Bb T Benefits Plantrac Form

What is the Bb T Benefits Plantrac

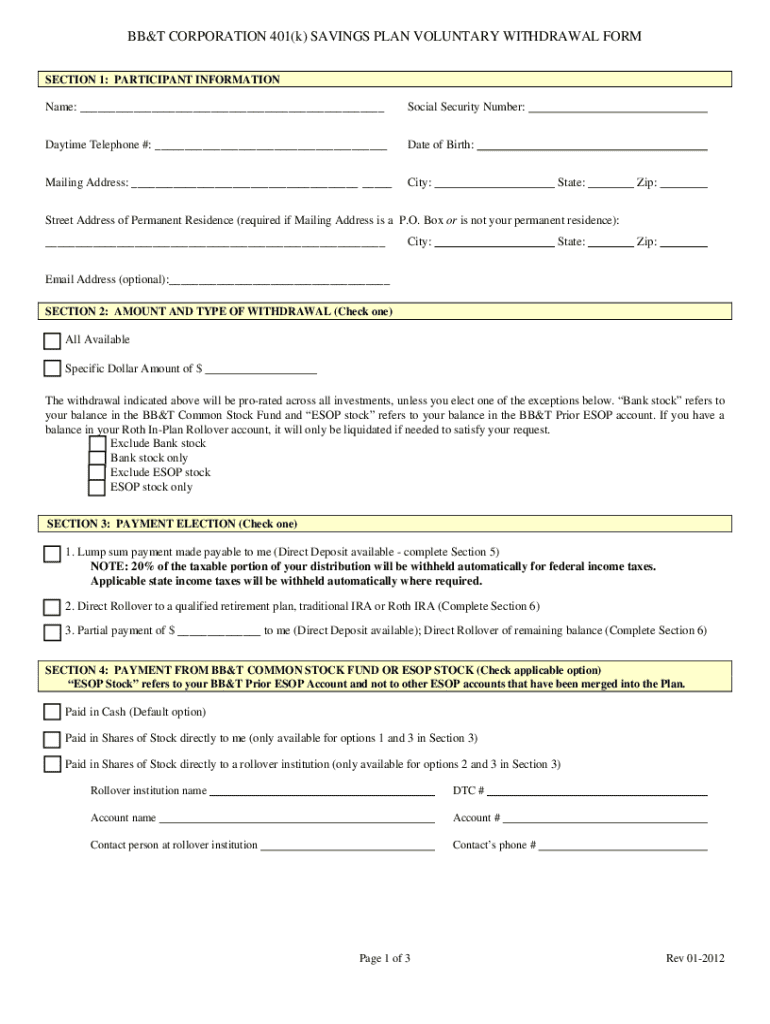

The Bb T Benefits Plantrac is a digital platform designed to assist employees in managing their benefits, including retirement plans such as the BB&T 401(k). This tool provides users with access to essential documents, including tax forms and plan year forms, facilitating a smoother experience in handling benefits-related tasks. It is tailored to meet the needs of employees, ensuring they can efficiently navigate their benefits options and make informed decisions.

How to use the Bb T Benefits Plantrac

Using the Bb T Benefits Plantrac is straightforward. Employees can log in to the platform using their BB&T credentials. Once logged in, users can access their benefits information, including the BB&T 401(k) withdrawal options and other relevant documents. The platform allows for easy navigation, enabling users to view their plan details, submit requests, and track their benefits status. Familiarity with the layout will enhance the experience, making it easier to find necessary forms and information.

Steps to complete the Bb T Benefits Plantrac

Completing the Bb T Benefits Plantrac involves several key steps:

- Log in to the Bb T Benefits Plantrac using your credentials.

- Navigate to the section relevant to your needs, such as retirement plans or tax forms.

- Fill out the required forms, ensuring all information is accurate and complete.

- Review your submissions for any errors before finalizing.

- Submit the forms electronically through the platform.

- Keep a copy of your submissions for your records.

Legal use of the Bb T Benefits Plantrac

The Bb T Benefits Plantrac is designed to comply with relevant legal standards for digital documentation and eSignatures. The platform adheres to the ESIGN Act and UETA, ensuring that electronic submissions are legally binding. Users can be confident that their submitted forms, such as the tax day forms and BB&T 401(k) withdrawal requests, meet the necessary legal requirements for acceptance by employers and regulatory bodies.

Required Documents

When using the Bb T Benefits Plantrac, certain documents may be required to complete your requests. Commonly needed documents include:

- Identification documents, such as a driver's license or Social Security card.

- Tax forms, including W-2s or 1099s, if applicable.

- Any previous plan year forms that may be relevant to your current request.

- Proof of employment or participation in the BB&T benefits program.

Form Submission Methods

Forms within the Bb T Benefits Plantrac can typically be submitted electronically. This method is efficient and secure, allowing for immediate processing. In some cases, users may also have the option to print and mail forms or submit them in person, depending on the specific requirements of the form or the preferences of the employer. It is advisable to check the submission guidelines for each specific form to ensure compliance.

Quick guide on how to complete bb t benefits plantrac

Effortlessly Prepare Bb T Benefits Plantrac on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle Bb T Benefits Plantrac on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Bb T Benefits Plantrac with ease

- Locate Bb T Benefits Plantrac and click Get Form to initiate.

- Make use of the tools we offer to finish your form.

- Highlight essential parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your chosen device. Modify and eSign Bb T Benefits Plantrac to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bb t benefits plantrac

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is bbtplantrac and how does it work?

bbtplantrac is a powerful tool within airSlate SignNow that facilitates efficient document signing and management. It streamlines the eSigning process, allowing users to generate, send, and sign documents electronically with ease. This tool is designed for businesses of all sizes, providing a cost-effective solution to handle documents securely.

-

What are the pricing options for bbtplantrac?

bbtplantrac offers flexible pricing plans tailored to meet the diverse needs of businesses. Whether you are a small startup or a large enterprise, you can choose from various subscription options that ensure you only pay for what you use. Visit our pricing page to find the best plan that fits your requirements.

-

What features does bbtplantrac include?

bbtplantrac includes a wide array of features designed to enhance document management and eSigning experiences. Key features include customizable templates, multi-party signing, advanced security protocols, and automated workflows. These ensure that your document processes are efficient and secure.

-

How can bbtplantrac benefit my business?

By utilizing bbtplantrac, your business can signNowly improve efficiency and reduce turnaround times for document signing. The easy-to-use interface allows for quick onboarding and minimal training. Additionally, bbtplantrac helps in cutting costs associated with paper and manual processes.

-

What integrations are available with bbtplantrac?

bbtplantrac seamlessly integrates with various popular applications and software to streamline your workflows. These integrations include CRM systems, cloud storage services, and project management tools, allowing you to enhance your productivity. The compatibility of bbtplantrac with existing tools makes it a versatile solution for any business.

-

Can I customize templates in bbtplantrac?

Yes, bbtplantrac allows you to create and customize document templates to fit your specific business needs. You can easily adjust the templates to include personalized branding, fields, and instructions. This feature ensures that your documents reflect your company's identity and facilitates efficient eSigning.

-

Is bbtplantrac secure for sensitive documents?

Absolutely, bbtplantrac prioritizes the security of your documents through advanced encryption and compliance with industry standards. Every eSignature process is recorded and tracked, ensuring accountability and transparency. With bbtplantrac, you can confidently handle sensitive documents knowing they are protected.

Get more for Bb T Benefits Plantrac

- Ca form 3519 payment for automatic extension for individuals

- Form ftb3533 ampquotchange of address for individualsampquot california

- Form 540nr schedule d ampquotcalifornia capital gain or loss adjustment

- Department of taxation and finance instructions for form ct 5 ct 5 i

- About form 4562 depreciation and amortization irs tax forms

- Form it 213 claim for empire state child credit tax year 2022

- Form ct 3 abc members detail report filed by adepartment of taxation and finance instructions for formform ct 3 abc members

- Enhanced form it 558 new york adjustments due toenhanced form it 558 new york adjustments due toform it 558 ny state adj due to

Find out other Bb T Benefits Plantrac

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free