City of Owensboro Tax Form

What is the City of Owensboro Tax Form?

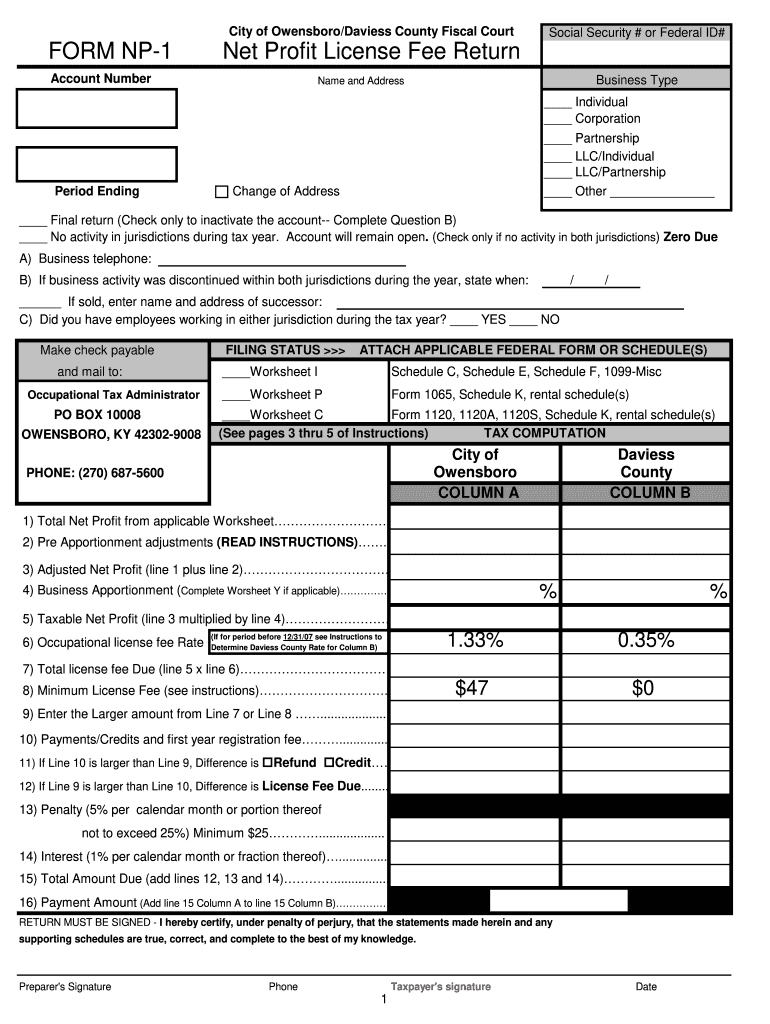

The City of Owensboro Tax Form is a crucial document used for reporting various tax obligations within the city. This form is primarily utilized by businesses to declare their net profit and ensure compliance with local tax regulations. It plays an essential role in the city’s tax collection system, helping to fund public services and infrastructure. Understanding the purpose and requirements of this form is vital for businesses operating in Owensboro.

Steps to Complete the City of Owensboro Tax Form

Completing the City of Owensboro Tax Form involves several important steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect financial records, including income statements and expense reports, to accurately report your net profit.

- Fill out the form: Enter your business details, including name, address, and tax identification number, along with your calculated net profit.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties or delays.

- Sign and date: Ensure that the form is signed by an authorized representative of the business.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Required Documents

To successfully complete the City of Owensboro Tax Form, certain documents are required. These documents provide the necessary information and support for your tax return:

- Financial statements: Income statements and balance sheets are essential for determining your net profit.

- Tax identification number: Ensure you have your business’s tax ID readily available for accurate reporting.

- Previous tax returns: Having copies of past filings can help ensure consistency and accuracy in your current submission.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance with the City of Owensboro tax regulations. Typically, the deadline for submitting the City of Owensboro Tax Form aligns with the end of the fiscal year. It is advisable to check the city’s official resources for any updates or changes to these dates. Missing the deadline may result in penalties or interest on unpaid taxes.

Form Submission Methods

The City of Owensboro Tax Form can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online submission: Many businesses prefer this method for its convenience and speed.

- Mail: You can print the completed form and send it to the designated city tax office address.

- In-person submission: For those who prefer direct interaction, forms can be submitted at the city tax office during business hours.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the City of Owensboro Tax Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to all regulations and deadlines to avoid these consequences. Regularly reviewing compliance practices can help mitigate risks associated with non-compliance.

Quick guide on how to complete city of owensboro tax formpdffillercom

Manage City Of Owensboro Tax Form effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Handle City Of Owensboro Tax Form on any device with airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign City Of Owensboro Tax Form without any hassle

- Find City Of Owensboro Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Modify and eSign City Of Owensboro Tax Form and guarantee superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

Is it illegal for my boss to fill out the tax papers to tell them how much to take out?

It would be illegal for an employer to fill out a W-4 form for you.However, if you have not signed a W-4 form and given it to your employer, the employer is still required to withhold taxes. If I remember correctly they must do as if you'd filled out the form as single with 0 exemptions.If you want to change what your employer is withholding, you should be able to go to Internal Revenue Service, print out a W-4 form, fill it out and give it to your employer.If after that your withholding doesn't change in a reasonable time (I think they're allowed a couple of weeks), then talk to the IRS.

-

How can I do my income tax return filing without the help of an auditor?

You can do the same, by using online tools available, free chat forums and with the help of professionals that are ready to help at Quora. Even i try to answer all the queries that are posted on QuoraHowever, a word of advise, do not try to do your self. The filing of return, apparently has been simplified. But the correlation in returns from external source of information is so much that filing one-self(unless you are a professional) can be dangerous

-

How do I fill out services tax?

HelloTwo cases here.You want to make service tax payment: Click this link to move the Service tax payment page on ACES site. EASIESTYou need to fill service tax return.Other than the paid software in the market. You can fill it from two utilities.a. St-3 offline utility.b. Online in aces website.Excel utility procedure is here: A separate excel utility is launched by the department for April to June 17 period. You can download utility from here. ACES’s Excel Utility for e-filing of ST-3/ ST-3C (Service Tax Return) for Apr. 2017 to Jun. 2017Going with the excel utility.You need to enable macro when you open excel. Excel asks to enable them when you open this file.Worksheet (Return): You need to fill the information of your company, service tax number, Type of return (Original), Constituion (e.g private limited company) and description of services. Validate the sheet and click next, you will get more tabs in the excel workbook after click next.Worksheet (Payable Services(1)): It includes the services provided, export and tax, taxable services under reverse charge. The sheet calculates the taxes by default after filling the necessary info of outward supplies.Paid-Service: Need to mention the tax paid in cash and by input credit recd. from your supplier of services. Separate figures of ST, KKC and SBC to be provided.Challan-Service: All the challan number and amountCenvat: This sheet comprises your opening cenvat as on 1st April 17 and credit taken and availed. You closing balance of Taxes in your account books should match with the closing balance in this sheet.Hope this answer your queries.Please upvote if this answer your queries. Thanks

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the city of owensboro tax formpdffillercom

How to create an electronic signature for your City Of Owensboro Tax Formpdffillercom in the online mode

How to make an electronic signature for your City Of Owensboro Tax Formpdffillercom in Chrome

How to create an eSignature for signing the City Of Owensboro Tax Formpdffillercom in Gmail

How to make an electronic signature for the City Of Owensboro Tax Formpdffillercom straight from your mobile device

How to generate an electronic signature for the City Of Owensboro Tax Formpdffillercom on iOS devices

How to create an electronic signature for the City Of Owensboro Tax Formpdffillercom on Android

People also ask

-

What is the City Of Owensboro Tax Form and how can airSlate SignNow help?

The City Of Owensboro Tax Form is a document required for filing local taxes in Owensboro. airSlate SignNow provides an easy-to-use platform that allows you to fill out and eSign the City Of Owensboro Tax Form quickly and efficiently, ensuring that your submissions are accurate and timely.

-

How much does it cost to use airSlate SignNow for the City Of Owensboro Tax Form?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. You can choose from monthly or annual subscriptions, making it cost-effective to manage your City Of Owensboro Tax Form and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for the City Of Owensboro Tax Form?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to streamline your workflow for the City Of Owensboro Tax Form. Whether you use CRM systems, project management tools, or cloud storage, our integrations enhance your document signing experience.

-

Is airSlate SignNow secure for handling the City Of Owensboro Tax Form?

Absolutely! airSlate SignNow prioritizes security with industry-standard encryption and compliance measures. When managing the City Of Owensboro Tax Form, you can trust that your sensitive information is protected throughout the signing process.

-

Can I send reminders for the City Of Owensboro Tax Form using airSlate SignNow?

Yes, airSlate SignNow includes features that allow you to send reminders for the City Of Owensboro Tax Form to ensure timely completion. This helps keep all parties informed and accountable, making the tax filing process smoother.

-

What features does airSlate SignNow offer for the City Of Owensboro Tax Form?

airSlate SignNow offers a variety of features for the City Of Owensboro Tax Form, including eSigning, document templates, and collaboration tools. These features streamline the process, making it easier to complete and submit your tax form efficiently.

-

How does airSlate SignNow improve the efficiency of filing the City Of Owensboro Tax Form?

By using airSlate SignNow, you can fill out, eSign, and manage the City Of Owensboro Tax Form in one centralized platform. This reduces the time spent on paperwork and ensures that your tax documents are organized and easily accessible.

Get more for City Of Owensboro Tax Form

- Office of k 12 educational services form

- Working with digital signatures oracle help center form

- Uniform complaint procedures complaint procedures ca dept

- District forms pdf versions east whittier city school district

- Injury and illness prevention program orange unified school form

- Calstrs refund application 1112910 form

- Motor claims notification form allianz insurance

- Green dog cat form

Find out other City Of Owensboro Tax Form

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form