find out other Chapter 4 Accounting Cycle

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT