Mtu Me Flowchart 2011-2026

What is the Mtu Me Flowchart

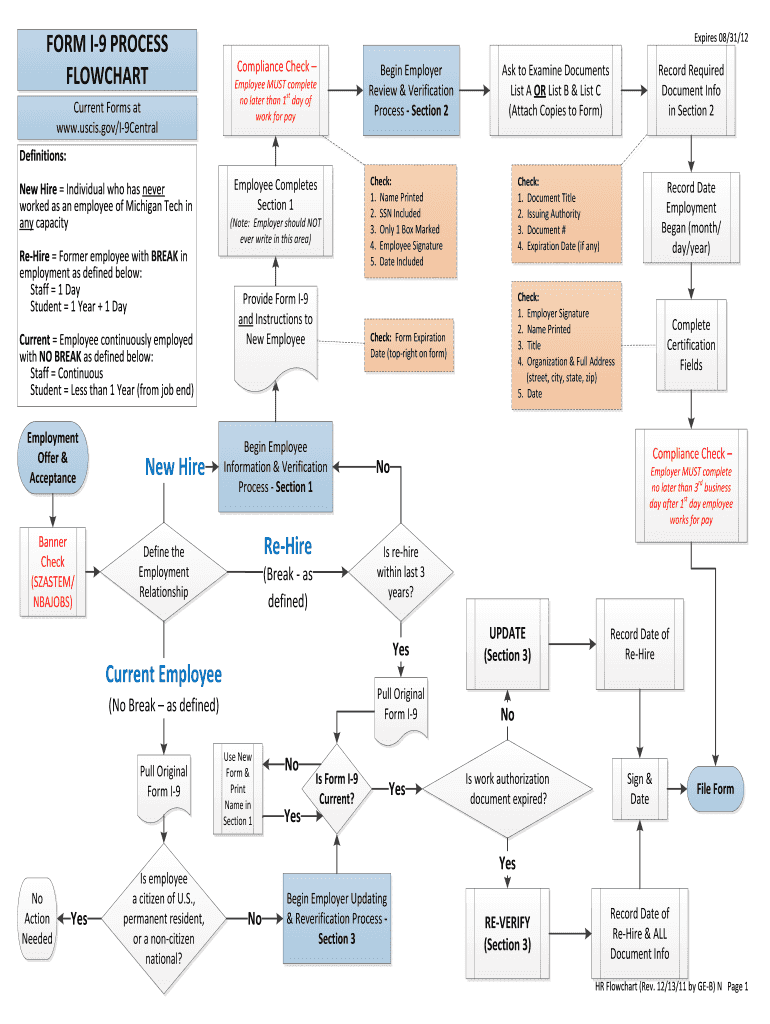

The Mtu Me flowchart is a visual representation designed to simplify the process of understanding and completing the necessary steps for a specific form or procedure. This flowchart typically outlines the sequence of actions required, helping users navigate through the complexities of the process efficiently. The Mtu Me flowchart is particularly useful for individuals and businesses needing clarity on documentation requirements, timelines, and procedural steps.

How to Use the Mtu Me Flowchart

Using the Mtu Me flowchart involves following the outlined steps in a logical sequence. Begin by identifying the starting point of the process, which is usually indicated at the top of the chart. Proceed through each step, ensuring that you complete all required actions before moving to the next. The flowchart may include decision points where you need to choose between different options based on your specific situation. This visual guide serves as a roadmap, making it easier to stay organized and compliant throughout the process.

Steps to Complete the Mtu Me Flowchart

Completing the Mtu Me flowchart involves several key steps:

- Review the flowchart to understand the overall process.

- Gather all necessary documents and information required for each step.

- Follow the flowchart sequentially, ensuring each action is completed before proceeding.

- Double-check for any decision points that may alter your path through the flowchart.

- Submit the completed documentation as indicated in the final steps of the flowchart.

Legal Use of the Mtu Me Flowchart

The Mtu Me flowchart must be used in accordance with applicable laws and regulations. It is essential to ensure that all steps and documentation align with legal requirements to avoid potential penalties. Familiarize yourself with the specific legal context surrounding the flowchart to ensure compliance. This may include understanding state-specific rules or federal guidelines that govern the use of the form.

Required Documents

To effectively complete the Mtu Me flowchart, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or passport.

- Proof of residency or business registration.

- Any specific forms related to the process outlined in the flowchart.

- Supporting documentation that may be necessary for verification purposes.

Form Submission Methods

The Mtu Me flowchart may outline various methods for submitting your completed form. Common submission options include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at a designated location.

Each method may have different requirements regarding documentation and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form i 9 process flowchart mtu

Discover the simplest method to complete and sign your Mtu Me Flowchart

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow provides a superior alternative to complete and sign your Mtu Me Flowchart and similar forms for public services. Our intelligent eSignature platform equips you with everything required to handle documents swiftly and in line with formal standards - robust PDF editing, managing, safeguarding, signing, and sharing features all available within an intuitive interface.

Only a few steps are needed to complete to fill out and sign your Mtu Me Flowchart:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Mtu Me Flowchart.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Redact parts that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using any method that suits you.

- Include the Date next to your signature and conclude your work with the Done button.

Store your completed Mtu Me Flowchart in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our platform also offers versatile file sharing options. There’s no need to print your forms when needing to send them to the appropriate public office - do it via email, fax, or by requesting a USPS delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

What is the process to fill out the BSTC application form?

First, candidates need to apply online for BSTC 2019 by following the instructions and guidelines which are mentioned in the information brochure. GGTU has uploaded the official notification along with complete details such as Eligibility, Exam Dates, Pattern and syllabus. Before going to fill the form, you need to check the eligibility criteria. If you are appearing in the 12th class then you are also eligible for the exam.Candidates who are eligible for the BSTC Exam 2019 they have to check the important documents which are required for filling the application form. As you know, this year, the written test is conducting by the university in the first week of May 2019. So the candidates must have to complete online registration of BSTC 2019 and make the payment. Candidates must have to check the required documents for filing the forms such as10th & 12th Class Mark Sheet12th/ HSC Class Roll NumberScanned Images (Photograph & Signature)Passing Year, Marks & PercentageCategory & DomicileCandidates must have to check the size of the photograph which will not be more than 100 KB also width 8CM & height 10 CM and 50KB for Signature with 5 CM Width & 3 CM height. If your images are longer than its mention size then images can’t upload. It’s also mandatory to check the format of the images. Now, you can check the below steps for filling the BSTC 2019 online application form.How to Fill the BSTC 2019 Online FormCandidates who are ready to fill the application they can visit the official website by entering the URL or search in the Google. Now, you can follow the website link and redirect to the webpage. Now you have to search the link for fill the BSTC 2019 Form and click on it. A new webpage will open and starts filling the application form by mention the details such asEnter the Candidate’s Name and Father/ Mother NameSelect the Date of Birth (Date / Month/ Year)Select the course i.e. BSTC General/ BSTC Sanskrit or BothMode the payment i.e. Online PaymentCandidates can pay the fee for Rs.450/ – for both papers and Rs.400/ – for either General or Sanskrit. If you want to change all the details then you can click on the reset button or click on the next button.After completing the first step, you have to go through the second step i.e. uploading the scanned images. First, you can upload the scanned photograph and signature in the valid size and format by clicking on the choose file. Now you can select the photograph and signature and submit it.Now you will signNow on the final step of the GGTU BSTC 2019 Application Form. So candidates who need to fill the remaining information such asGender, Marital Status, State of Bonafide and DistrictSelect the category i.e. SC/ ST/ OBC/ PWD/ Divorces/ WidowEnter the Permanent & correspondence addressSelect the Two exam centreEnter the Education Details i.e. 10th & 12th Class DetailsBSTC 2019 Application FeeAfter that, candidates can click on proceed and check the Token & application no. Finally, you need to pay the BSTC Application Fee 2019. To pay the fee, you can use the Debit/ Credit Card/ Net Banking or Challan. If you are going to fill the form for General or Sanskrit then you need to make the payment of Rs.450/ -. For both papers, the university will charge the Rs.400/ -. It’s important to download the application form and take a printout for further reference.Important LinksGet Admit CardDownload BSTC College ListCounselling Dates

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the form i 9 process flowchart mtu

How to create an electronic signature for the Form I 9 Process Flowchart Mtu online

How to create an electronic signature for the Form I 9 Process Flowchart Mtu in Chrome

How to make an eSignature for putting it on the Form I 9 Process Flowchart Mtu in Gmail

How to generate an eSignature for the Form I 9 Process Flowchart Mtu right from your smartphone

How to generate an electronic signature for the Form I 9 Process Flowchart Mtu on iOS

How to generate an eSignature for the Form I 9 Process Flowchart Mtu on Android devices

People also ask

-

What is the Mtu Me Flowchart and how does it work with airSlate SignNow?

The Mtu Me Flowchart is a visual representation of your document workflow that can be integrated with airSlate SignNow. It helps you streamline the signing process by mapping out the steps needed to get documents signed quickly and efficiently. By utilizing the Mtu Me Flowchart, you can ensure that every necessary action is taken, reducing delays and enhancing productivity.

-

How much does airSlate SignNow cost, and does it include the Mtu Me Flowchart feature?

airSlate SignNow offers flexible pricing plans to cater to various business needs, and the Mtu Me Flowchart feature is included in these plans. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment. With airSlate SignNow, you gain access to a powerful eSignature solution along with tools like the Mtu Me Flowchart to optimize your workflows.

-

What are the key features of airSlate SignNow related to the Mtu Me Flowchart?

AirSlate SignNow includes several key features that enhance the functionality of the Mtu Me Flowchart, such as customizable templates, automated workflows, and real-time tracking. These features enable you to create a seamless signing experience while maintaining oversight of your document processes. By leveraging these capabilities, you can maximize the efficiency of the Mtu Me Flowchart in your organization.

-

Can I integrate airSlate SignNow with other applications while using the Mtu Me Flowchart?

Yes, airSlate SignNow offers robust integrations with various applications, making it easy to incorporate the Mtu Me Flowchart into your existing workflows. Whether you're using CRM systems, cloud storage, or project management tools, you can seamlessly connect airSlate SignNow to enhance productivity. This integration allows for a cohesive document signing process alongside your preferred tools.

-

What benefits does the Mtu Me Flowchart provide for businesses using airSlate SignNow?

The Mtu Me Flowchart provides numerous benefits for businesses using airSlate SignNow, including improved clarity in document workflows and reduced turnaround times for signatures. By visualizing your signing process, you can identify bottlenecks and streamline operations effectively. This results in a more efficient workflow, ultimately leading to better customer satisfaction and increased productivity.

-

Is the Mtu Me Flowchart suitable for all types of businesses?

Absolutely! The Mtu Me Flowchart is designed to be versatile and can be adapted to suit businesses of all sizes and industries. Whether you are a small startup or a large enterprise, utilizing the Mtu Me Flowchart within airSlate SignNow can help you manage your document signing processes more effectively.

-

How can I get started with the Mtu Me Flowchart on airSlate SignNow?

Getting started with the Mtu Me Flowchart on airSlate SignNow is simple. First, sign up for an account and explore the user-friendly interface to create your flowchart. From there, you can customize your workflows and integrate them with your document signing processes, making it easy to manage and track your signing tasks.

Get more for Mtu Me Flowchart

Find out other Mtu Me Flowchart

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast