Sba Form 3508s Fillable

What is the SBA Form 3508S Fillable

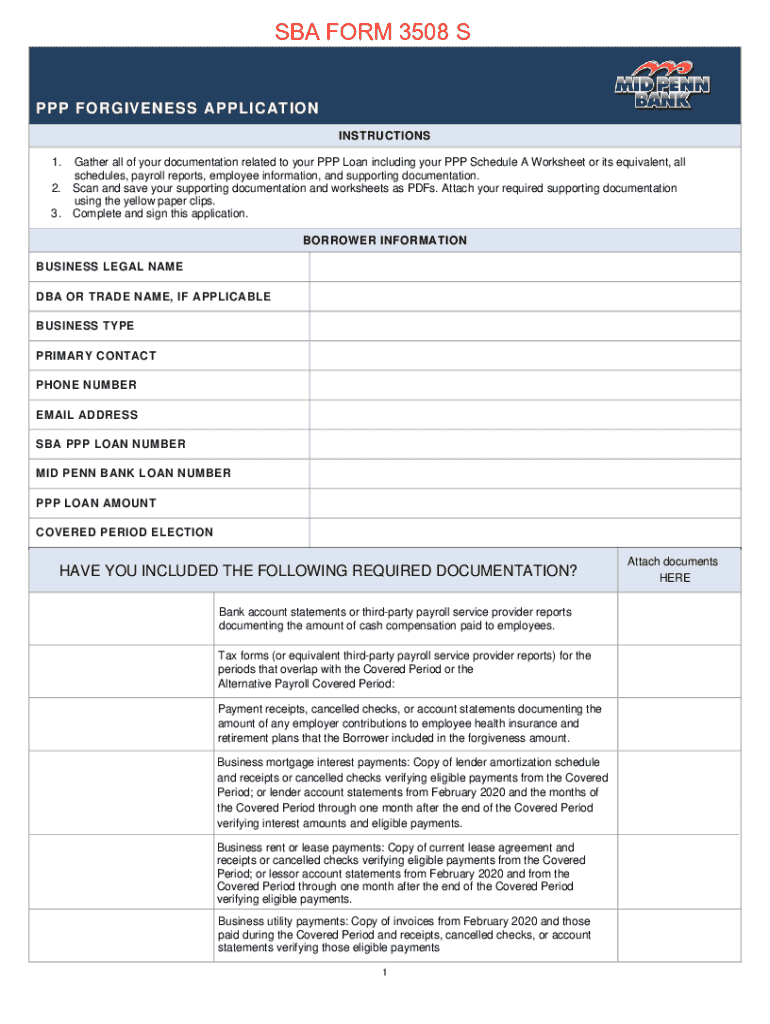

The SBA Form 3508S is a simplified application designed for borrowers seeking forgiveness for Paycheck Protection Program (PPP) loans of $150,000 or less. This fillable form allows businesses to report their eligible expenses and demonstrate compliance with the program's requirements. By utilizing the fillable format, applicants can easily input their information digitally, ensuring accuracy and efficiency in the submission process.

How to Use the SBA Form 3508S Fillable

To effectively use the SBA Form 3508S fillable version, follow these steps:

- Download the form from a reliable source or access it through an authorized platform.

- Open the form using a compatible PDF reader that supports fillable fields.

- Carefully enter the required information, including your business details and eligible expenses.

- Review the completed form for accuracy before saving or printing it.

Steps to Complete the SBA Form 3508S Fillable

Completing the SBA Form 3508S fillable version involves several key steps:

- Begin by entering your business name, address, and other identifying information in the designated fields.

- Document the total amount of your PPP loan and the covered period for which you are applying for forgiveness.

- Detail your eligible payroll and non-payroll costs, ensuring they align with the guidelines provided by the SBA.

- Include any necessary calculations to determine the forgiveness amount, following the instructions included with the form.

- Sign and date the form electronically if possible, or print it out for a handwritten signature.

Legal Use of the SBA Form 3508S Fillable

The SBA Form 3508S fillable version is legally recognized when completed accurately and submitted in accordance with the guidelines set forth by the Small Business Administration. To ensure its legal standing, it is important to adhere to the following:

- Provide truthful and complete information to avoid potential legal repercussions.

- Maintain documentation that supports the expenses reported on the form, as the SBA may request verification.

- Submit the form within the required timeframe to comply with PPP loan forgiveness regulations.

Required Documents for the SBA Form 3508S Fillable

When completing the SBA Form 3508S, certain documents are necessary to support your application for forgiveness. These include:

- Payroll records, such as bank statements or payroll reports, to verify employee compensation.

- Invoices or receipts for non-payroll expenses, like rent or utilities, incurred during the covered period.

- Documentation of any reductions in workforce or employee hours, if applicable.

Form Submission Methods

The SBA Form 3508S can be submitted through various methods, ensuring convenience for applicants. The primary submission methods include:

- Online submission via the lender's portal, allowing for a streamlined process.

- Mailing a printed copy of the completed form directly to the lender.

- In-person delivery to the lender’s office, if preferred.

Quick guide on how to complete sba form 3508s fillable

Complete Sba Form 3508s Fillable seamlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Sba Form 3508s Fillable on any device with airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The easiest way to modify and electronically sign Sba Form 3508s Fillable effortlessly

- Locate Sba Form 3508s Fillable and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow offers expressly for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Alter and electronically sign Sba Form 3508s Fillable and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 3508s fillable

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow's form application feature?

The form application feature in airSlate SignNow allows users to create, edit, and manage forms easily within the platform. This functionality streamlines the document workflow, enabling businesses to send and eSign documents quickly. It's designed for both simplicity and efficiency, ensuring your team can focus on what matters most.

-

How much does airSlate SignNow's form application cost?

airSlate SignNow offers several pricing plans to accommodate different needs, starting from a free trial to premium subscriptions. Pricing for the form application feature is competitive and designed to provide a cost-effective solution for businesses of all sizes. You can explore the pricing tiers on our website to find the best fit for your organization's needs.

-

What are the benefits of using the form application in airSlate SignNow?

Using the form application in airSlate SignNow enhances productivity by simplifying document management and eSigning processes. It allows for easy customization of forms, gathering signatures faster, and improving overall workflow efficiency. With this tool, businesses can reduce paper usage and increase professionalism in their documentation.

-

Can I integrate airSlate SignNow's form application with other software?

Yes, airSlate SignNow's form application seamlessly integrates with various third-party applications, allowing for smooth data transfer and enhanced functionality. Popular integrations include CRM systems, project management tools, and payment gateways. This ensures that your business can maintain a cohesive workflow across different platforms.

-

Is it easy to create a form application using airSlate SignNow?

Absolutely! Creating a form application with airSlate SignNow is user-friendly, requiring no technical expertise. The intuitive drag-and-drop interface and customizable templates make it simple for anyone to design forms that meet their specific requirements. This means your team can quickly adapt and respond to changing business needs.

-

How secure is the form application on airSlate SignNow?

Security is a top priority at airSlate SignNow. The form application employs advanced encryption to protect sensitive information and ensures data compliance with industry standards. With robust authentication methods, your documents and signatures are safe from unauthorized access.

-

What types of documents can I manage with the form application?

The form application in airSlate SignNow can be used to manage a wide variety of documents including contracts, applications, and consent forms. This versatility makes it suitable for different industries and purposes. You can customize each form to fit your specific needs, ensuring a tailored approach to document management.

Get more for Sba Form 3508s Fillable

Find out other Sba Form 3508s Fillable

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe