Request for Waiver from Public Disclosure of Tax Preference Form

What is the Request For Waiver From Public Disclosure Of Tax Preference

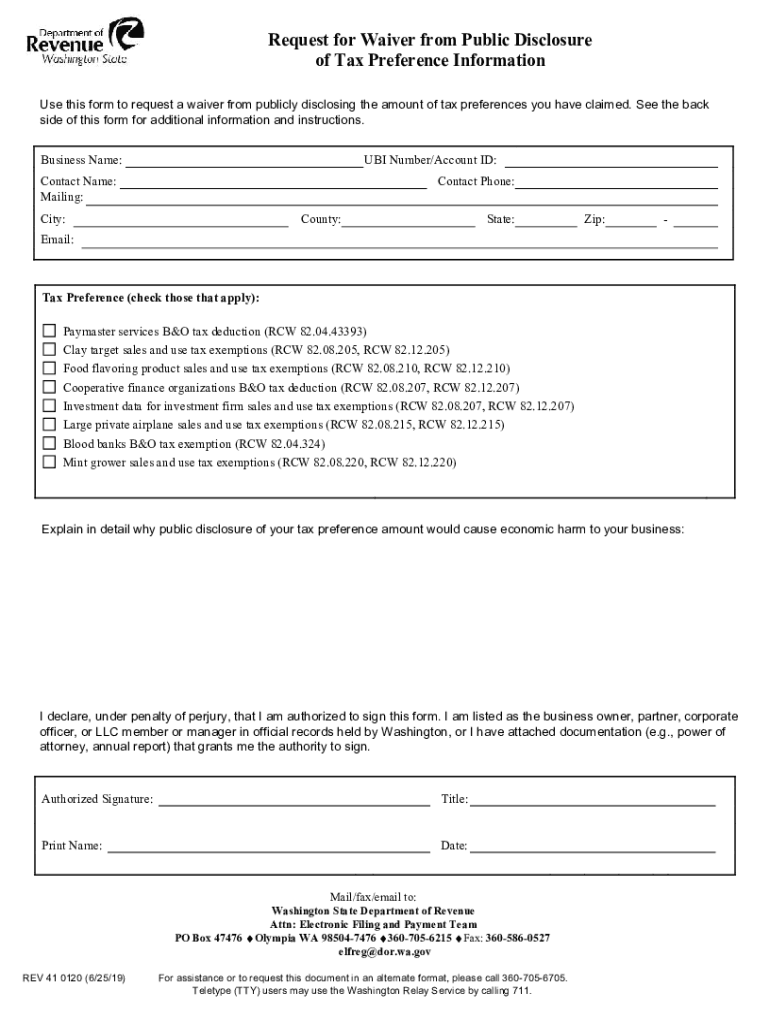

The Request For Waiver From Public Disclosure Of Tax Preference is a formal document that allows individuals or entities to request the confidentiality of certain tax preferences from public disclosure. This form is typically used to protect sensitive information related to tax credits, deductions, or other financial benefits that may be disclosed in public records. By submitting this request, taxpayers aim to maintain privacy regarding their financial affairs while still complying with tax regulations.

How to use the Request For Waiver From Public Disclosure Of Tax Preference

Using the Request For Waiver From Public Disclosure Of Tax Preference involves several steps. First, gather the necessary information, including your tax identification number and details about the specific tax preference you wish to protect. Next, complete the form accurately, ensuring that all required fields are filled out. Once the form is completed, submit it to the appropriate tax authority, either electronically or via mail, depending on the guidelines provided by your state or local jurisdiction.

Steps to complete the Request For Waiver From Public Disclosure Of Tax Preference

Completing the Request For Waiver From Public Disclosure Of Tax Preference requires careful attention to detail. Follow these steps:

- Obtain the form from your state or local tax authority's website.

- Fill in your personal information, including your name, address, and tax identification number.

- Clearly describe the tax preference you are requesting a waiver for.

- Provide any supporting documentation that may strengthen your request.

- Review the form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Request For Waiver From Public Disclosure Of Tax Preference

The legal use of the Request For Waiver From Public Disclosure Of Tax Preference is governed by state and federal laws. This form is recognized as a legitimate means for taxpayers to protect sensitive information from public access. It is important to ensure that the request is made in accordance with applicable laws and regulations to avoid potential legal issues. Proper completion and submission of the form can help safeguard your financial information while complying with disclosure requirements.

Eligibility Criteria

To be eligible for the Request For Waiver From Public Disclosure Of Tax Preference, individuals or entities must typically meet specific criteria set by the tax authority. Generally, this includes being a taxpayer who has claimed a tax preference that is eligible for confidentiality. Additionally, applicants must demonstrate a legitimate interest in protecting their financial information, which may involve providing supporting documentation or explanations for the request.

Required Documents

When submitting the Request For Waiver From Public Disclosure Of Tax Preference, certain documents may be required to support your application. Commonly required documents include:

- A completed request form.

- Proof of identity, such as a driver's license or tax identification number.

- Documentation related to the specific tax preference being requested for confidentiality.

- Any additional supporting materials that may assist in justifying the request.

Quick guide on how to complete request for waiver from public disclosure of tax preference

Complete Request For Waiver From Public Disclosure Of Tax Preference effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can locate the required form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Request For Waiver From Public Disclosure Of Tax Preference on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Request For Waiver From Public Disclosure Of Tax Preference seamlessly

- Locate Request For Waiver From Public Disclosure Of Tax Preference and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and eSign Request For Waiver From Public Disclosure Of Tax Preference and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Request For Waiver From Public Disclosure Of Tax Preference?

A Request For Waiver From Public Disclosure Of Tax Preference is a formal document submitted to seek exemption from disclosing certain tax-related information. Organizations often use this request to protect sensitive financial data while still complying with regulatory requirements.

-

How can airSlate SignNow help with a Request For Waiver From Public Disclosure Of Tax Preference?

airSlate SignNow streamlines the process of creating, sending, and signing documents, including a Request For Waiver From Public Disclosure Of Tax Preference. With our platform, you can quickly prepare your waiver requests and ensure they are securely signed and stored.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing tiers that cater to different business needs, starting with a free trial for new users. Our pricing is designed to be cost-effective, ensuring that you can manage documents, including Requests For Waiver From Public Disclosure Of Tax Preference, without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various business applications, including CRM and document management systems. This feature allows for smoother workflows when submitting a Request For Waiver From Public Disclosure Of Tax Preference and managing other related documents.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers a robust suite of features including customizable templates, in-app signing, secure cloud storage, and real-time tracking. These tools help you efficiently handle your Request For Waiver From Public Disclosure Of Tax Preference and other essential documents.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely! airSlate SignNow utilizes top-of-the-line encryption and security protocols to protect your documents. This ensures that your Request For Waiver From Public Disclosure Of Tax Preference remains confidential and secure throughout the signing process.

-

How does airSlate SignNow enhance collaboration on documents?

AirSlate SignNow facilitates collaboration by allowing multiple users to view, comment, and eSign documents simultaneously. This collaborative feature is particularly useful for teams working on a Request For Waiver From Public Disclosure Of Tax Preference, speeding up the approval process.

Get more for Request For Waiver From Public Disclosure Of Tax Preference

Find out other Request For Waiver From Public Disclosure Of Tax Preference

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form