Form 1020

What is the Form 1020

The 1020 tax form, officially known as IRS Form 1020, is a crucial document used by taxpayers in the United States to report specific financial information. This form is typically required for certain types of business entities, including corporations and partnerships, to disclose their income, deductions, and credits. Understanding what this form entails is essential for compliance with federal tax regulations.

How to use the Form 1020

Using the 1020 tax form involves several key steps. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax credits. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Once completed, review the form for accuracy before submission. It is important to understand the specific instructions provided by the IRS to ensure proper usage.

Steps to complete the Form 1020

Completing the Form 1020 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in your business information, including the name, address, and Employer Identification Number (EIN).

- Report all sources of income, including sales, services, and other revenue streams.

- List all allowable deductions, such as operating expenses and depreciation.

- Calculate the total tax liability based on the information provided.

- Sign and date the form, ensuring that all required signatures are included.

Legal use of the Form 1020

The legal use of the 1020 tax form is governed by IRS regulations. To ensure that the form is legally binding, it must be completed truthfully and submitted by the appropriate deadline. Electronic signatures are accepted, provided they meet the requirements set forth by the IRS. Utilizing a reliable eSignature solution can enhance the legal validity of the form when submitted electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 1020 tax form vary depending on the type of business entity. Generally, corporations must file by the fifteenth day of the fourth month following the end of their tax year. For partnerships, the deadline is typically the fifteenth day of the third month after the end of the tax year. It is crucial to stay informed about these dates to avoid penalties and ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The 1020 tax form can be submitted through various methods. Taxpayers have the option to file online using IRS e-file services, which offer a secure and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location. In-person submissions are generally not available for the 1020 tax form, making online and mail options the primary methods for filing.

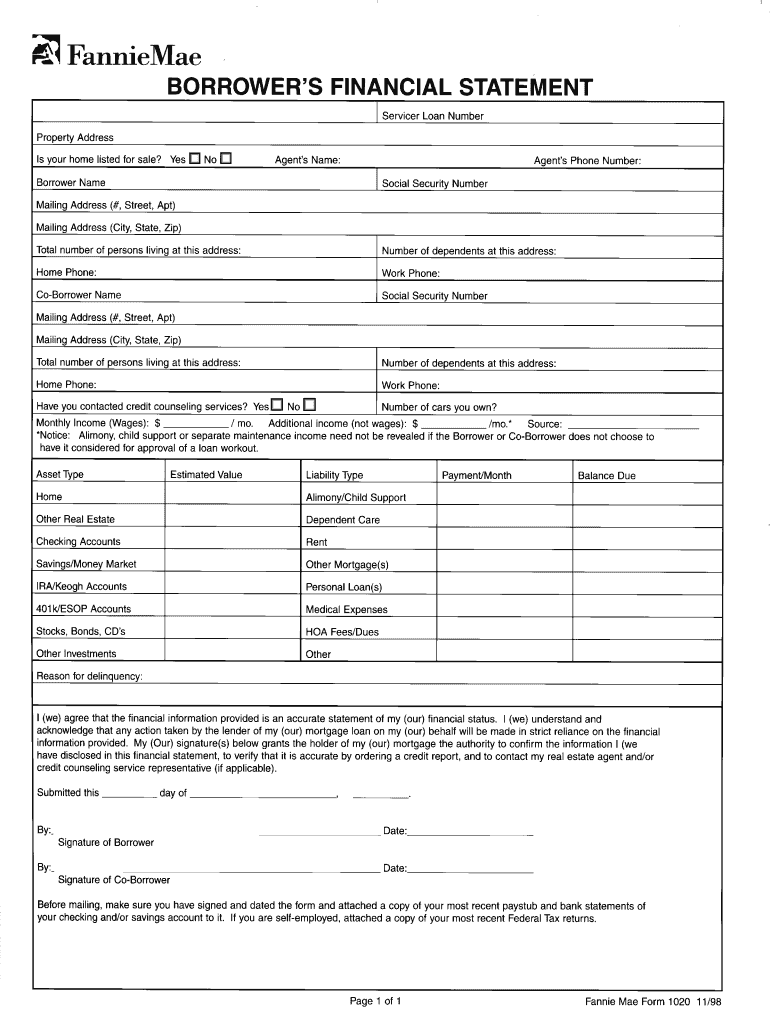

Quick guide on how to complete borroweramp39s financial statement form 1020 pdf fannie mae

Easily Prepare Form 1020 on Any Device

Virtual document management has become favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without complications. Manage Form 1020 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form 1020 Effortlessly

- Find Form 1020 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 1020 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borroweramp39s financial statement form 1020 pdf fannie mae

How to make an electronic signature for your Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae in the online mode

How to create an electronic signature for the Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae in Google Chrome

How to create an electronic signature for putting it on the Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae in Gmail

How to generate an eSignature for the Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae straight from your smart phone

How to generate an eSignature for the Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae on iOS

How to create an eSignature for the Borroweramp39s Financial Statement Form 1020 Pdf Fannie Mae on Android devices

People also ask

-

What is a 1020 tax form and why is it important?

The 1020 tax form is a tax document used by certain businesses for federal income reporting. It is crucial for ensuring compliance with IRS regulations and accurate tax filing, helping businesses avoid potential penalties.

-

How can airSlate SignNow help with the 1020 tax form?

airSlate SignNow streamlines the eSigning process for the 1020 tax form, ensuring that all signatures are collected efficiently and securely. This reduces processing time and improves the overall accuracy of your tax documentation.

-

What features does airSlate SignNow offer for managing the 1020 tax form?

airSlate SignNow offers features such as templates for the 1020 tax form, automated workflows, and real-time tracking of document status. These tools enhance productivity by simplifying the document management process.

-

Is there a cost associated with using airSlate SignNow for the 1020 tax form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to powerful features that can simplify the handling of the 1020 tax form and other documents.

-

Can I integrate airSlate SignNow with other software to handle the 1020 tax form?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, allowing you to manage the 1020 tax form more effectively. This integration helps streamline your workflow and centralizes your financial documentation.

-

What are the benefits of using airSlate SignNow for the 1020 tax form?

Using airSlate SignNow for the 1020 tax form saves time and reduces errors associated with manual processes. The platform ensures that your important tax documents are signed and stored securely, providing peace of mind.

-

How does airSlate SignNow ensure the security of the 1020 tax form?

airSlate SignNow employs advanced security measures such as encryption and secure cloud storage to protect your sensitive 1020 tax form data. This commitment to security ensures that your information remains confidential and compliant with regulations.

Get more for Form 1020

Find out other Form 1020

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure