Irs Rollover Form

What is the IRS rollover?

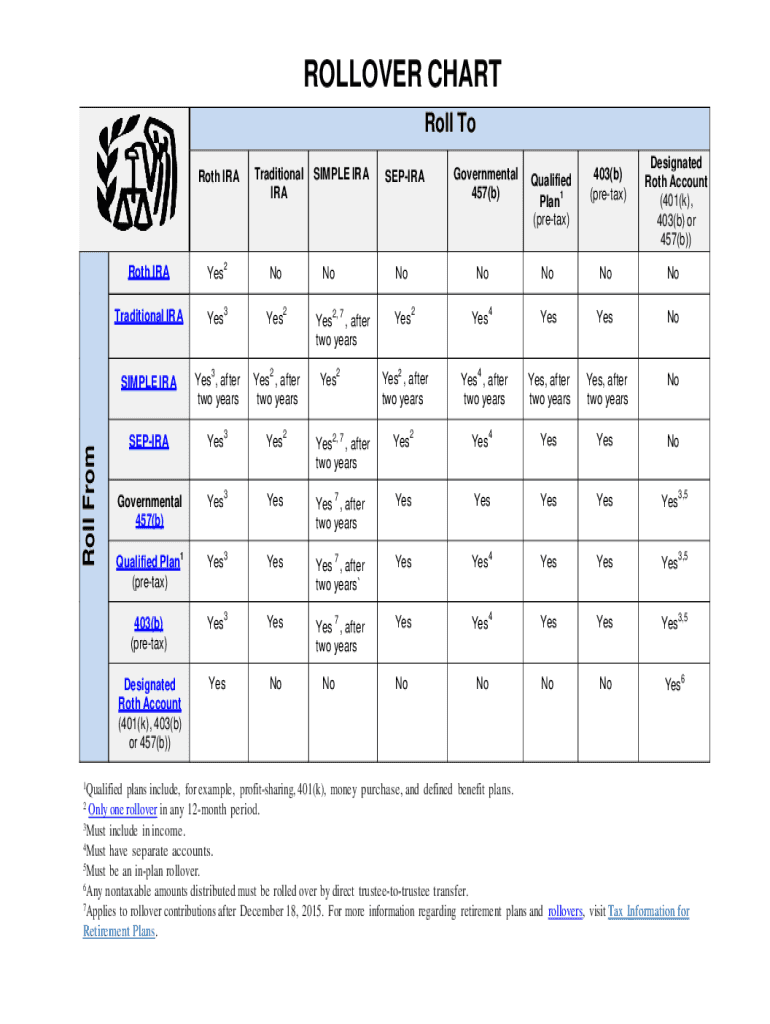

The IRS rollover refers to the process of transferring funds from one retirement account to another without incurring tax penalties. This is commonly done with Individual Retirement Accounts (IRAs) and 401(k) plans. The rollover allows individuals to maintain the tax-deferred status of their retirement savings while changing account types or providers. Understanding the specific rules and regulations governing rollovers is essential to ensure compliance with IRS guidelines.

Steps to complete the IRS rollover

Completing an IRS rollover involves several key steps to ensure a smooth and compliant transfer of funds:

- Determine eligibility: Confirm that your current account allows rollovers and that you meet any eligibility criteria.

- Select the new account: Choose the type of retirement account to which you want to transfer your funds.

- Request the rollover: Contact your current account provider to initiate the rollover process. They may require specific forms or documentation.

- Complete the transfer: Ensure that the funds are transferred directly to the new account to avoid tax implications.

- Document the transaction: Keep records of the rollover for tax purposes, including any forms received from both the old and new account providers.

Legal use of the IRS rollover

To legally execute an IRS rollover, it is important to adhere to IRS regulations. The rollover must be completed within sixty days to avoid penalties and taxes. Additionally, only one rollover is permitted per twelve-month period for IRAs. Understanding these legal stipulations helps ensure that the rollover process remains compliant and that individuals can avoid unnecessary tax liabilities.

Required documents

When completing an IRS rollover, certain documents may be required to facilitate the process:

- Rollover request form: This form is typically provided by the current account custodian.

- New account application: If opening a new retirement account, this application must be completed.

- Proof of identity: Identification documents may be required to verify your identity during the transfer.

- Tax forms: Keep any tax-related documents that may be necessary for reporting the rollover on your tax return.

IRS Guidelines

The IRS has established specific guidelines for rollovers to ensure that individuals do not face unexpected tax consequences. Key guidelines include:

- Funds must be transferred within sixty days to avoid taxation.

- Only one rollover is allowed per twelve-month period for IRAs.

- Direct rollovers are preferred as they minimize the risk of tax withholding.

- Consult IRS Publication 590-B for detailed information on rollovers and related tax implications.

Eligibility Criteria

Eligibility for an IRS rollover depends on several factors, including the type of retirement account and the individual's circumstances. Common eligibility criteria include:

- The account must be a qualified retirement plan, such as a 401(k) or IRA.

- The account holder must not have reached the age of seventy and a half, unless specific conditions apply.

- The rollover must comply with IRS regulations regarding timing and frequency.

Quick guide on how to complete irs rollover

Complete Irs Rollover effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents rapidly without delays. Manage Irs Rollover on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and eSign Irs Rollover with ease

- Locate Irs Rollover and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Revise and eSign Irs Rollover while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an IRS rollover and how does it work?

An IRS rollover is a process where funds from a qualified retirement plan are transferred to another retirement account without incurring tax penalties. This can be beneficial for maintaining the growth of your investments while adhering to IRS regulations. Understanding the mechanics of an IRS rollover can help you make informed financial decisions.

-

How can airSlate SignNow assist with IRS rollover documentation?

airSlate SignNow provides a streamlined platform for eSigning and sending necessary IRS rollover documents securely. Our easy-to-use interface allows you to complete and submit forms swiftly, ensuring compliance with IRS requirements. This facilitates a smoother rollover process, saving you time and reducing paperwork hassles.

-

What are the costs associated with using airSlate SignNow for IRS rollovers?

airSlate SignNow offers a cost-effective solution for document management, including IRS rollover paperwork. With multiple pricing plans, users can choose the option that best fits their needs and budget. This allows businesses to manage their documentation efficiently without incurring high costs.

-

What features does airSlate SignNow offer for managing IRS rollover documents?

Our platform offers key features such as customizable templates, secure eSigning, and document tracking which are essential for managing IRS rollover documents. These tools enhance your workflow, ensuring all necessary forms are completed accurately and promptly. Additionally, features like reminders help keep the IRS rollover process on track.

-

Can airSlate SignNow integrate with other financial software for IRS rollovers?

Yes, airSlate SignNow seamlessly integrates with various financial software solutions, making the IRS rollover process more efficient. This integration allows users to sync their documents and data across platforms, ensuring all information is up-to-date and accessible. Streamlining your workflow can signNowly enhance your rollover experience.

-

Is airSlate SignNow secure for handling sensitive IRS rollover information?

Absolutely, airSlate SignNow prioritizes the security of your documents, including sensitive IRS rollover information. We utilize encryption and compliance measures to safeguard all transmitted data. Our commitment to security ensures that your information remains confidential during the rollover process.

-

What benefits does using airSlate SignNow provide for IRS rollover transactions?

Using airSlate SignNow for IRS rollover transactions offers numerous benefits, including increased efficiency and reduced paper waste. Our digital platform simplifies the signing and sending process, making it faster to complete rollovers. Ultimately, this results in a more streamlined experience and better management of your retirement accounts.

Get more for Irs Rollover

- Waiver child form 497427089

- Liability ski form

- Subcontractor release and waiver of liability form

- Waiver and release from liability for adult for paint ball form

- Waiver and release from liability for minor paint ball form

- Waiver release liability form 497427094

- Waiver release liability 497427095 form

- Waiver release liability online form

Find out other Irs Rollover

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free