Self Employment Expenses Form

What is the Self Employment Expenses Form

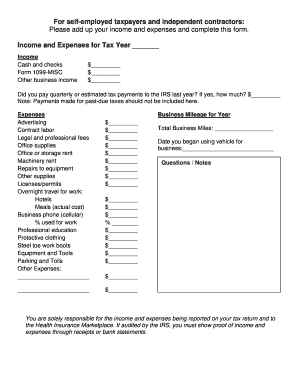

The self employment expenses form is a crucial document for individuals who operate their own businesses or work as independent contractors. This form allows self-employed individuals to report their income and deduct eligible expenses when filing their taxes. By accurately documenting these expenses, taxpayers can lower their taxable income, potentially resulting in a reduced tax liability. Understanding the components of this form is essential for effective tax management and compliance with IRS regulations.

How to Use the Self Employment Expenses Form

Using the self employment expenses form involves several key steps. First, gather all relevant financial records, including receipts, invoices, and bank statements that detail your business income and expenses. Next, categorize your expenses into appropriate sections, such as office supplies, travel, and utilities. Once you have organized your data, complete the form by entering your total income and the total amount of deductible expenses. Finally, ensure that you sign and date the form before submitting it to the IRS with your tax return.

Steps to Complete the Self Employment Expenses Form

Completing the self employment expenses form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, list your total income from self-employment. After that, itemize your business expenses, ensuring that you include only those that are ordinary and necessary for your trade or business. Review your entries for accuracy and completeness, then calculate your net profit or loss. This figure will be critical for your overall tax return.

Legal Use of the Self Employment Expenses Form

The legal use of the self employment expenses form is governed by IRS guidelines. To be considered valid, the form must be filled out accurately and submitted on time. It is important to retain all supporting documentation for at least three years in case of an audit. Additionally, the form must comply with relevant tax laws, ensuring that only legitimate business expenses are claimed. Understanding these legal requirements can help protect you from potential penalties or audits.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the self employment expenses form. Taxpayers should familiarize themselves with the IRS publications relevant to self-employment, such as Publication 535, which outlines business expenses. Following these guidelines ensures that all reported expenses are compliant with tax laws and that taxpayers maximize their deductions while minimizing the risk of errors. Staying informed about IRS updates is also beneficial for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the self employment expenses form align with the general tax return deadlines. Typically, self-employed individuals must file their tax returns by April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, which provides an additional six months to submit their forms. However, it is important to note that any taxes owed are still due by the original deadline to avoid penalties and interest.

Quick guide on how to complete self employment expenses form

Complete Self Employment Expenses Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing easy access to the necessary form and secure online storage. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Self Employment Expenses Form across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Self Employment Expenses Form effortlessly

- Locate Self Employment Expenses Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow meets all your document management needs with just a few clicks from any chosen device. Modify and eSign Self Employment Expenses Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employment expenses form?

A self employment expenses form is a document used by self-employed individuals to track and report their business-related expenses. This form is essential for accurately calculating taxable income and ensuring compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign your self employment expenses form, streamlining the process.

-

How can I create a self employment expenses form using airSlate SignNow?

To create a self employment expenses form in airSlate SignNow, simply start by selecting a template or building your own from scratch. Our platform provides intuitive tools for adding fields, including expense categories, amounts, and signatures. Once completed, you can eSign your form and share it instantly with your accountant or tax preparer.

-

Is airSlate SignNow a cost-effective solution for managing self employment expenses forms?

Yes, airSlate SignNow offers a cost-effective solution for managing self employment expenses forms. With various pricing plans available, you can choose one that fits your budget and needs. This platform not only saves you money on printing and mailing but also gives you the flexibility to manage documents digitally.

-

What features does airSlate SignNow offer for self employment expenses forms?

airSlate SignNow offers a range of features for self employment expenses forms, including easy document creation, customizable templates, and electronic signatures. Additionally, our platform allows for secure storage and sharing of your forms, ensuring that your sensitive information is protected. You can also track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other financial software for handling self employment expenses?

Absolutely! airSlate SignNow integrates seamlessly with many popular financial software applications, making it easy to sync your self employment expenses forms with your accounting tools. This integration simplifies tracking and reporting, helping you maintain organized records for tax purposes. Explore our integrations library to find the best options for your needs.

-

What are the benefits of using airSlate SignNow for self employment expenses forms?

Using airSlate SignNow for self employment expenses forms provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our platform allows for quick eSigning and document sharing, which accelerates your workflow. Plus, you can easily access your forms from any device, ensuring you're always organized and ready for tax season.

-

Is it secure to use airSlate SignNow for my self employment expenses forms?

Yes, airSlate SignNow is designed with security in mind, providing robust encryption for your self employment expenses forms. We comply with industry standards to ensure that your sensitive financial information remains safe and confidential. Our platform also offers audit trails and user permissions to maintain control over your documents.

Get more for Self Employment Expenses Form

- Amendment to living trust vermont form

- Living trust property record vermont form

- Financial account transfer to living trust vermont form

- Assignment to living trust vermont form

- Notice of assignment to living trust vermont form

- Revocation of living trust vermont form

- Letter to lienholder to notify of trust vermont form

- Vt contract form

Find out other Self Employment Expenses Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online