720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

What is the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

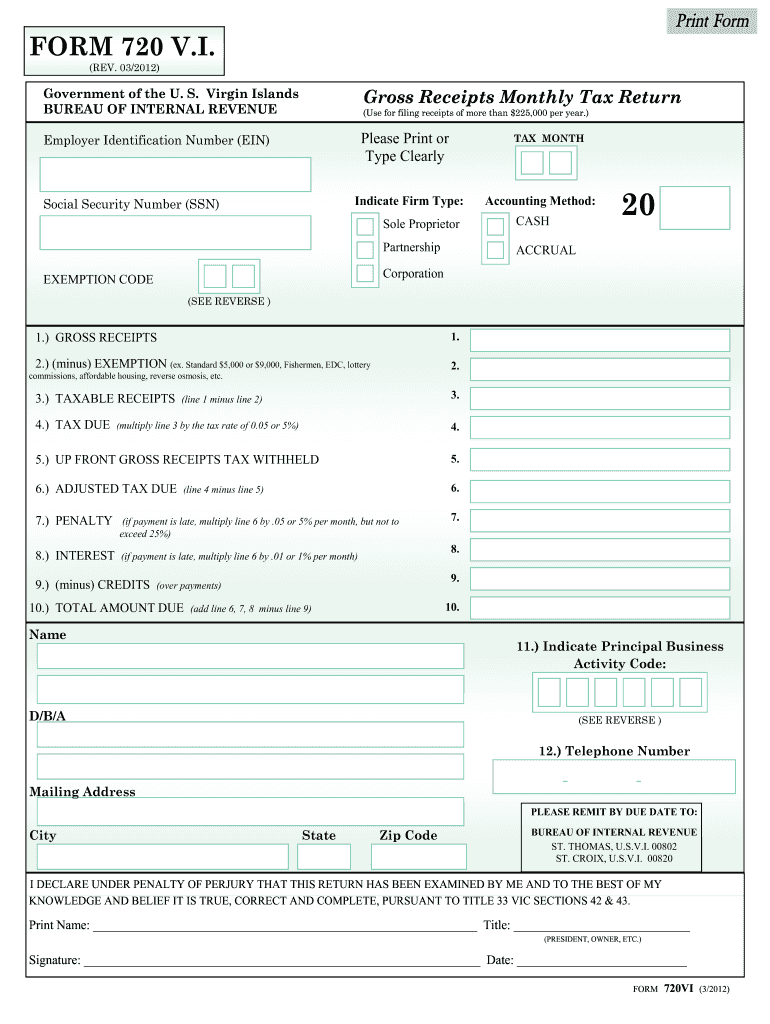

The 720VI Gross Receipts Monthly Form 5% is a tax document used by businesses operating in the Virgin Islands to report their gross receipts and calculate the applicable gross receipts tax. This form is essential for compliance with local tax regulations and is required to be filed monthly. The tax rate is set at five percent, making it crucial for businesses to accurately report their earnings to avoid penalties.

How to use the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

Using the 720VI Gross Receipts Monthly Form involves several steps. First, businesses must gather all necessary financial data, including gross receipts from sales and services rendered. Next, the form must be filled out accurately, ensuring that all figures are correct and reflect the business's earnings for the reporting period. Once completed, the form can be submitted electronically or by mail, depending on the preferred method of submission.

Steps to complete the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

Completing the 720VI Gross Receipts Monthly Form requires careful attention to detail. Follow these steps:

- Gather financial records for the month, including sales receipts and invoices.

- Fill out the form with accurate gross receipts figures.

- Calculate the total tax owed by applying the five percent rate to the gross receipts.

- Review the form for accuracy before submission.

- Submit the completed form by the designated deadline.

Key elements of the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

Key elements of the 720VI Gross Receipts Monthly Form include the business name, tax identification number, total gross receipts for the month, and the calculated tax amount. It is important to ensure that all information is accurate and complete to avoid delays or issues with the submission. Additionally, businesses must retain copies of the submitted form for their records.

Filing Deadlines / Important Dates

Filing deadlines for the 720VI Gross Receipts Monthly Form are typically set for the last day of the month following the reporting period. For example, the form for January must be filed by the end of February. It is essential for businesses to stay informed about these deadlines to ensure timely compliance and avoid potential penalties.

Penalties for Non-Compliance

Failure to file the 720VI Gross Receipts Monthly Form on time can result in penalties, including fines and interest on unpaid taxes. The Virgin Islands government takes non-compliance seriously, and businesses may face additional scrutiny if they consistently fail to meet filing requirements. It is advisable for businesses to establish a routine for timely filing to avoid these consequences.

Quick guide on how to complete 720vi gross receipts monthly form 5 virgin islands internal

Complete 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documentation, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal on any platform with airSlate SignNow's Android or iOS applications and streamline your document-centered processes today.

How to modify and eSign 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal with ease

- Locate 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 720vi gross receipts monthly form 5 virgin islands internal

The best way to create an e-signature for your PDF file online

The best way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

The 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal is an essential document that businesses must file to report their gross receipts in the Virgin Islands. This form helps ensure compliance with local tax regulations and provides a clear record of business activities.

-

How can airSlate SignNow help with the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

airSlate SignNow streamlines the process of preparing and eSigning the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal. Our platform allows businesses to create, edit, and submit this form electronically, saving both time and reducing errors associated with manual submissions.

-

Is there a cost associated with using airSlate SignNow for the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs. The cost-effective solution allows you to manage your 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal filings without breaking the bank.

-

What features does airSlate SignNow offer for the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and safe document storage for the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal. These features simplify the filing process and enhance overall efficiency.

-

Can airSlate SignNow integrate with other tools for filing the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management platforms. This means you can easily pull data for the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal directly from your existing systems, improving accuracy and saving time.

-

How secure is the information submitted through airSlate SignNow for the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security measures to ensure that all information submitted, including the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal, is protected and complies with industry standards.

-

Can multiple users collaborate on the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal in real time. This enhances teamwork and ensures that your filing is processed efficiently and accurately.

Get more for 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

Find out other 720VI Gross Receipts Monthly Form 5% Virgin Islands Internal

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself