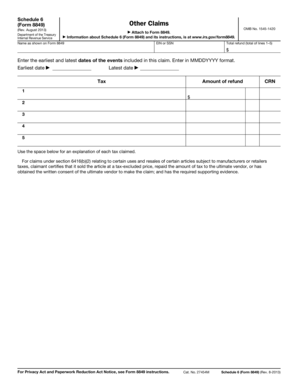

Schedule 6 Form 8849 Rev August Other Claims

What is the Schedule 6 Form 8849?

The Schedule 6 Form 8849 is a specific document used by taxpayers in the United States to claim refunds for certain excise taxes. This form is particularly relevant for individuals or businesses seeking to recover overpayments related to fuel taxes, environmental taxes, and other specific excise taxes. It is a part of the Internal Revenue Service (IRS) Form 8849, which serves as a general claims form for refunds of excise taxes paid. Understanding the purpose and requirements of the Schedule 6 Form 8849 is essential for ensuring accurate and timely submissions.

Steps to Complete the Schedule 6 Form 8849

Completing the Schedule 6 Form 8849 involves several key steps to ensure accuracy and compliance with IRS guidelines. Here are the primary steps:

- Gather necessary documentation, including receipts and records of the excise taxes paid.

- Fill out the taxpayer information section, including your name, address, and taxpayer identification number.

- Detail the specific claims you are making, including the type of tax and the amount you are requesting as a refund.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form, certifying that the information provided is true and accurate.

IRS Guidelines for Schedule 6 Form 8849

The IRS provides specific guidelines for completing and submitting the Schedule 6 Form 8849. It is crucial to follow these guidelines to avoid delays or rejections of your claims. Key points include:

- Ensure that the claims are for eligible taxes and that you have supporting documentation.

- Submit the form within the required time frame, typically within three years from the date the tax was paid.

- Use the most current version of the form, as the IRS may update forms periodically.

Filing Deadlines for Schedule 6 Form 8849

Filing deadlines for the Schedule 6 Form 8849 are critical to ensure that your claims are accepted. Generally, you must file the form within three years from the date you paid the excise tax. It is advisable to keep track of these deadlines to avoid missing out on potential refunds. Additionally, the IRS may have specific deadlines for different types of claims, so it is essential to verify the relevant dates for your situation.

Legal Use of the Schedule 6 Form 8849

The Schedule 6 Form 8849 is legally binding when completed correctly and submitted in accordance with IRS regulations. To ensure its legal validity, it is important to provide accurate information, maintain supporting documentation, and comply with all filing requirements. The form serves as an official request for a tax refund, and any discrepancies or inaccuracies could lead to complications, including potential audits or denial of claims.

Key Elements of the Schedule 6 Form 8849

Understanding the key elements of the Schedule 6 Form 8849 is essential for successful completion. Important components include:

- Taxpayer identification information, including name and address.

- Details of the excise tax being claimed, including the type and amount.

- Signature and date to validate the submission.

- Any additional documentation required to support the claim.

Quick guide on how to complete schedule 6 form 8849 rev august 2013 other claims

Complete Schedule 6 Form 8849 Rev August Other Claims effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an excellent sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without delays. Manage Schedule 6 Form 8849 Rev August Other Claims on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Schedule 6 Form 8849 Rev August Other Claims without hassle

- Locate Schedule 6 Form 8849 Rev August Other Claims and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or redact sensitive information with tools specifically supplied by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Schedule 6 Form 8849 Rev August Other Claims and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form 8849 schedule 6 used for?

The form 8849 schedule 6 is utilized to claim a credit for certain fuel purchases, specifically for tax-exempt uses. By filling out this form, businesses can ensure they receive the credits they are entitled to, making it a crucial document for companies that use fuel in their operations.

-

How does airSlate SignNow help with the form 8849 schedule 6?

airSlate SignNow provides a simple and efficient way to eSign and send your form 8849 schedule 6 documents. Our platform streamlines the signing process, ensuring that you can complete and submit the form quickly, minimizing delays in your claims.

-

Is there a cost to using airSlate SignNow for form 8849 schedule 6?

airSlate SignNow offers competitive pricing tailored to various needs, including businesses that frequently use the form 8849 schedule 6. We provide cost-effective solutions to ensure you can manage and sign your important documents without breaking the bank.

-

What features does airSlate SignNow offer for form 8849 schedule 6 management?

With airSlate SignNow, you benefit from features such as secure eSigning, document templates, and easy tracking of your form 8849 schedule 6 submissions. These functionalities enhance efficiency and ensure your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for form 8849 schedule 6?

Yes, airSlate SignNow offers integrations with various business software, allowing for seamless management of your form 8849 schedule 6. This flexibility empowers you to maintain your workflow without the hassle of switching between different applications.

-

What are the benefits of using airSlate SignNow for form 8849 schedule 6?

Using airSlate SignNow for your form 8849 schedule 6 brings efficiency, ease of use, and compliance to your document processes. It helps ensure timely submissions, reduces errors, and allows you to focus more on your business operations instead of paperwork.

-

How secure is airSlate SignNow for handling form 8849 schedule 6?

Security is a top priority for airSlate SignNow. We implement the latest encryption and authentication protocols to safeguard your form 8849 schedule 6 and other sensitive documents, ensuring they are protected throughout the eSigning process.

Get more for Schedule 6 Form 8849 Rev August Other Claims

- Paving contract for contractor virginia form

- Site work contract for contractor virginia form

- Siding contract for contractor virginia form

- Virginia contract contractor 497427917 form

- Drainage contract for contractor virginia form

- Foundation contract for contractor virginia form

- Plumbing contract for contractor virginia form

- Brick mason contract for contractor virginia form

Find out other Schedule 6 Form 8849 Rev August Other Claims

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile