Form 8633

What is the Form 8633

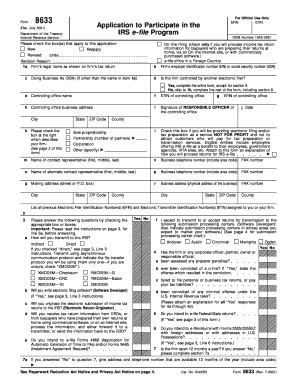

The Form 8633, officially known as the eFIN Application Form, is utilized by tax professionals to apply for an Electronic Filing Identification Number (eFIN) from the IRS. This form is essential for those who wish to electronically file tax returns on behalf of clients. The eFIN serves as a unique identifier for tax preparers and is a prerequisite for participating in the IRS e-file program. Understanding the purpose and requirements of the Form 8633 is crucial for tax professionals aiming to streamline their filing processes.

Steps to complete the Form 8633

Completing the Form 8633 involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary information, including your business details and tax identification number. Next, fill out the form, ensuring that all sections are completed accurately. Pay special attention to the eligibility criteria, as incomplete or incorrect submissions can lead to delays. After filling out the form, review it thoroughly for any errors before submitting it to the IRS. Finally, keep a copy of the submitted form for your records, as it may be needed for future reference.

Legal use of the Form 8633

The legal use of the Form 8633 is governed by IRS regulations, which stipulate that only authorized tax professionals may apply for an eFIN. The form must be filled out truthfully and submitted in accordance with the IRS's guidelines to ensure its validity. Misrepresentation or failure to comply with the requirements can result in penalties, including the denial of your eFIN application. It is important to understand the legal implications of submitting the Form 8633, as it establishes your authority to file taxes electronically on behalf of clients.

Required Documents

When applying for an eFIN using the Form 8633, several documents may be required to support your application. These typically include proof of your identity, such as a driver's license or social security card, as well as business documentation like your Employer Identification Number (EIN) if applicable. Additionally, you may need to provide evidence of your tax preparation experience and any relevant certifications. Having these documents ready can facilitate a smoother application process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 8633 is crucial for tax professionals. The IRS typically requires that applications for an eFIN be submitted well in advance of the tax season to allow for processing time. It is advisable to submit your Form 8633 at least 45 days before you plan to begin filing electronically. Keeping track of important dates, such as the start of the e-file season and the deadlines for submitting the form, can help ensure that you are prepared to serve your clients efficiently.

Application Process & Approval Time

The application process for the Form 8633 involves submitting the completed form to the IRS, either electronically or by mail. Once submitted, the IRS will review your application, which can take several weeks. Typically, applicants can expect to receive their eFIN within four to six weeks, although processing times may vary based on the volume of applications received. Staying informed about the status of your application is important, as any issues may delay your ability to file electronically.

Quick guide on how to complete form 8633

Easily prepare Form 8633 on any device

Digital document management has gained traction with businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 8633 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign Form 8633 effortlessly

- Locate Form 8633 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Set aside concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8633 to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is rev 2001 and how does it relate to airSlate SignNow?

Rev 2001 is a term often associated with electronic signature regulations and compliance. airSlate SignNow ensures that all electronic signatures meet these legal requirements, providing businesses with confidence in their document management processes.

-

How much does airSlate SignNow cost compared to other eSignature solutions?

When evaluating cost, airSlate SignNow offers competitive pricing structures tailored to different business needs. The rev 2001 compliance and features provided by airSlate SignNow deliver signNow value at a cost-effective pricing tier.

-

What key features does airSlate SignNow offer to support rev 2001 compliance?

AirSlate SignNow includes essential features such as secure storage, audit trails, and authentication methods that align with rev 2001 regulations. These features ensure all signed documents maintain integrity and legality.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow seamlessly integrates with various software tools, enhancing your workflow efficiency. This allows businesses to utilize their existing systems while ensuring compliance with rev 2001.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow streamlines the document signing process, making it faster and more efficient. The platform's alignment with rev 2001 standards ensures that your signatures are not only fast but also legally binding.

-

Is airSlate SignNow suitable for small businesses regarding rev 2001 regulations?

Absolutely, airSlate SignNow is designed to be user-friendly and cost-effective, making it a great option for small businesses. It helps them comply with rev 2001 standards without the complexities of larger enterprise solutions.

-

How does airSlate SignNow handle document security and rev 2001 compliance?

AirSlate SignNow employs advanced encryption methods to secure documents and signatures. By focusing on rev 2001 compliance, the platform guarantees that sensitive information remains protected throughout the signing process.

Get more for Form 8633

Find out other Form 8633

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form