Which States Require Sales Tax on Software as a Service Form

Understanding access exemption

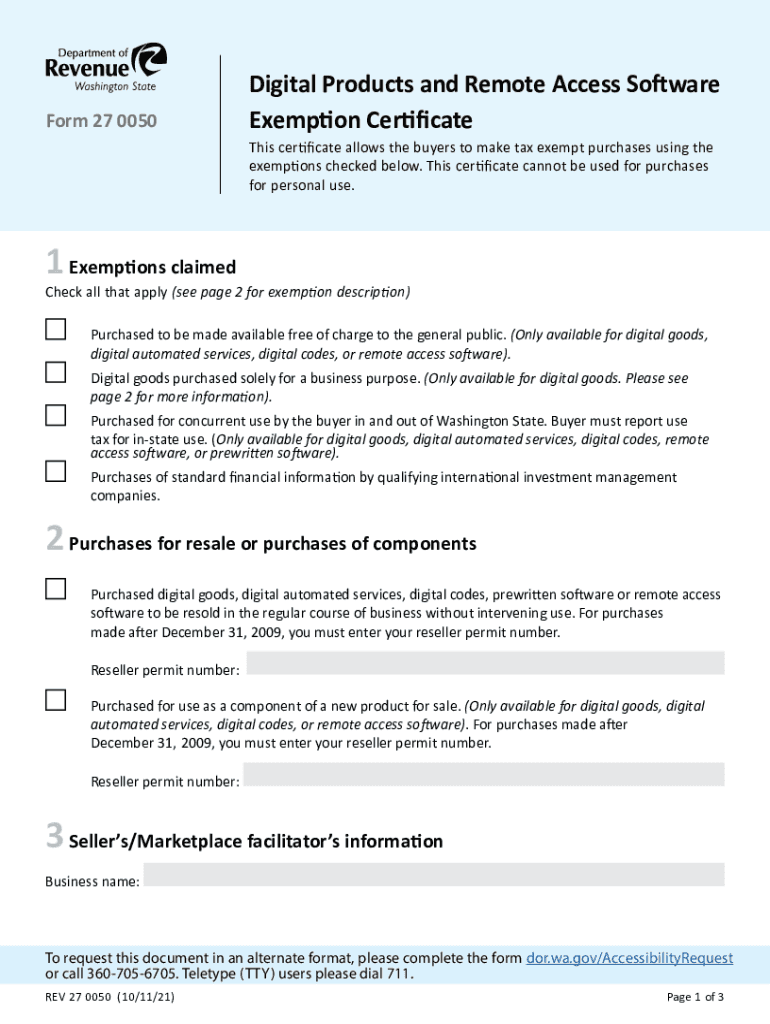

The access exemption pertains to specific circumstances under which certain software services may not be subject to sales tax in various states, including Washington. This exemption is crucial for businesses that utilize software as a service (SaaS) solutions. Understanding the nuances of this exemption can help organizations navigate compliance and optimize their tax obligations.

In general, the access exemption applies when software is delivered electronically and does not involve the transfer of tangible personal property. This means that businesses can leverage digital tools without incurring additional sales tax, provided they meet the criteria established by state laws.

Steps to complete the access exemption form

Completing the access exemption form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering necessary information about your business and the software services you utilize. This includes details about the software provider, the nature of the services, and the specific state tax regulations that apply.

Next, fill out the form accurately, ensuring all required fields are completed. Pay close attention to any state-specific requirements that may affect your exemption status. After completing the form, review it for any errors or omissions before submission.

State-specific rules for access exemption

Each state has its own regulations regarding access exemptions, particularly concerning software as a service. In Washington, for instance, the state has specific guidelines that determine when an exemption applies. Familiarizing yourself with these rules is essential for compliance and can help prevent potential tax liabilities.

It is advisable to consult the Washington Department of Revenue or a tax professional to understand the nuances of the exemption and how it applies to your specific situation. This can include understanding any documentation required to substantiate your claim for exemption.

Required documents for access exemption

When applying for an access exemption, certain documents may be required to validate your claim. These typically include proof of business registration, details about the software services utilized, and any relevant contracts or agreements with software providers. Having these documents ready can streamline the process and ensure compliance with state regulations.

In some cases, you may also need to provide additional documentation that demonstrates how your software services qualify for the exemption. Keeping thorough records can be beneficial in the event of an audit or review by state tax authorities.

Legal use of access exemption

The legal use of the access exemption is governed by state tax laws, which outline the criteria for eligibility. It is important to ensure that your business meets these criteria to avoid penalties or back taxes. This includes understanding what constitutes a qualifying software service and maintaining compliance with all relevant regulations.

Utilizing the access exemption legally requires a clear understanding of the definitions and stipulations set forth by state authorities. Businesses should regularly review their compliance status and stay informed about any changes in legislation that may affect their exemption eligibility.

Quick guide on how to complete which states require sales tax on software as a service

Effortlessly Prepare Which States Require Sales Tax On Software as a Service on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Which States Require Sales Tax On Software as a Service on any device using airSlate SignNow's Android or iOS applications, and enhance any document-driven process today.

How to Modify and Electronically Sign Which States Require Sales Tax On Software as a Service with Ease

- Obtain Which States Require Sales Tax On Software as a Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Which States Require Sales Tax On Software as a Service, ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is access exemption in airSlate SignNow?

Access exemption in airSlate SignNow refers to the features that allow users to send and eSign documents while controlling who can access and manage those documents. This ensures that sensitive information remains secure and only accessible to authorized parties.

-

How can I manage access exemption for my documents?

Managing access exemption in airSlate SignNow is straightforward. You can easily set permissions when sending documents, allowing you to limit access to specific users or groups, thereby ensuring that only the intended recipients can view or sign the documents.

-

Is there a cost associated with using access exemption features?

The access exemption features are included in various pricing plans of airSlate SignNow. Depending on your subscription level, you'll have access to different functionalities that enhance document security and access control.

-

What are the benefits of using access exemption?

Utilizing access exemption in airSlate SignNow helps preserve document security and integrity. It allows businesses to maintain confidentiality and control over their documents, which is particularly valuable in industries where data protection is crucial.

-

Does airSlate SignNow integrate with other applications regarding access exemption?

Yes, airSlate SignNow can be integrated with various applications that enhance the functionality of access exemption. Integrations with platforms such as CRM and project management tools allow users to streamline document workflows while maintaining access control.

-

Can I customize access exemption settings for different users?

Absolutely! airSlate SignNow allows you to customize access exemption settings for different users, giving you the flexibility to adjust permissions based on roles and responsibilities. This customization ensures that everyone has the appropriate level of access to sensitive documents.

-

What types of documents can I protect with access exemption?

You can protect a wide range of document types with access exemption in airSlate SignNow, including contracts, legal documents, and sensitive business materials. This feature is essential for maintaining the security of critical files that require restricted access.

Get more for Which States Require Sales Tax On Software as a Service

- Waiver and release from liability for minor child for scuba diving and skin diving form

- Release adult 497427126 form

- Waiver and release from liability for minor child for cultural or ethnic events form

- Waiver petting zoo 497427128 form

- Liability minor form

- Waiver release liability 497427130 form

- Waiver and release from liability for minor child for bowling alley form

- Waiver and release from liability for adult for parasailing form

Find out other Which States Require Sales Tax On Software as a Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors