Form 1023 Checklist Internal Revenue Service Irs

What is the Form 1023 Checklist Internal Revenue Service IRS

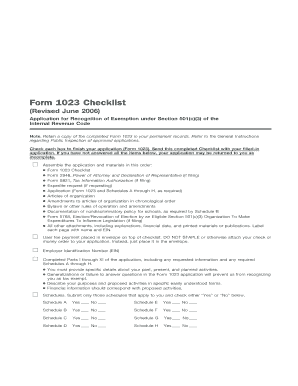

The Form 1023 Checklist is a crucial document provided by the Internal Revenue Service (IRS) for organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This checklist helps applicants ensure they include all necessary information and documentation when submitting their Form 1023 application. It outlines the key requirements and serves as a guide to streamline the application process, ultimately aiding organizations in achieving their nonprofit goals.

Steps to complete the Form 1023 Checklist Internal Revenue Service IRS

Completing the Form 1023 Checklist involves several important steps to ensure a comprehensive application. Start by gathering essential information about your organization, including its mission, structure, and activities. Next, review the checklist to confirm that you have all required documents, such as articles of incorporation, bylaws, and financial statements. Fill out the Form 1023 accurately, addressing each section as outlined in the checklist. Finally, double-check your application for completeness before submission to avoid delays in processing.

Required Documents

When completing the Form 1023 Checklist, several documents are essential for a successful submission. These include:

- Articles of incorporation that establish your organization as a legal entity.

- Bylaws that outline the governance structure and operational procedures.

- Financial statements, including a budget for the upcoming year and any previous financial records.

- Detailed descriptions of your organization’s programs and activities.

Having these documents prepared in advance can facilitate a smoother application process.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1023 Checklist. These guidelines emphasize the importance of clarity and accuracy in your application. Organizations must demonstrate that they operate exclusively for charitable purposes and comply with all applicable federal regulations. It is crucial to follow these guidelines closely to enhance the likelihood of approval and avoid potential complications during the review process.

Filing Deadlines / Important Dates

Understanding filing deadlines is vital for organizations submitting the Form 1023 Checklist. Generally, applications should be filed within 27 months of the organization's formation to ensure retroactive tax-exempt status. It is advisable to stay informed about any changes in IRS deadlines or policies that may affect your application timeline. Keeping track of these dates can help ensure timely submission and compliance with IRS requirements.

Eligibility Criteria

To qualify for tax-exempt status, organizations must meet specific eligibility criteria outlined by the IRS. These criteria include operating exclusively for charitable, educational, or religious purposes, and ensuring that no part of the organization's net earnings benefits any private individual or shareholder. Additionally, organizations must demonstrate that their activities serve the public interest. Understanding these criteria is essential for successfully completing the Form 1023 Checklist.

Application Process & Approval Time

The application process for the Form 1023 Checklist involves several stages, starting with the preparation of the application and required documents. Once submitted, the IRS typically takes between three to six months to review the application. During this period, the IRS may request additional information or clarification, which can extend the approval timeline. Organizations should remain patient and responsive to any inquiries from the IRS to facilitate a smoother approval process.

Quick guide on how to complete form 1023 checklist internal revenue service irs

Complete Form 1023 Checklist Internal Revenue Service Irs effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow supplies you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1023 Checklist Internal Revenue Service Irs on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to update and eSign Form 1023 Checklist Internal Revenue Service Irs without stress

- Find Form 1023 Checklist Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about losing or misplacing files, cumbersome form searching, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1023 Checklist Internal Revenue Service Irs while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Form 1023 Checklist Internal Revenue Service Irs and why is it important?

The Form 1023 Checklist Internal Revenue Service Irs is a crucial tool for organizations seeking tax-exempt status. This checklist outlines all the necessary documentation and requirements to ensure a smooth application process with the IRS. By following this checklist, organizations can avoid common pitfalls and increase their chances of approval.

-

How can airSlate SignNow help with the Form 1023 Checklist Internal Revenue Service Irs process?

airSlate SignNow offers an easy-to-use platform to prepare and eSign documents related to the Form 1023 Checklist Internal Revenue Service Irs. With our user-friendly features, you can efficiently organize needed documents, follow the checklist, and ensure compliance with IRS requirements. This streamlines your application process signNowly.

-

What pricing options does airSlate SignNow offer for users working on the Form 1023 Checklist Internal Revenue Service Irs?

airSlate SignNow provides flexible pricing plans suited for various organizational needs. Whether you are a small nonprofit or a larger organization, pricing starts at an affordable rate, allowing you to access features focused on the Form 1023 Checklist Internal Revenue Service Irs without a hefty investment. Be sure to check our website for the latest promotions.

-

Are there any integrations available that enhance the use of the Form 1023 Checklist Internal Revenue Service Irs with airSlate SignNow?

Yes, airSlate SignNow offers multiple integrations that can enhance your experience when working on the Form 1023 Checklist Internal Revenue Service Irs. Integrate with popular tools such as Google Drive, Dropbox, and CRM systems to easily access and manage your documents. This allows for seamless collaboration and document management.

-

What features does airSlate SignNow provide that are beneficial for the Form 1023 Checklist Internal Revenue Service Irs?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time document tracking, all of which are beneficial for managing the Form 1023 Checklist Internal Revenue Service Irs. These features allow users to create tailored documents that meet IRS standards while ensuring quick, legal electronic signatures.

-

How does airSlate SignNow ensure the security of documents related to the Form 1023 Checklist Internal Revenue Service Irs?

Security is paramount at airSlate SignNow, especially for sensitive documents tied to the Form 1023 Checklist Internal Revenue Service Irs. We employ state-of-the-art encryption and comply with industry standards to protect your data. Additionally, user permissions and audit trails are in place to ensure only authorized personnel have access.

-

Can I collaborate with my team on the Form 1023 Checklist Internal Revenue Service Irs using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration among team members when working on the Form 1023 Checklist Internal Revenue Service Irs. You can invite team members to view and edit documents, comment, and share updates in real-time, fostering a more efficient workflow.

Get more for Form 1023 Checklist Internal Revenue Service Irs

- Affidavit for transfer of title to motor vehicles in a small estate proceeding utah form

- Utah landlord notices for eviction unlawful detainer forms package utah

- Utah criminal form

- Checklist for victims statement in petition to expunge records utah form

- Utah expungement application form

- Victims statement for expungement request utah form

- Utah reply form

- Utah reply 497427666 form

Find out other Form 1023 Checklist Internal Revenue Service Irs

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form