Calstrs Refund Application 2020

What is the Calstrs Refund Application

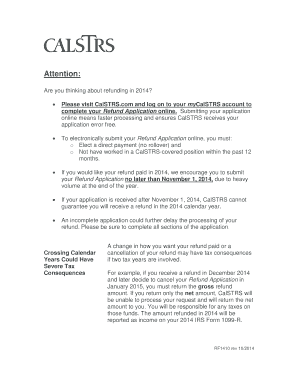

The Calstrs refund application is a formal request submitted by members of the California State Teachers' Retirement System (CalSTRS) to withdraw their contributions from the retirement fund. This application is typically used by individuals who are no longer employed in a qualifying position or who wish to access their funds for other reasons. The process involves completing the CalSTRS form RF 1360, which outlines the necessary information and documentation required for the refund.

Steps to complete the Calstrs Refund Application

Completing the Calstrs refund application involves several key steps to ensure accuracy and compliance. Begin by downloading the CalSTRS form RF 1360 from the official CalSTRS website. Next, gather all required documentation, which may include proof of identity and employment history. Fill out the form carefully, ensuring all sections are completed accurately. Once the form is filled out, review it for any errors before submitting it. The completed application can then be sent to CalSTRS via mail or submitted electronically, depending on the options available.

Required Documents

When applying for a refund through the Calstrs refund application, specific documents are necessary to support your request. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Employment records to verify your tenure with a qualifying employer.

- Any additional forms or documentation specified by CalSTRS.

It is essential to ensure that all documents are current and accurately reflect your employment status to avoid delays in processing your application.

Eligibility Criteria

Eligibility for the Calstrs refund application is typically determined by several factors. Applicants must be former members of CalSTRS who have ceased employment in a qualifying position. Additionally, individuals must have made contributions to the retirement system and are seeking to withdraw those funds. It is important to review the specific eligibility criteria outlined by CalSTRS, as there may be variations based on individual circumstances.

Form Submission Methods

The Calstrs refund application can be submitted through multiple methods, providing flexibility for applicants. Common submission methods include:

- Online Submission: If available, applicants can submit the completed form electronically via the CalSTRS website.

- Mail: The application can be printed and mailed to the designated CalSTRS address.

- In-Person: Applicants may also have the option to submit their application in person at a CalSTRS office, depending on local regulations.

Choosing the appropriate submission method can help streamline the application process and ensure timely processing of the refund request.

Legal use of the Calstrs Refund Application

The legal use of the Calstrs refund application is governed by various regulations and guidelines established by CalSTRS. To ensure that the application is legally binding, it is crucial that all information provided is truthful and complete. Additionally, applicants must adhere to any deadlines or requirements set forth by CalSTRS to avoid potential penalties or delays. Utilizing electronic signature solutions, such as those offered by signNow, can enhance the legal validity of your submission by ensuring compliance with eSignature laws.

Quick guide on how to complete calstrs refund application 1112910

Complete Calstrs Refund Application effortlessly on any device

The management of online documents has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Calstrs Refund Application on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Calstrs Refund Application without breaking a sweat

- Obtain Calstrs Refund Application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Calstrs Refund Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calstrs refund application 1112910

Create this form in 5 minutes!

How to create an eSignature for the calstrs refund application 1112910

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a calstrs refund application, and how does it work?

A calstrs refund application is a process for members of the California State Teachers' Retirement System to request a refund of their contributions. Completing this application is essential for retrieving your retirement contributions upon leaving service or when you've decided to withdraw from the system. Utilize airSlate SignNow to streamline the signing and submission of your documents for a hassle-free experience.

-

How much does it cost to use the airSlate SignNow for my calstrs refund application?

AirSlate SignNow offers a cost-effective solution tailored to meet various needs, including the processing of your calstrs refund application. Pricing plans vary based on the features you choose but generally provide a budget-friendly option for both individuals and businesses. You can explore our pricing page to find the plan that best fits your requirements.

-

What features does airSlate SignNow offer that benefit my calstrs refund application?

AirSlate SignNow provides robust features such as eSignature, document storage, and automated workflows that simplify your calstrs refund application. With an intuitive interface, you can easily manage and track your applications, ensuring you stay organized throughout the process. These features enhance efficiency and save you valuable time.

-

Can I integrate airSlate SignNow with other tools for my calstrs refund application?

Yes, airSlate SignNow supports integrations with various applications to streamline your workflow for the calstrs refund application. You can connect it with cloud storage, CRM systems, and other business applications to organize your document management effectively. This integration ensures a seamless experience while handling your refund application.

-

What are the benefits of using airSlate SignNow for my calstrs refund application?

Using airSlate SignNow for your calstrs refund application presents several benefits, including ease of use and enhanced security for your sensitive documents. You can eSign your application quickly, reducing the time spent on paperwork. Additionally, our platform ensures compliance with legal requirements, providing peace of mind during the process.

-

Is airSlate SignNow secure for handling my calstrs refund application documents?

Absolutely! AirSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and authentication protocols. When you handle your calstrs refund application through our platform, you can rest assured that your data is safeguarded against unauthorized access and bsignNowes. Security is a fundamental part of our service.

-

How quickly can I complete my calstrs refund application using airSlate SignNow?

With airSlate SignNow, you can complete your calstrs refund application in a fraction of the time compared to traditional methods. The user-friendly interface allows for quick document preparation and eSigning, typically allowing you to finalize your application in just a few minutes. This efficiency accelerates the review and approval process.

Get more for Calstrs Refund Application

- Form i 600a application for advance processing of orphan uscis uscis

- Boxing registration form

- Supabarn employment form

- Product return form martindale electric co uk

- Dear parents we would like to take this opportunity to welcome you form

- Modex system use agreement missouri state highway patrol mshp dps mo form

- Form 8825 rev december

- Form 8725 rev december excise tax on greenmail

Find out other Calstrs Refund Application

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe