8826 Form

What is the IRS Form 8826?

The IRS Form 8826, also known as the Disabled Access Credit, is a tax form designed to assist small businesses in making their facilities accessible to individuals with disabilities. This form allows eligible businesses to claim a credit for expenses incurred in making their facilities compliant with the Americans with Disabilities Act (ADA). The credit can cover various accessibility improvements, including modifications to entrances, restrooms, and parking areas. Understanding the purpose and benefits of this form is crucial for businesses aiming to enhance accessibility and potentially reduce their tax liability.

Eligibility Criteria for the 8826

To qualify for the Disabled Access Credit, businesses must meet specific eligibility requirements. Primarily, the business must have gross receipts of less than one million dollars in the previous tax year. Additionally, the expenses claimed must be directly related to making the business accessible to individuals with disabilities. Eligible expenses can include costs for removing architectural barriers and acquiring accessible equipment. It is important for businesses to keep detailed records of these expenses to support their claims.

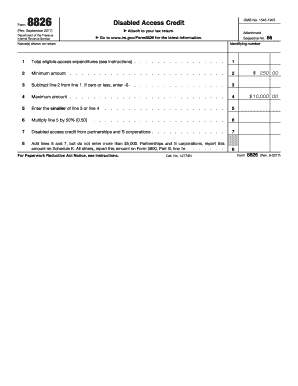

Steps to Complete the 8826

Completing the IRS Form 8826 involves several key steps. First, gather all necessary documentation related to accessibility improvements. Next, accurately fill out the form, ensuring all required fields are completed. Businesses must detail the costs incurred for each accessibility modification and calculate the total credit amount. It is essential to review the form for accuracy before submission. Finally, submit the completed form along with the business's tax return to the IRS by the applicable deadline.

Legal Use of the 8826

The legal use of the IRS Form 8826 is governed by the Internal Revenue Code, which outlines the eligibility and requirements for claiming the Disabled Access Credit. Businesses must ensure compliance with all IRS regulations to avoid penalties. The form must be used only for legitimate expenses related to making facilities accessible. Failure to adhere to these guidelines may result in disqualification from claiming the credit or potential legal ramifications.

Required Documents for the 8826

When preparing to file the IRS Form 8826, businesses should gather specific documents to substantiate their claims. Required documents include receipts and invoices for all accessibility-related expenses, a detailed description of the modifications made, and any relevant contracts or agreements with service providers. Maintaining organized records will facilitate the completion of the form and support the legitimacy of the claimed expenses during any potential audits.

Filing Deadlines for the 8826

The IRS Form 8826 must be filed alongside the business's annual tax return. For most businesses, the deadline for filing is April 15 of the following year. However, if the business operates on a fiscal year, the deadline will correspond to the end of that fiscal year. It is crucial for businesses to be aware of these deadlines to ensure they do not miss the opportunity to claim the Disabled Access Credit, which can provide significant tax relief.

Quick guide on how to complete 8826

Easily Prepare 8826 on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a superb environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 8826 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign 8826 Effortlessly

- Find 8826 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes a matter of seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign 8826 to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a form disabled access credit?

A form disabled access credit is a financial benefit designed to assist individuals with disabilities by facilitating easier access to necessary documents and services. By leveraging airSlate SignNow, users can create and manage these forms efficiently, ensuring that all essential information is easily accessible and manageable.

-

How does airSlate SignNow support form disabled access credit?

airSlate SignNow provides various tools that enhance accessibility for individuals utilizing a form disabled access credit. With our intuitive interface, users can quickly eSign and manage documents while ensuring compliance with important accessibility standards, benefiting both businesses and their clients.

-

Is there a cost associated with using airSlate SignNow for form disabled access credit?

Yes, there are various pricing plans available on airSlate SignNow for using services related to form disabled access credit. Each plan is competitively priced, designed to offer value tailored to different business needs. You can choose a plan that fits your organization's requirements without breaking the budget.

-

What features make airSlate SignNow ideal for handling form disabled access credit?

airSlate SignNow offers comprehensive features such as customizable templates, secure eSigning, and automated workflows, making it ideal for managing form disabled access credits. These features streamline the process, ensuring that forms are processed quickly and accurately, meeting the needs of both users and businesses.

-

Can airSlate SignNow integrate with other software for managing form disabled access credits?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software solutions to help manage form disabled access credits. This integration capability allows businesses to enhance their workflows, ensuring that access to necessary forms and services is both efficient and straightforward.

-

What benefits does airSlate SignNow offer for businesses processing form disabled access credit?

By using airSlate SignNow for processing form disabled access credit, businesses can enjoy improved efficiency and reduced processing times. The solution helps ensure compliance with accessibility regulations while also delivering an enhanced user experience for clients needing access to these forms.

-

How user-friendly is the airSlate SignNow platform for form disabled access credit?

The airSlate SignNow platform is extremely user-friendly, designed for anyone to navigate easily, regardless of technical proficiency. This is particularly important for users managing form disabled access credits, as the simplicity of the platform improves accessibility and ensures that all documents can be handled quickly and effectively.

Get more for 8826

- Flooring contract for contractor utah form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract utah form

- Notice of intent to enforce forfeiture provisions of contact for deed utah form

- Final notice of forfeiture and request to vacate property under contract for deed utah form

- Buyers request for accounting from seller under contract for deed utah form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed utah form

- General notice of default for contract for deed utah form

- Utah seller disclosure form 497427306

Find out other 8826

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney