Sfa Form

What is the SFA Form?

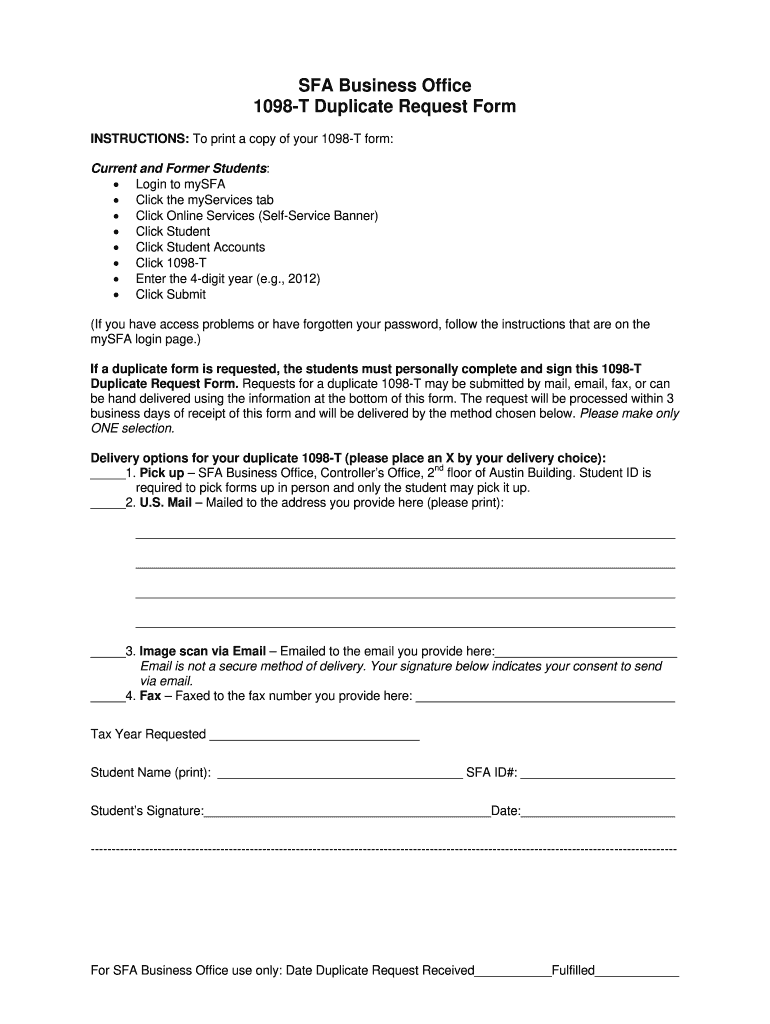

The SFA form, specifically the 1098-T duplicate request form, is utilized by students to request a duplicate of their 1098-T tax form. This form is essential for reporting qualified tuition and related expenses to the Internal Revenue Service (IRS). Educational institutions issue the 1098-T to students, providing necessary information for tax filing purposes. The form contains details such as the amount billed for qualified tuition and fees, scholarships received, and adjustments made to prior year amounts.

How to Obtain the SFA Form

To obtain the 1098-T duplicate request form, students typically need to contact their educational institution's financial aid or registrar's office. Many institutions provide access to the form through their online portals, allowing students to download it directly. If the form is not readily available online, students can request it via email or phone. It is important to provide necessary identification and details to facilitate the request.

Steps to Complete the SFA Form

Completing the 1098-T duplicate request form involves several straightforward steps:

- Gather personal information, including your name, address, and student identification number.

- Indicate the specific tax year for which you are requesting the duplicate.

- Provide any additional details required by your institution, such as the reason for the request.

- Sign and date the form to validate your request.

Once completed, submit the form according to your institution's guidelines, which may include online submission, mailing, or in-person delivery.

Legal Use of the SFA Form

The 1098-T duplicate request form is legally recognized as a valid document when completed properly. It serves as an official request for a duplicate tax form, which is crucial for compliance with IRS regulations. Institutions must adhere to specific guidelines when issuing these forms, ensuring that they maintain accurate records of tuition payments and related expenses. Proper use of the form helps students claim eligible tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit.

IRS Guidelines

The IRS has specific guidelines regarding the issuance and use of the 1098-T form. Educational institutions are required to provide this form to eligible students by January 31 of each year. The form must accurately reflect the amounts billed for qualified tuition and fees, as well as any scholarships or grants received. Students should refer to IRS publications, such as Publication 970, for detailed information on how to use the 1098-T form for tax purposes and to understand their eligibility for various educational tax benefits.

Form Submission Methods

Students can submit their completed 1098-T duplicate request form through various methods, depending on their institution's policies. Common submission methods include:

- Online submission through the institution's student portal.

- Mailing the form to the designated office.

- Delivering the form in person to the financial aid or registrar's office.

It is advisable to check with the institution for specific submission guidelines and to ensure timely processing of the request.

Quick guide on how to complete sfa form

Easily Prepare Sfa Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly option to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly without any delays. Manage Sfa Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process starting today.

How to Edit and eSign Sfa Form Effortlessly

- Locate Sfa Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your method of sharing the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Sfa Form, ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1098 t duplicate request form?

The 1098 t duplicate request form is a document that allows taxpayers to request a duplicate of their 1098-T form, which reports tuition payments made to qualified educational institutions. This form is essential for accurately filing taxes and taking advantage of education-related tax benefits. Using airSlate SignNow, you can easily create and manage your 1098 t duplicate request form.

-

How much does it cost to use the 1098 t duplicate request form feature on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include features for creating and sending the 1098 t duplicate request form. Pricing varies based on the plan you choose, but our cost-effective solutions are designed to meet the needs of businesses of all sizes. Check our website for the latest pricing details and choose the best plan for your needs.

-

What are the key features of the 1098 t duplicate request form on airSlate SignNow?

The 1098 t duplicate request form on airSlate SignNow allows for easy digital signing, document tracking, and quick template creation. Our platform streamlines the process, making it simple to send, sign, and store your forms securely. With user-friendly navigation, you can efficiently handle your education tax documents.

-

How can I integrate the 1098 t duplicate request form with other software?

airSlate SignNow provides seamless integrations with various software solutions, ensuring your 1098 t duplicate request form fits into your existing workflows. Whether you're using CRM systems, document management tools, or cloud storage services, our platform supports easy integration to enhance your document management. Explore our integrations page for more details.

-

What are the benefits of using airSlate SignNow for the 1098 t duplicate request form?

Using airSlate SignNow for your 1098 t duplicate request form offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our digital platform eliminates the hassles of paper-based processes, ensuring quick turnaround times for document submissions. Additionally, our secure storage options guarantee the safety of your sensitive information.

-

Is it possible to save templates for the 1098 t duplicate request form?

Yes, airSlate SignNow allows you to create and save templates for the 1098 t duplicate request form for easy reuse. This feature streamlines your workflow, enabling you to generate forms quickly without having to start from scratch each time. Easily access and modify your saved templates as your needs evolve.

-

Can I track the status of my 1098 t duplicate request form?

Absolutely! With airSlate SignNow, you can track the status of your 1098 t duplicate request form in real-time. Our document tracking feature notifies you when your form has been viewed, signed, or completed, providing transparency throughout the process. Stay informed every step of the way.

Get more for Sfa Form

Find out other Sfa Form

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement