Internal Revenue Service Payment Form

What is the Internal Revenue Service Payment

The Internal Revenue Service (IRS) payment refers to the funds that taxpayers must remit to the IRS to settle their tax obligations. This payment can be made for various reasons, including income tax, self-employment tax, and estimated tax payments. The IRS provides specific guidelines on how to calculate these payments, which can vary based on individual circumstances, such as income level and filing status.

Steps to complete the Internal Revenue Service Payment

Completing an IRS payment involves several key steps:

- Determine the amount owed: Review your tax return to calculate the total tax liability.

- Select the payment method: Choose between online payment, mailing a check, or paying in person at an authorized location.

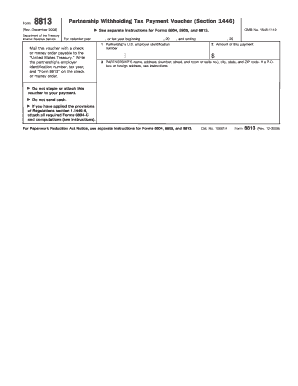

- Complete the IRS tax payment voucher: If paying by mail, fill out the appropriate IRS tax payment voucher, such as Form 8813 for partnership payments.

- Submit the payment: Follow the instructions for your chosen payment method to ensure timely processing.

How to use the Internal Revenue Service Payment

Using the IRS payment involves understanding the different forms and methods available. For instance, Form 8813 is specifically designed for partnership payments. Taxpayers can utilize this form to report and pay taxes owed by partnerships. It is essential to fill out the form accurately and submit it by the due date to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for IRS payments vary depending on the type of tax and the taxpayer's situation. Generally, individual income tax returns are due on April fifteenth. However, partnerships typically have a due date of March fifteenth. It is crucial to be aware of these deadlines to avoid late fees and interest charges.

Required Documents

To complete an IRS payment, certain documents are necessary. These include:

- Your completed tax return or estimated tax calculation.

- Any applicable IRS forms, such as Form 8813 for partnership payments.

- Documentation of prior payments and any credits that may apply.

Penalties for Non-Compliance

Failure to make timely IRS payments can result in significant penalties. The IRS may impose fines for late payments, which typically accrue interest until the balance is settled. Additionally, non-compliance can lead to more severe consequences, such as liens or levies against personal property. Understanding these penalties emphasizes the importance of meeting payment obligations.

Quick guide on how to complete internal revenue service payment

Complete Internal Revenue Service Payment effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Internal Revenue Service Payment on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Internal Revenue Service Payment with ease

- Locate Internal Revenue Service Payment and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Internal Revenue Service Payment and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an IRS tax payment voucher?

An IRS tax payment voucher is a document that taxpayers use to submit their tax payments to the IRS. It provides essential information about the taxpayer and the payment being made, ensuring accurate processing by the IRS. Using an IRS tax payment voucher is a critical part of maintaining compliance with federal tax obligations.

-

How can airSlate SignNow help with IRS tax payment vouchers?

airSlate SignNow allows users to create, send, and eSign IRS tax payment vouchers quickly and easily. By utilizing our platform, you can streamline your tax payment processes, ensuring that your voucher is completed accurately and sent on time. This helps reduce the risk of errors and provides a clear record of your payment.

-

Is there a cost associated with using airSlate SignNow for IRS tax payment vouchers?

Yes, airSlate SignNow offers various pricing plans to cater to your business needs, starting with a free trial. The cost may vary depending on the features you choose, such as advanced integrations and additional users. Investing in airSlate SignNow for your IRS tax payment vouchers can save you time and enhance your overall efficiency.

-

Are there features specific to IRS tax payment vouchers within airSlate SignNow?

airSlate SignNow includes features that cater specifically to the preparation and submission of IRS tax payment vouchers. These features include customizable templates, automated reminders, and secure eSignature capabilities. This ensures you have all the tools necessary for effective and timely submission of your vouchers.

-

Can I integrate airSlate SignNow with other tax software for IRS tax payment vouchers?

Yes, airSlate SignNow offers integrations with various tax software applications. This allows for seamless transfer of data and documentation related to your IRS tax payment vouchers. By integrating these tools, you can streamline your tax filing and payment process.

-

What are the benefits of using airSlate SignNow for IRS tax payment vouchers?

Using airSlate SignNow for IRS tax payment vouchers offers several benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface allows for quick document preparation and signing, which minimizes the chances of errors in submission. Additionally, you can access your documents anytime and anywhere.

-

How secure is airSlate SignNow when handling IRS tax payment vouchers?

airSlate SignNow prioritizes security and ensures that all documents, including IRS tax payment vouchers, are encrypted and securely stored. Our platform complies with industry standards for data protection, keeping your sensitive information safe from unauthorized access. You can trust that your tax payment documentation is in good hands.

Get more for Internal Revenue Service Payment

Find out other Internal Revenue Service Payment

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement