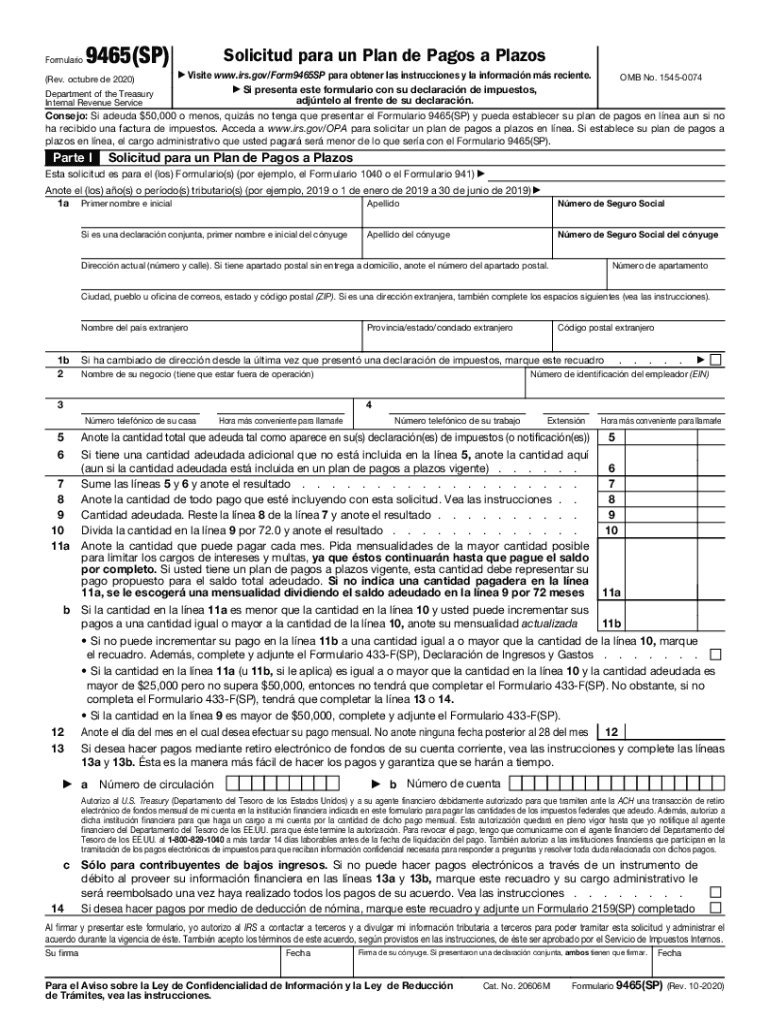

Internal Revenue Service Form

What is the Internal Revenue Service?

The Internal Revenue Service (IRS) is the U.S. government agency responsible for administering and enforcing federal tax laws. Established in 1862, the IRS plays a crucial role in collecting taxes, processing tax returns, and issuing refunds. The agency also provides guidance on tax regulations and ensures compliance with tax laws. Understanding the IRS is essential for individuals and businesses to navigate their tax obligations effectively.

Steps to complete the Internal Revenue Service

Completing your obligations with the IRS involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Choose the correct form: Depending on your tax situation, select the appropriate IRS form, such as the 1040 for individual income tax returns.

- Fill out the form: Carefully complete the chosen form, ensuring all information is accurate and complete.

- Review and sign: Double-check your entries for errors, then sign and date the form where required.

- Submit the form: File your completed form electronically or by mail, depending on your preference and the form type.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance with the IRS. Key dates include:

- April 15: The standard deadline for filing individual income tax returns for the previous year.

- October 15: The deadline for filing extended returns if an extension has been granted.

- Quarterly estimated tax payments: Due on April 15, June 15, September 15, and January 15 of the following year for self-employed individuals or those with additional income.

Required Documents

When preparing to file your taxes, certain documents are essential for accurate reporting. These include:

- Income statements: Forms such as W-2s and 1099s that report your earnings.

- Deductions and credits: Documentation for any deductions or credits you plan to claim, such as receipts for charitable contributions or mortgage interest statements.

- Previous tax returns: Having your last year's return can help ensure consistency and accuracy in your current filing.

Penalties for Non-Compliance

Failing to comply with IRS regulations can result in significant penalties. Common penalties include:

- Failure to file: A penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent.

- Failure to pay: A penalty of half a percent of the unpaid tax for each month the payment is late, also up to a maximum of 25 percent.

- Accuracy-related penalties: Additional charges may apply if the IRS determines that there is a substantial understatement of income.

Eligibility Criteria

Eligibility for various IRS forms and programs often depends on specific criteria. For example, to file a standard individual tax return, you typically must:

- Be a U.S. citizen or resident alien.

- Have a valid Social Security number.

- Meet income thresholds set by the IRS for the tax year.

Quick guide on how to complete 2020 internal revenue service

Complete Internal Revenue Service effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Internal Revenue Service with ease

- Obtain Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow regarding plazos?

airSlate SignNow offers a variety of features that enhance document signing and management, focusing on plazos. With its intuitive interface, users can create, send, and eSign documents efficiently while ensuring that deadlines are met. The platform also allows for reminders and notifications, helping users stay on top of plazos.

-

How does airSlate SignNow support businesses in managing plazos?

Managing plazos is simple with airSlate SignNow, as the platform provides automated reminders and status tracking for each document. This way, businesses can ensure that all parties are notified before plazos are signNowed, reducing the risk of delays. The comprehensive dashboard also allows for easy oversight of all pending documents.

-

What is the pricing structure of airSlate SignNow concerning plazos?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring cost-effective solutions regardless of the number of plazos. Users can choose from monthly or annual subscriptions, with options that include features specifically designed to manage plazos effectively. The flexible pricing allows businesses to scale up as they grow.

-

Can airSlate SignNow integrate with other tools to manage plazos?

Yes, airSlate SignNow provides seamless integrations with many popular tools to help manage plazos efficiently. Whether you use project management software or CRM systems, these integrations ensure that document workflows align with your existing processes. This connectivity enhances productivity and keeps track of essential plazos.

-

What benefits does airSlate SignNow provide for small businesses in terms of plazos?

For small businesses, airSlate SignNow streamlines the document signing process, making it easier to manage plazos without the need for extensive resources. The user-friendly platform requires minimal training, enabling teams to hit the ground running. Additionally, being cost-effective means small businesses can focus more on their growth while managing critical plazos.

-

How secure is airSlate SignNow when handling sensitive documents with plazos?

Security is a top priority for airSlate SignNow. The platform employs robust encryption methods and compliance with electronic signature regulations, ensuring that all documents, especially those related to plazos, are transmitted safely. Users can trust that their sensitive information is protected against unauthorized access.

-

How can airSlate SignNow enhance team collaboration around plazos?

AirSlate SignNow enhances team collaboration by providing a centralized platform for managing documents related to plazos. Team members can review, comment, and sign documents in real-time, streamlining communication and decision-making. This collaborative environment ensures that everyone is on the same page concerning important deadlines.

Get more for Internal Revenue Service

Find out other Internal Revenue Service

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement