Ira Rollover Chart Form

What is the IRA Rollover Chart

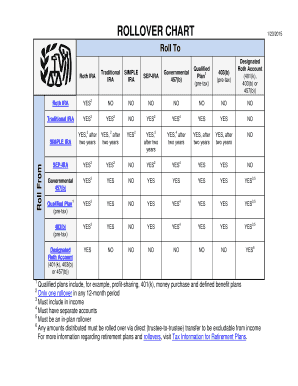

The IRA rollover chart is a crucial tool for individuals looking to transfer funds from one retirement account to another, specifically from a qualified retirement plan to an Individual Retirement Account (IRA). This chart provides a visual representation of the various options available for rolling over retirement funds, including direct rollovers, indirect rollovers, and the associated tax implications. Understanding the IRA rollover chart can help individuals make informed decisions about their retirement savings and ensure compliance with IRS regulations.

How to Use the IRA Rollover Chart

Using the IRA rollover chart involves a few straightforward steps. First, identify the type of retirement account you currently hold and the type of IRA you wish to roll over into. Next, consult the chart to determine the rollover options available to you. The chart outlines the rules and timelines for each option, helping you understand whether a direct or indirect rollover is more suitable for your situation. It is essential to follow the guidelines provided in the chart to avoid unnecessary taxes or penalties.

Steps to Complete the IRA Rollover Chart

Completing the IRA rollover chart requires careful attention to detail. Begin by gathering all necessary documentation related to your current retirement account, including account statements and any relevant tax information. Next, fill out the chart by indicating the type of rollover you are pursuing and the amounts involved. Ensure that you provide accurate information to prevent any complications during the rollover process. Once completed, keep a copy of the chart for your records and consult with a financial advisor if needed.

Legal Use of the IRA Rollover Chart

The legal use of the IRA rollover chart is essential for ensuring compliance with IRS regulations. The chart serves as a guideline for individuals to follow when executing a rollover, helping them understand the legal implications of their choices. It is important to adhere to the timelines and requirements outlined in the chart to avoid potential penalties. Additionally, using the chart can help individuals maintain the tax-deferred status of their retirement funds during the rollover process.

IRS Guidelines

The IRS provides specific guidelines regarding IRA rollovers, which are reflected in the IRA rollover chart. These guidelines include the 60-day rule for indirect rollovers, which requires individuals to complete the transfer within sixty days to avoid taxes. The IRS also outlines the types of accounts eligible for rollovers and the tax treatment of different rollover scenarios. Familiarizing yourself with these guidelines is crucial for a smooth rollover process and to ensure compliance with federal tax laws.

Required Documents

To successfully complete the IRA rollover chart, several documents are typically required. These include statements from your current retirement account, proof of identity, and any forms necessary for initiating the rollover. Additionally, if you are rolling over funds from a qualified plan, you may need to provide documentation from the plan administrator. Having these documents ready will streamline the rollover process and help ensure that all information is accurate and complete.

Eligibility Criteria

Eligibility criteria for rolling over funds into an IRA are outlined in the IRA rollover chart. Generally, individuals must have a qualified retirement plan to initiate a rollover. This includes 401(k) plans, 403(b) plans, and other employer-sponsored retirement accounts. Additionally, individuals must meet certain age requirements and may need to consider the tax implications of their rollover choices. Understanding these criteria is vital for making informed decisions about retirement savings and ensuring compliance with IRS regulations.

Quick guide on how to complete ira rollover chart

Complete Ira Rollover Chart easily on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to find the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Ira Rollover Chart on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ira Rollover Chart effortlessly

- Obtain Ira Rollover Chart and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Leave behind the hassle of lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Ira Rollover Chart and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IRS rollover chart, and how can it benefit me?

The IRS rollover chart is a helpful resource for understanding the rules and limitations regarding the transfer of funds between retirement accounts. By utilizing the IRS rollover chart, you can easily see which types of rollovers are allowed, helping you make informed decisions about your retirement finances.

-

How does airSlate SignNow integrate with the IRS rollover chart to enhance document signing?

airSlate SignNow streamlines the document signing process by allowing you to quickly send and eSign documents related to your retirement accounts, including those that reference the IRS rollover chart. This integration ensures that your financial agreements are completed efficiently, enabling you to focus on your retirement planning.

-

Is there a cost associated with using airSlate SignNow for IRS rollover chart documentation?

airSlate SignNow is a cost-effective solution for all your document signing needs, including those that involve the IRS rollover chart. We offer flexible pricing plans to fit different budgets, ensuring businesses of all sizes can access our services without overspending.

-

What features does airSlate SignNow provide for managing IRS rollover chart-related documents?

airSlate SignNow offers a range of features such as customizable templates, real-time tracking, and secure storage for documents related to the IRS rollover chart. These features simplify the process of managing your important retirement documents while ensuring compliance with relevant regulations.

-

Can I access the IRS rollover chart using mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access the IRS rollover chart and sign related documents on the go. This mobile compatibility ensures that you can handle your retirement paperwork anytime and anywhere, making the process more convenient.

-

What types of documents can I eSign that involve the IRS rollover chart?

You can eSign various types of documents involving the IRS rollover chart, including transfer requests, rollover forms, and retirement account agreements. airSlate SignNow makes it easy to manage all your paperwork digitally, ensuring a seamless process for your retirement planning.

-

How secure is airSlate SignNow for handling documents related to the IRS rollover chart?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards, ensuring that your documents related to the IRS rollover chart are protected. You can trust our platform to keep your sensitive retirement information safe and secure.

Get more for Ira Rollover Chart

Find out other Ira Rollover Chart

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement