Irs Ira Distribution Form

What is the IRS IRA Distribution Form

The IRS IRA Distribution Form is a document used by individuals to report distributions from their Individual Retirement Accounts (IRAs). This form is essential for taxpayers who are withdrawing funds from their IRAs, as it helps ensure compliance with federal tax regulations. The form captures important details such as the amount distributed, the type of distribution, and any taxes withheld. Understanding this form is crucial for managing tax liabilities and maintaining the tax-advantaged status of the IRA.

Steps to Complete the IRS IRA Distribution Form

Completing the IRS IRA Distribution Form involves several key steps:

- Gather Information: Collect all necessary details about your IRA, including account numbers, the amount of distribution, and any withholding information.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number. Provide details about the distribution, such as the date and amount.

- Review for Accuracy: Double-check all entries to ensure they are correct, as errors can lead to complications with the IRS.

- Sign and Date: Ensure that you sign and date the form, as an unsigned form may not be accepted.

- Submit the Form: Send the completed form to the appropriate IRS address or include it with your tax return, depending on your situation.

Legal Use of the IRS IRA Distribution Form

The IRS IRA Distribution Form must be used in accordance with IRS regulations to ensure that distributions are reported correctly. Legal use of the form involves adhering to the guidelines set forth by the IRS regarding the timing and amount of distributions. It is vital to understand the implications of early withdrawals, as they may incur penalties and additional taxes. Consulting with a tax professional can provide clarity on the legal aspects of using this form.

Required Documents for the IRS IRA Distribution Form

To complete the IRS IRA Distribution Form, you will need several documents:

- Personal identification, such as a driver's license or Social Security card.

- Statements from your IRA provider detailing the distribution.

- Any previous tax returns that may affect your current tax situation.

- Records of any other income that may impact your tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the IRS IRA Distribution Form align with the general tax filing schedule. Typically, taxpayers must submit their forms by April fifteenth of the following year. If you take a distribution late in the tax year, it is crucial to report it on your tax return for that year. Be aware of any extensions you may qualify for, as they can affect your filing timeline.

Examples of Using the IRS IRA Distribution Form

There are various scenarios in which the IRS IRA Distribution Form may be utilized:

- Withdrawing funds for retirement expenses, where the individual must report the distribution as income.

- Taking an early withdrawal due to financial hardship, which may require additional documentation and could incur penalties.

- Rolling over funds to another retirement account, which may not be taxable but still requires reporting on the form.

Quick guide on how to complete irs ira distribution form

Effortlessly Prepare Irs Ira Distribution Form on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditionally printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any holdups. Administer Irs Ira Distribution Form on any device using airSlate SignNow's Android or iOS applications and facilitate any document-related task today.

How to Alter and eSign Irs Ira Distribution Form with Ease

- Obtain Irs Ira Distribution Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate new printed copies. airSlate SignNow manages all your document needs in just a few clicks from any device you prefer. Modify and eSign Irs Ira Distribution Form and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

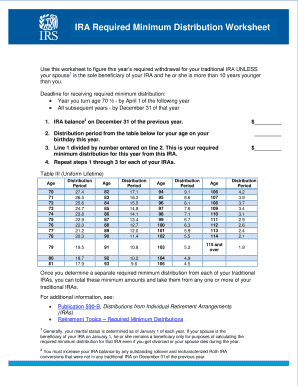

What is an IRA required minimum distribution?

An IRA required minimum distribution (RMD) is the minimum amount you must withdraw from your Individual Retirement Account annually once you signNow age 72. Understanding RMDs is crucial for managing your retirement funds effectively and avoiding penalties associated with not taking the required amount.

-

How does airSlate SignNow help with IRA required minimum distributions?

airSlate SignNow streamlines the process of documenting your IRA required minimum distributions by providing a secure platform for eSigning essential forms. This ensures that all necessary paperwork is completed promptly, helping you stay compliant with IRS regulations regarding RMDs.

-

Are there any costs associated with electronic signatures for IRA required minimum distributions?

Using airSlate SignNow for IRA required minimum distributions offers a cost-effective solution, with flexible pricing plans that cater to different business needs. You can sign up for a free trial to explore the features before committing, ensuring you find the right fit for your RMD documentation.

-

What features does airSlate SignNow offer for managing IRA required minimum distributions?

airSlate SignNow offers features like easy document sharing, customizable templates, and automated reminders to help manage your IRA required minimum distributions efficiently. The platform's user-friendly interface also ensures that users can navigate the eSigning process with ease.

-

Can I integrate airSlate SignNow with financial software for IRA required minimum distributions?

Yes, airSlate SignNow integrates seamlessly with various financial software applications, allowing you to manage your IRA required minimum distributions more effectively. This integration streamlines your workflow, ensuring that all your financial documents are in one place.

-

How secure is the process of eSigning IRA required minimum distribution documents?

Security is a top priority at airSlate SignNow, especially when handling documents related to IRA required minimum distributions. The platform uses advanced encryption protocols to protect your data, ensuring that your eSigned documents remain confidential and secure.

-

What are the tax implications of not taking my IRA required minimum distribution?

Failing to take your IRA required minimum distribution can result in signNow tax penalties, amounting to 50% of the amount you were supposed to withdraw. Using airSlate SignNow helps you stay organized and compliant with your RMD obligations, minimizing the risk of costly penalties.

Get more for Irs Ira Distribution Form

- Release adult form

- Release minor child 497427234 form

- Waiver and release from liability for adult for snowmobile form

- Waiver and release from liability for minor child for snowmobile form

- Waiver and release from liability for adult for disc golf form

- Waiver release liability form 497427238

- Waiver hunting form

- Waiver and release from liability for minor child for duck hunting form

Find out other Irs Ira Distribution Form

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT