Startup Costs Form

What is the startup costs?

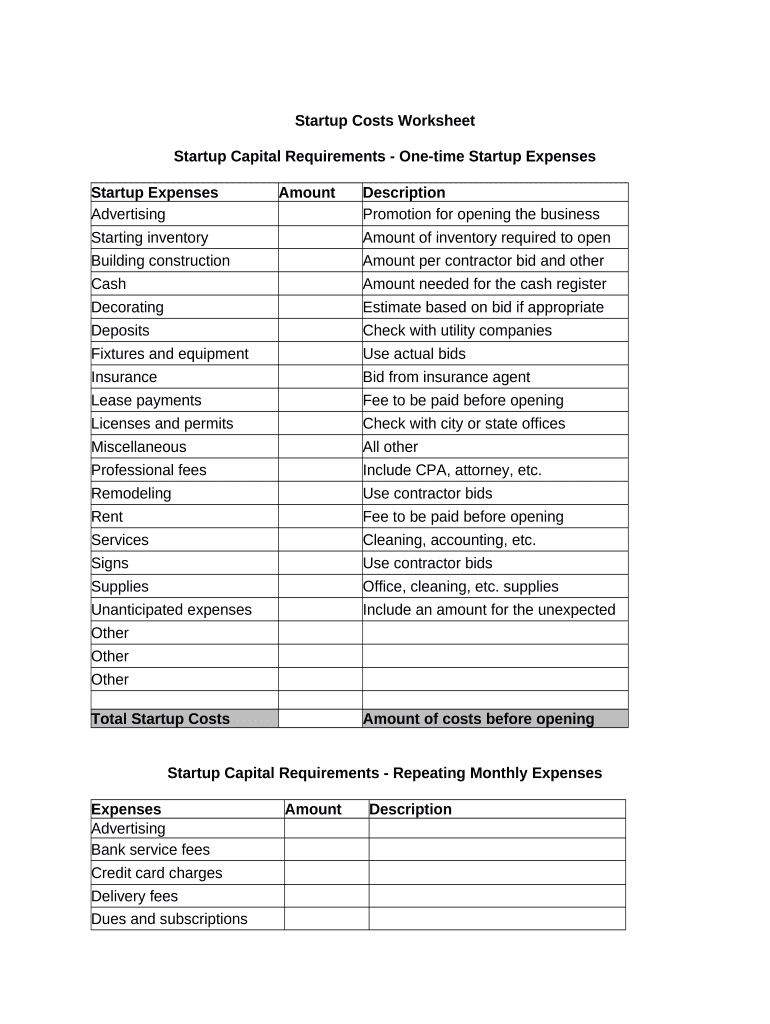

The startup costs refer to the initial expenses incurred when launching a new business. These costs can include a variety of items essential for establishing operations, such as equipment, inventory, legal fees, marketing, and workspace. Understanding these costs is crucial for budgeting and financial planning. A comprehensive business startup costs list can help entrepreneurs identify all necessary expenditures to ensure a smooth launch.

Key elements of the startup costs

When preparing a startup costs statement, several key elements should be included to provide a clear overview of the financial requirements. These elements typically consist of:

- Equipment purchases: Costs for machinery, computers, and office supplies.

- Licenses and permits: Fees associated with obtaining necessary legal permissions to operate.

- Marketing and advertising: Initial expenses for promoting the business to attract customers.

- Rent or lease: Costs for securing a physical location for the business.

- Employee salaries: Initial payroll expenses for hiring staff.

Steps to complete the startup costs

Completing a startup costs form involves several systematic steps to ensure accuracy and thoroughness. Here are the essential steps:

- Identify all potential costs: List every expense that may arise during the startup phase.

- Research costs: Gather current data on the prices of equipment, services, and permits.

- Organize the information: Categorize costs into fixed and variable expenses for better clarity.

- Calculate total startup costs: Sum all identified costs to determine the overall financial requirement.

- Review and adjust: Reassess the list to ensure no expenses are overlooked and make adjustments as necessary.

Examples of using the startup costs

Using a startup costs statement effectively can guide entrepreneurs in various scenarios. For instance:

- A small bakery might detail costs for ovens, display cases, and initial ingredient purchases.

- A tech startup could outline expenses for software development, office space, and marketing campaigns.

- A food catering business might include costs for kitchen equipment, transportation, and permits.

IRS guidelines

The IRS provides specific guidelines regarding the classification and deduction of startup costs. According to IRS regulations, businesses can deduct up to five thousand dollars of startup costs in the first year of operation, with any remaining costs amortized over a period of fifteen years. It is essential for entrepreneurs to maintain accurate records of all expenses to support their claims during tax filings.

Legal use of the startup costs

Understanding the legal implications of startup costs is vital for compliance. Businesses must ensure that all expenses claimed adhere to IRS regulations and local laws. This includes obtaining necessary licenses and permits before incurring certain costs. Proper documentation and record-keeping are essential to validate the legitimacy of the startup costs in case of an audit or legal inquiry.

Quick guide on how to complete startup costs 497426966

Achieve Startup Costs effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed materials, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without hindrance. Manage Startup Costs on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The optimal method to modify and eSign Startup Costs effortlessly

- Locate Startup Costs and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Startup Costs and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are examples of start up costs statement?

Examples of start up costs statement typically include expenses such as legal fees, marketing costs, equipment purchases, and initial inventory expenses. These costs provide a clear picture of the financial requirements needed to launch a business. By outlining these expenses, you can better prepare your financial projections and budget.

-

How does airSlate SignNow assist with managing start up costs?

airSlate SignNow helps streamline the document management process, making it easier to handle invoices and payment confirmations related to your start up costs. By digitally signing agreements and contracts, you can reduce delays and ensure faster processing. This efficiency is crucial for startups needing to manage their finances effectively.

-

Can I customize my start up costs statement template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your start up costs statement templates to fit your business needs. You can easily add, remove, or edit sections to ensure all relevant expenses are clearly outlined. This flexibility ensures that your statements accurately reflect your unique startup costs.

-

What features does airSlate SignNow offer for startups?

airSlate SignNow offers a variety of features tailored for startups, including digital signatures, customizable document templates, and collaboration tools. These features simplify the process of managing important documents such as start up costs statements and enhance team efficiency. Startups can benefit from a cost-effective and user-friendly solution.

-

How secure is airSlate SignNow for handling financial documents?

airSlate SignNow employs industry-leading security features, including encryption and secure cloud storage, to protect your financial documents. This is crucial when dealing with sensitive data, such as examples of start up costs statement. You can trust airSlate SignNow to keep your information safe while providing easy access when needed.

-

Are there any integrations available with airSlate SignNow for financial management?

Yes, airSlate SignNow integrates with various financial management tools and accounting software, allowing you to streamline the handling of your start up costs statements. This seamless integration means you can manage your finances and documents in one place, increasing productivity. Check our website for a comprehensive list of supported integrations.

-

How do I get started with airSlate SignNow for my startup?

To get started with airSlate SignNow for managing your startup costs, simply sign up for an account on our website. You can choose a plan that suits your business needs and begin creating and signing documents right away. Our user-friendly interface makes it easy for startups to implement a professional solution for their document management.

Get more for Startup Costs

- Opm 4b form

- The city of evansville through actions by the evansville police department and ci evansville wi form

- Application for transient vendor permit eastham ma eastham ma form

- Land use affidavit mda maryland form

- Uc 62 form ct

- Ds 3753a cder diagnostic form california department of dds ca

- Tcfp 006 texas commission on fire form

- State of alaska board of massage therapists board packet february 28 form

Find out other Startup Costs

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement