Long Term Care Insurance Policy Illustration Form

Understanding the Long Term Care Insurance Policy Illustration Form

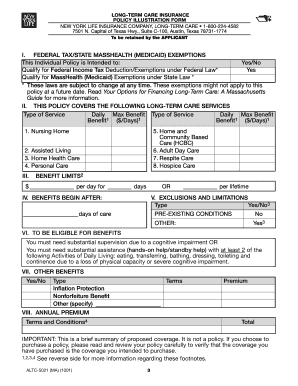

The Long Term Care Insurance Policy Illustration Form is a crucial document that outlines the benefits, coverage, and costs associated with long term care insurance. This form provides a detailed representation of how the policy functions over time, including premium payments, potential benefits, and any exclusions or limitations. It serves as a visual guide to help policyholders understand what to expect from their insurance coverage, making it easier to make informed decisions about their long term care needs.

Steps to Complete the Long Term Care Insurance Policy Illustration Form

Completing the Long Term Care Insurance Policy Illustration Form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, such as your age, health status, and financial details. Next, carefully review the policy options available, including coverage amounts and premium structures. Fill out the form with precise information, ensuring that all sections are completed. After filling out the form, double-check for any errors or omissions before submitting it to the insurance provider.

Legal Use of the Long Term Care Insurance Policy Illustration Form

The Long Term Care Insurance Policy Illustration Form is legally binding once it is properly completed and signed. It must comply with state regulations and insurance laws to ensure that it is recognized by insurers and courts. This form serves as a representation of the agreement between the policyholder and the insurance company, outlining the obligations of both parties. It is essential to retain a copy of the completed form for personal records, as it may be required for future reference or in case of disputes.

Key Elements of the Long Term Care Insurance Policy Illustration Form

Several key elements are integral to the Long Term Care Insurance Policy Illustration Form. These include:

- Premium Amounts: The cost of the policy, which may vary based on age and health.

- Coverage Details: Information on the types of services covered, such as in-home care or assisted living.

- Benefit Period: The duration for which benefits will be paid, which can range from a few years to a lifetime.

- Inflation Protection: Options to increase benefits over time to keep pace with rising costs.

- Exclusions and Limitations: Specific conditions or situations that are not covered by the policy.

Obtaining the Long Term Care Insurance Policy Illustration Form

The Long Term Care Insurance Policy Illustration Form can typically be obtained directly from your insurance provider. Many companies offer the form online through their websites, allowing for easy access and completion. Alternatively, you can request a physical copy from an insurance agent or representative. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods

Once the Long Term Care Insurance Policy Illustration Form is completed, it can be submitted through various methods. Most insurance companies allow for online submissions via their secure portals, which is often the fastest option. Alternatively, you may choose to mail the form directly to the insurance provider or deliver it in person to a local office. Be sure to check the specific submission guidelines provided by your insurer to ensure proper processing.

Quick guide on how to complete long term care insurance policy illustration form

Effortlessly Complete Long Term Care Insurance Policy Illustration Form on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers a fantastic eco-friendly substitute to conventional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Long Term Care Insurance Policy Illustration Form on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

How to Edit and eSign Long Term Care Insurance Policy Illustration Form with Ease

- Locate Long Term Care Insurance Policy Illustration Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you'd prefer to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Edit and eSign Long Term Care Insurance Policy Illustration Form to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a term policy in the context of airSlate SignNow?

A term policy is a temporary agreement that allows businesses to use airSlate SignNow's eSigning services for a specified period. This option is ideal for organizations looking to streamline their document management and eSigning processes without committing to a long-term contract. By choosing a term policy, you can evaluate our features and benefits effectively.

-

How does a term policy benefit my business?

A term policy offers flexibility and cost savings, allowing your business to access airSlate SignNow's powerful eSigning capabilities without a large upfront investment. This arrangement allows you to assess if our solutions align with your needs before committing to a longer-term plan. Additionally, it ensures you stay compliant with legal standards for document signing.

-

What are the pricing options for a term policy with airSlate SignNow?

Pricing for a term policy with airSlate SignNow varies based on the duration and features you select. Our team can provide you with tailored pricing that fits your business needs, ensuring you get the best value for eSigning services. We encourage you to contact us for a customized quote that reflects your requirements.

-

Can I switch my term policy to a long-term plan later?

Yes, you can easily transition from a term policy to a long-term plan once you determine that airSlate SignNow is the right fit for your organization. This transition is straightforward and allows you to continue using our powerful eSigning features without interruption. Just signNow out to our support team for assistance.

-

What features are included in a term policy?

A term policy provides access to all core features of airSlate SignNow, including document eSigning, templates, and secure storage. Additionally, you can benefit from advanced features based on the specific policy you choose. Our platform offers user-friendly tools designed to enhance your document workflows.

-

Is airSlate SignNow secure for signing documents under a term policy?

Absolutely, security is a top priority for airSlate SignNow, even under a term policy. Our platform employs advanced encryption and complies with industry standards for data protection. You can confidently manage sensitive documents knowing that they are secure and legally binding.

-

What integrations are available with a term policy?

airSlate SignNow offers a variety of integrations with popular software tools to enhance your document management workflow, even under a term policy. This includes CRM systems, cloud storage services, and productivity applications, making it easier to incorporate eSigning into your daily operations. Check our website for a comprehensive list of available integrations.

Get more for Long Term Care Insurance Policy Illustration Form

- Tuition agreement ampamp payment preference form for

- Pdf cvrp household summary form clean vehicle rebate project

- Policy ownership transfer affidavit form

- Form 4683 complaint

- New aid after loan discharge new aid after loan discharge form

- National homebuyers fund inc welcome to nhfs form

- Unitypoint doctors note form

- Massage client feedback form

Find out other Long Term Care Insurance Policy Illustration Form

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself