Self Employment Short If You 're Self Employed, Have Relatively Simple Tax Affairs and Your Annual Business Turnover Was below 7 Form

Understanding the Self Employment Tax Form

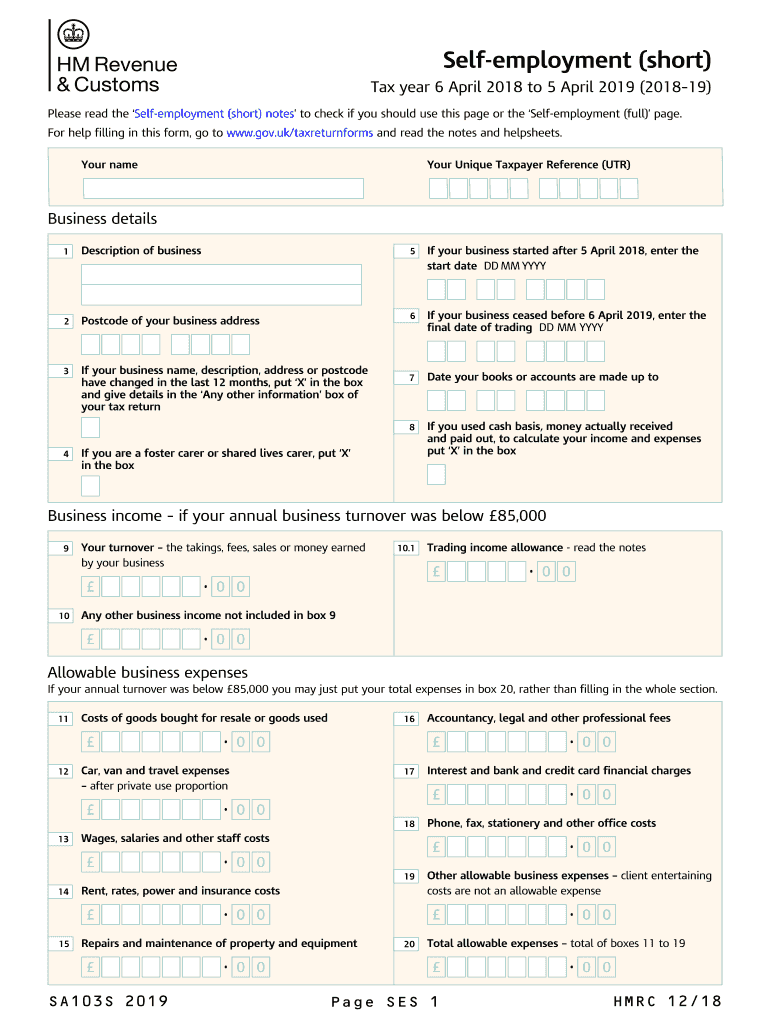

The self employment tax form is crucial for individuals who earn income from self-employment. This form is used to report earnings and calculate the self employment tax, which covers Social Security and Medicare taxes. If your annual business turnover is below $73,000 and your tax affairs are relatively simple, you may be eligible to use the simplified version, known as the SA103S. This form streamlines the filing process, making it easier for self-employed individuals to meet their tax obligations.

Steps to Complete the Self Employment Tax Form

Completing the self employment tax form involves several key steps:

- Gather necessary documents, including income statements and expense records.

- Determine your eligibility for using the SA103S short version based on your annual turnover.

- Fill out the form accurately, ensuring all income and expenses are reported.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

IRS Guidelines for Self Employment Tax Filing

The IRS provides specific guidelines for filing the self employment tax form. It's essential to adhere to these regulations to avoid penalties. Key points include:

- Filing deadlines are typically April 15 for the previous tax year.

- Ensure all income is reported, including cash payments.

- Keep detailed records of all business expenses to maximize deductions.

Required Documents for Filing

When preparing to file the self employment tax form, gather the following documents:

- Form 1099-NEC or 1099-K for reported income.

- Receipts and invoices for business expenses.

- Bank statements reflecting business transactions.

- Any previous year tax returns for reference.

Form Submission Methods

Self employed individuals have various options for submitting their tax forms. You can choose to file online using tax software, mail a paper form to the IRS, or visit a local office for in-person submission. Each method has its advantages, such as immediate processing for online submissions or personal assistance at local offices.

Penalties for Non-Compliance

Failing to file the self employment tax form on time can result in significant penalties. The IRS may impose fines for late filings, and interest may accrue on any unpaid taxes. It is crucial to understand the implications of non-compliance and to file accurately and on time to avoid these consequences.

Quick guide on how to complete self employment short 2019 if you re self employed have relatively simple tax affairs and your annual business turnover was

Complete Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7 effortlessly

- Find Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax form for self employed individuals?

A tax form for self employed individuals is a document used to report income and expenses to the IRS. It typically involves forms like Schedule C for profit or loss from business, along with related documents such as the 1099-MISC or 1099-NEC. Understanding how to properly complete these forms is crucial for self employed individuals to ensure accurate tax reporting.

-

How does airSlate SignNow help with self employed tax forms?

airSlate SignNow streamlines the process of managing tax forms for self employed individuals by allowing users to easily send, sign, and store documents electronically. This ensures that all necessary tax forms are processed quickly and securely, reducing the risk of lost paperwork. Additionally, the user-friendly interface makes it simple to track the status of documents.

-

Are there any costs associated with using airSlate SignNow for tax form management?

Yes, airSlate SignNow offers affordable pricing plans tailored to various needs. Whether you're an individual or a small business, you can choose a plan that fits your budget for managing your tax form for self employed purposes. It's a cost-effective solution compared to traditional methods of document handling.

-

Can I integrate airSlate SignNow with other accounting software for my tax forms?

Absolutely! airSlate SignNow allows seamless integration with popular accounting solutions, making it easier to manage your tax forms for self employed needs. This integration ensures your documents sync effortlessly, streamlining your overall financial workflow and improving accuracy in tax submissions.

-

What benefits does airSlate SignNow offer for self employed professionals?

The primary benefit of airSlate SignNow for self employed professionals is the convenience it provides in handling tax forms. Users can quickly prepare, sign, and share documents without needing to print or scan. Additionally, features like templates and automation can save time, allowing you to focus on your business instead of paperwork.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security for all your documents, including tax forms for self employed individuals. The platform complies with industry standards to ensure that your information is stored safely. Features like password protection and encryption further enhance document security during transmission.

-

How can I access my signed tax forms with airSlate SignNow?

Once your tax form for self employed has been signed using airSlate SignNow, it is stored securely in your account. You can easily access, download, or share these forms whenever necessary. The platform also allows you to organize your documents for quick retrieval, ensuring that you never misplace important tax forms.

Get more for Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7

- Waiver and release from liability for minor child for church function form

- Waiver and release from liability for adult for field hockey form

- Waiver and release from liability for minor child for field hockey form

- Waiver entertainment form

- Waiver and release from liability for adult for handball courts form

- Release minor child form

- Waiver and release from liability for adult for canoeing kayaking form

- Release minor form 497427172

Find out other Self employment Short If You 're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 7

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe