Payroll Correction Form

What is the payroll correction form?

The payroll correction form is a vital document used to rectify errors in employee payroll records. This form addresses discrepancies such as incorrect wages, miscalculated deductions, or errors in employee classifications. By submitting this form, employers ensure that employees receive the correct compensation and that payroll records are accurate and compliant with legal requirements. It serves as an official record of the changes made and helps maintain transparency in payroll management.

Steps to complete the payroll correction form

Completing the payroll correction form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the employee's details, the specific error, and the corrected information. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is crucial to provide a clear explanation of the error and the reason for the correction. Once the form is filled out, review it for any mistakes before submitting it to the appropriate department or payroll administrator.

Legal use of the payroll correction form

The payroll correction form is legally binding when completed correctly. It must comply with relevant regulations, such as the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) guidelines. To ensure its legal standing, the form should include signatures from both the employee and the employer, confirming the accuracy of the corrections made. Proper documentation and adherence to legal requirements help protect both parties in case of disputes regarding payroll discrepancies.

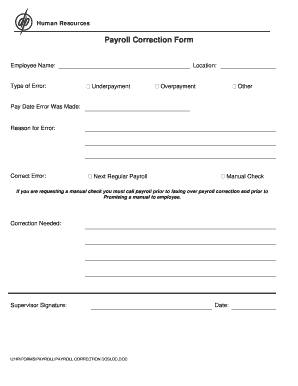

Key elements of the payroll correction form

A well-structured payroll correction form includes several essential elements. These typically consist of:

- Employee Information: Name, employee ID, and contact details.

- Error Description: A detailed account of the error that occurred.

- Corrected Information: The accurate data that needs to be updated.

- Signatures: Required signatures from both the employee and the employer.

- Date: The date when the correction form is submitted.

Including these elements ensures that the form is comprehensive and meets all necessary requirements for processing.

How to obtain the payroll correction form

The payroll correction form can typically be obtained through your company's human resources or payroll department. Many organizations provide a standard template that employees can fill out. Additionally, some companies may offer the form in a digital format, allowing for easier access and completion. If the form is not readily available, employees can request it directly from their HR representative, who can provide guidance on the process for submitting corrections.

Form submission methods

Submitting the payroll correction form can be done through various methods, depending on the organization's policies. Common submission methods include:

- Online Submission: Many companies allow employees to submit forms electronically through a secure portal.

- Mail: The form can be printed and mailed to the payroll department.

- In-Person: Employees may also choose to deliver the form directly to their HR or payroll administrator.

Choosing the appropriate method ensures that the correction is processed promptly and efficiently.

Quick guide on how to complete payroll correction form 42559715

Complete Payroll Correction Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Payroll Correction Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

How to modify and eSign Payroll Correction Form with ease

- Locate Payroll Correction Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Payroll Correction Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll correction form 42559715

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is a payroll correction form and why is it important?

A payroll correction form is a document used to rectify errors in payroll processing. It is crucial for ensuring that employees receive accurate compensation, as mistakes can lead to overpayments or underpayments. Utilizing a payroll correction form helps maintain compliance and fosters employee trust in the payroll system.

-

How does airSlate SignNow simplify the payroll correction form process?

airSlate SignNow simplifies the payroll correction form process by providing an intuitive platform for eSigning and document management. Users can easily create, send, and track payroll correction forms, ensuring a streamlined workflow. This automation saves time and reduces the risk of errors that can occur with manual processing.

-

What are the pricing options for using airSlate SignNow for payroll correction forms?

airSlate SignNow offers flexible pricing plans designed to cater to various business needs. You can choose a subscription that best fits your organization's size and usage requirements, whether it's a small business or a large enterprise. Each plan includes access to features that enhance the management of payroll correction forms.

-

Can airSlate SignNow integrate with existing payroll systems?

Yes, airSlate SignNow can seamlessly integrate with many popular payroll systems, allowing for efficient data management. This integration enables users to directly handle payroll correction forms within their existing frameworks, enhancing overall operational efficiency. As a result, you can minimize manual data entry and save time.

-

What features does airSlate SignNow offer for managing payroll correction forms?

airSlate SignNow provides various features for managing payroll correction forms, including customizable templates, automated workflows, and real-time tracking. Users can set reminders and notifications to ensure timely approvals and completion of corrections. These features enhance organization and reduce bottlenecks in the payroll process.

-

Is it secure to use airSlate SignNow for payroll correction forms?

Absolutely! airSlate SignNow prioritizes security by providing encrypted eSigning and document protection features. Your payroll correction forms are safeguarded with advanced security protocols, ensuring that sensitive employee information remains confidential. This security is crucial for maintaining compliance with data protection regulations.

-

How can airSlate SignNow benefit my HR team in handling payroll correction forms?

airSlate SignNow benefits HR teams by streamlining the payroll correction form process, reducing the administrative burden. It allows for quick and efficient approvals, which can lead to faster payroll corrections and improved employee satisfaction. With easy access to documents, your HR team can focus on more strategic tasks.

Get more for Payroll Correction Form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants washington form

- Shut off notice 497429684 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat washington form

- Waiver release lien form

- 30 day notice to terminate month to month lease for residential from tenant to landlord washington form

- 30 day notice to terminate month to month lease residential from landlord to tenant washington form

- 10 days notice form

- Assignment of deed of trust by individual mortgage holder washington form

Find out other Payroll Correction Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe