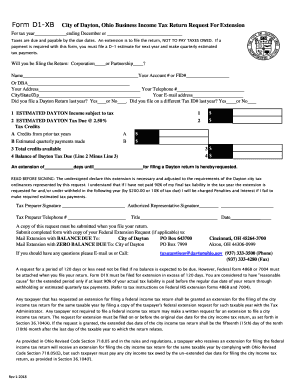

Form D1 X City of Dayton, Ohio Business Income Tax Return

What is the D1 Tax Return?

The D1 tax return is a specific form used by businesses operating within the City of Dayton, Ohio, to report their income and calculate their business income tax obligations. This form is essential for ensuring compliance with local tax regulations and is designed to capture various aspects of a business's financial activities within the city. By accurately completing the D1 tax return, businesses can fulfill their legal obligations and avoid potential penalties associated with non-compliance.

How to Use the D1 Tax Return

Using the D1 tax return involves several key steps that ensure accurate reporting of income and tax liabilities. First, businesses must gather all relevant financial documents, including income statements, expense reports, and any other documentation that supports the figures reported on the form. Next, the business should carefully fill out each section of the D1 tax return, ensuring that all information is accurate and complete. Once completed, the form can be submitted to the appropriate city tax authority, either online or through traditional mail, depending on the submission methods available.

Steps to Complete the D1 Tax Return

Completing the D1 tax return requires a systematic approach to ensure accuracy. The following steps are typically involved:

- Gather necessary financial documents, including income and expense records.

- Fill out the identification section with the business name, address, and tax identification number.

- Report total income earned during the tax year.

- Deduct allowable business expenses to determine taxable income.

- Calculate the tax due based on the applicable tax rate.

- Review the completed form for accuracy before submission.

Legal Use of the D1 Tax Return

The D1 tax return is legally binding and must be completed accurately to comply with city tax laws. Falsifying information or neglecting to report income can lead to serious legal consequences, including fines or audits. It is crucial for businesses to understand their obligations under local tax law and ensure that the D1 tax return is filled out truthfully and submitted on time.

Filing Deadlines / Important Dates

Businesses must be aware of key filing deadlines associated with the D1 tax return to avoid penalties. Typically, the D1 tax return is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the form is due by April 15. It is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Required Documents

To complete the D1 tax return, businesses must prepare several documents, including:

- Income statements detailing revenue generated.

- Expense reports outlining deductible business costs.

- Previous year’s tax returns for reference.

- Any additional documentation required by the City of Dayton tax authority.

Form Submission Methods

The D1 tax return can typically be submitted through various methods, including online submission via the city’s tax portal, mailing a paper copy to the tax office, or delivering it in person. Each method may have specific instructions that businesses should follow to ensure proper processing of their tax return.

Quick guide on how to complete form d1 x city of dayton ohio business income tax return

Prepare Form D1 X City Of Dayton, Ohio Business Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents rapidly without holdups. Manage Form D1 X City Of Dayton, Ohio Business Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form D1 X City Of Dayton, Ohio Business Income Tax Return with ease

- Find Form D1 X City Of Dayton, Ohio Business Income Tax Return and click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form D1 X City Of Dayton, Ohio Business Income Tax Return and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a D1 tax return, and why is it important?

A D1 tax return is a specific form used by taxpayers to report their income and calculate their tax obligations. Understanding your D1 tax return is crucial for ensuring compliance with tax laws and maximizing your potential tax refunds or minimizing liabilities.

-

How can airSlate SignNow assist with the D1 tax return process?

airSlate SignNow streamlines the D1 tax return process by allowing users to electronically sign and manage documents securely. Our platform ensures that you can quickly gather necessary signatures, reducing the time spent on tax preparation and submission.

-

What features does airSlate SignNow offer for handling D1 tax returns?

With airSlate SignNow, users can enjoy features like customizable templates, real-time tracking, and secure document storage. These tools make it easier to prepare and submit your D1 tax return efficiently and without errors.

-

Is airSlate SignNow affordable for small businesses filing D1 tax returns?

Yes, airSlate SignNow is a cost-effective solution designed with small businesses in mind. Our competitive pricing plans allow you to access all the essential features for managing your D1 tax return without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for my D1 tax return?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, which can help streamline the D1 tax return preparation process. These integrations allow for seamless data transfer and ensure your documents are organized and accessible.

-

How secure is the airSlate SignNow platform for my D1 tax return documents?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security measures to protect your D1 tax return documents, ensuring that your sensitive information remains confidential and secure.

-

What benefits can I expect from using airSlate SignNow for my D1 tax return?

Using airSlate SignNow for your D1 tax return provides numerous benefits, such as increased efficiency, reduced paperwork, and improved collaboration with tax professionals. You'll find that our platform simplifies the entire process, saving you time and reducing stress during tax season.

Get more for Form D1 X City Of Dayton, Ohio Business Income Tax Return

- Hsbc forms download

- Royal navy application form pdf

- Srg2150 form

- Mobile disco booking form wedding entertainment in gretna green gretna weddings

- Tv licence cancellation form pdf download

- Ease card north tyneside form

- Dairy nz milk smart workbook form

- Acc250 reimbursement of client travel expenses ancillary services client payments form

Find out other Form D1 X City Of Dayton, Ohio Business Income Tax Return

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document