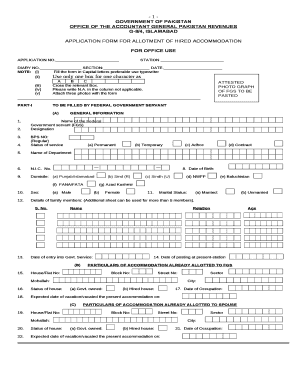

OFFICE of the ACCOUNTANT GENERAL PAKISTAN REVENUES Form

What is the Form PAYF06?

The Form PAYF06 is a specific document used for reporting and compliance purposes within the United States. This form is typically associated with payroll and tax reporting, ensuring that businesses meet their obligations regarding employee compensation and tax withholdings. Understanding the purpose and requirements of Form PAYF06 is essential for both employers and employees to ensure accurate reporting and compliance with federal and state regulations.

Steps to Complete the Form PAYF06

Completing the Form PAYF06 involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including employee details, tax identification numbers, and payroll data.

- Fill in the required fields accurately, ensuring that all information is current and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person, depending on the requirements.

Legal Use of the Form PAYF06

The Form PAYF06 holds legal significance as it serves as an official record of payroll and tax-related information. For the form to be legally binding, it must be completed accurately and submitted in accordance with applicable laws and regulations. Compliance with federal and state guidelines ensures that the form is recognized in legal contexts, protecting both employers and employees from potential disputes.

Filing Deadlines / Important Dates

Timely filing of the Form PAYF06 is crucial to avoid penalties and ensure compliance. Important deadlines typically include:

- Quarterly submission deadlines for payroll taxes.

- Annual filing deadlines for year-end summaries.

- Specific state deadlines that may vary based on local regulations.

Staying informed about these dates helps businesses maintain compliance and avoid unnecessary penalties.

Required Documents for Form PAYF06

To complete the Form PAYF06, certain documents are necessary. These may include:

- Employee payroll records, including hours worked and wages paid.

- Tax identification numbers for both the employer and employees.

- Any relevant tax forms or documentation that support the information reported on the form.

Having these documents ready can streamline the completion process and ensure accuracy.

Form Submission Methods

Submitting the Form PAYF06 can be done through various methods, depending on the requirements set forth by the governing tax authority. Common submission methods include:

- Online submission through designated government portals.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at local tax offices or designated locations.

Each method has its own guidelines and timelines, so it is important to choose the one that best fits your needs.

Quick guide on how to complete office of the accountant general pakistan revenues

Effortlessly prepare OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES on any device

The management of documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

Steps to modify and eSign OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES effortlessly

- Obtain OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form payf06 and how does it work?

The form payf06 is part of airSlate SignNow's suite of document signing tools. It allows users to create, send, and electronically sign documents easily, enhancing workflow efficiency. With its user-friendly interface, businesses can handle the entire signing process online, streamlining operations.

-

What are the key features of the form payf06?

The form payf06 offers features such as customizable templates, secure cloud storage, and real-time tracking of document status. It also includes multi-party signing, allowing multiple users to sign documents simultaneously. These features ensure that businesses can manage their document signing needs effectively.

-

Is the form payf06 cost-effective for small businesses?

Yes, the form payf06 is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its pricing plans are competitive and flexible, offering scalable options that meet varying needs without compromising on features. This makes it an ideal choice for budget-conscious organizations.

-

How does the form payf06 integrate with other applications?

The form payf06 integrates seamlessly with various applications and platforms to enhance productivity. Whether you're using CRM systems, project management tools, or cloud storage solutions, integration options are available to ensure smooth workflows. Check our integration page for a full list of compatible applications.

-

What security measures are in place for the form payf06?

Security is a top priority with the form payf06, which utilizes advanced encryption methods to protect sensitive data. Compliance with industry standards such as GDPR and HIPAA ensures that your documents and signatures are safe. airSlate SignNow prioritizes safeguarding user information throughout the signing process.

-

Can I customize templates using the form payf06?

Absolutely! The form payf06 allows users to create and customize templates tailored to their specific needs. You can edit fields, add branding elements, and set up workflows to match your business processes. This adaptability makes it easier for teams to maintain consistency in their documentation.

-

What are the benefits of using the form payf06 for document management?

Using the form payf06 simplifies document management by reducing paper usage and speeding up the signing process. It enhances collaboration among team members and clients by enabling real-time updates and notifications. This not only boosts efficiency but also gives businesses a professional edge in document handling.

Get more for OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES

- Disability self employed form

- Home repair form

- Recovery self employed form

- Landscaping contract form

- Outdoor play equipment installation and repair services contract self employed form

- Installation services contract form

- Specialty services contact self employed form

- Appliance refinish services contract self employed form

Find out other OFFICE OF THE ACCOUNTANT GENERAL PAKISTAN REVENUES

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT