Gpf Full Form PDF

Understanding the GPF Refundable Advance Form

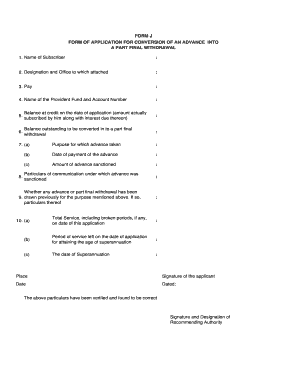

The GPF refundable advance form is a crucial document for individuals seeking to withdraw funds from their General Provident Fund (GPF) accounts. This form allows employees to request an advance against their accumulated savings in the GPF, which can be utilized for various personal needs, such as medical emergencies, education, or housing expenses. It is essential to understand the specific requirements and procedures involved in filling out this form to ensure a smooth application process.

Steps to Complete the GPF Refundable Advance Form

Completing the GPF refundable advance form involves several key steps. First, gather all necessary information, including your GPF account number, personal identification details, and the purpose for which you are requesting the advance. Next, accurately fill out the form, ensuring that all sections are completed without any errors. Once completed, review the form for accuracy and clarity. Finally, submit the form through the designated channels, which may include online submission or in-person delivery to your department's administrative office.

Required Documents for the GPF Refundable Advance Form

To successfully submit the GPF refundable advance form, certain documents may be required. These typically include:

- A copy of your identification proof, such as a driver's license or employee ID.

- Documentation supporting the purpose of the advance, such as medical bills or admission letters.

- Any additional forms or declarations as specified by your organization.

Ensuring that you have all necessary documents ready can expedite the approval process and prevent delays.

Legal Use of the GPF Refundable Advance Form

The GPF refundable advance form is legally binding once submitted. It is essential to ensure that the information provided is truthful and accurate. Misrepresentation or fraudulent claims can lead to severe consequences, including penalties or legal action. Compliance with the relevant regulations and guidelines is crucial to maintain the integrity of the application process.

Form Submission Methods

There are several methods available for submitting the GPF refundable advance form. These may include:

- Online Submission: Many organizations offer a digital platform for submitting forms, allowing for quick processing.

- Mail: You may also send the completed form via postal service to the designated office.

- In-Person: Submitting the form directly at your department's administrative office can provide immediate confirmation of receipt.

Choosing the appropriate submission method can enhance the efficiency of your application process.

Eligibility Criteria for the GPF Refundable Advance Form

Eligibility for submitting the GPF refundable advance form typically depends on your employment status and the specific policies of your organization. Generally, employees who have been actively contributing to the GPF for a specified period are eligible to apply for an advance. It is advisable to review your organization's guidelines to confirm your eligibility before proceeding with the application.

Quick guide on how to complete gpf full form pdf

Complete Gpf Full Form Pdf effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Gpf Full Form Pdf on any system using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Gpf Full Form Pdf with ease

- Find Gpf Full Form Pdf and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Gpf Full Form Pdf and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gpf full form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gpf refundable advance form and why is it important?

The gpf refundable advance form is a crucial document for employees seeking to withdraw funds from their General Provident Fund. It serves as a formal request, ensuring that the process is recognized and recorded by the authorities. Understanding its importance can help you in managing your finances effectively.

-

How do I fill out the gpf refundable advance form?

Filling out the gpf refundable advance form is straightforward. You will need to provide your personal details, account information, and the purpose for which you are requesting the advance. Ensure that all information is accurate to prevent delays in processing.

-

Are there any costs associated with submitting the gpf refundable advance form?

Generally, submitting the gpf refundable advance form is free of direct charges. However, some administrative fees may apply depending on your institution's policies. It is advisable to check with your HR department for specific details regarding any potential costs.

-

What are the benefits of using the gpf refundable advance form?

The gpf refundable advance form allows you to access funds in case of emergencies or urgent needs. It provides a structured way to request advances, ensuring you receive the necessary financial support while maintaining your budget. Utilizing this form can help you manage unexpected expenses effectively.

-

How long does it take to process the gpf refundable advance form?

Processing time for the gpf refundable advance form can vary, typically taking between 5 to 15 business days. Factors such as your organization's workload and submission accuracy can influence timing. Keeping your form complete and accurate will help expedite the process.

-

Can I submit the gpf refundable advance form online?

Many organizations now offer the option to submit the gpf refundable advance form online for convenience. This digital approach not only saves time but also ensures that your request is properly logged. Check with your HR department to see if an online submission option is available.

-

How does the gpf refundable advance form integrate with financial planning?

The gpf refundable advance form is an essential tool in financial planning as it enables you to manage your Provident Fund effectively. By understanding your options and how to request advances, you can make informed decisions about your finances. Integrating this form into your planning can help you better prepare for unexpected costs.

Get more for Gpf Full Form Pdf

Find out other Gpf Full Form Pdf

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now