Dollar Tree Tax Exempt Form

What is the Dollar Tree Tax Exempt

The Dollar Tree tax exempt program allows qualifying organizations to make purchases without paying sales tax. This exemption is typically available to non-profit organizations, government entities, and certain educational institutions that meet specific criteria. By obtaining a tax exempt status, these organizations can save money on their purchases, which can be particularly beneficial for budget-conscious operations.

How to Obtain the Dollar Tree Tax Exempt

To obtain tax exempt status at Dollar Tree, organizations must complete a tax exempt application. This process generally involves providing necessary documentation, such as proof of the organization's non-profit status or a tax exemption certificate issued by the state. Once submitted, the application is reviewed by Dollar Tree, and if approved, the organization will receive a tax exempt code that can be used for future purchases.

Steps to Complete the Dollar Tree Tax Exempt

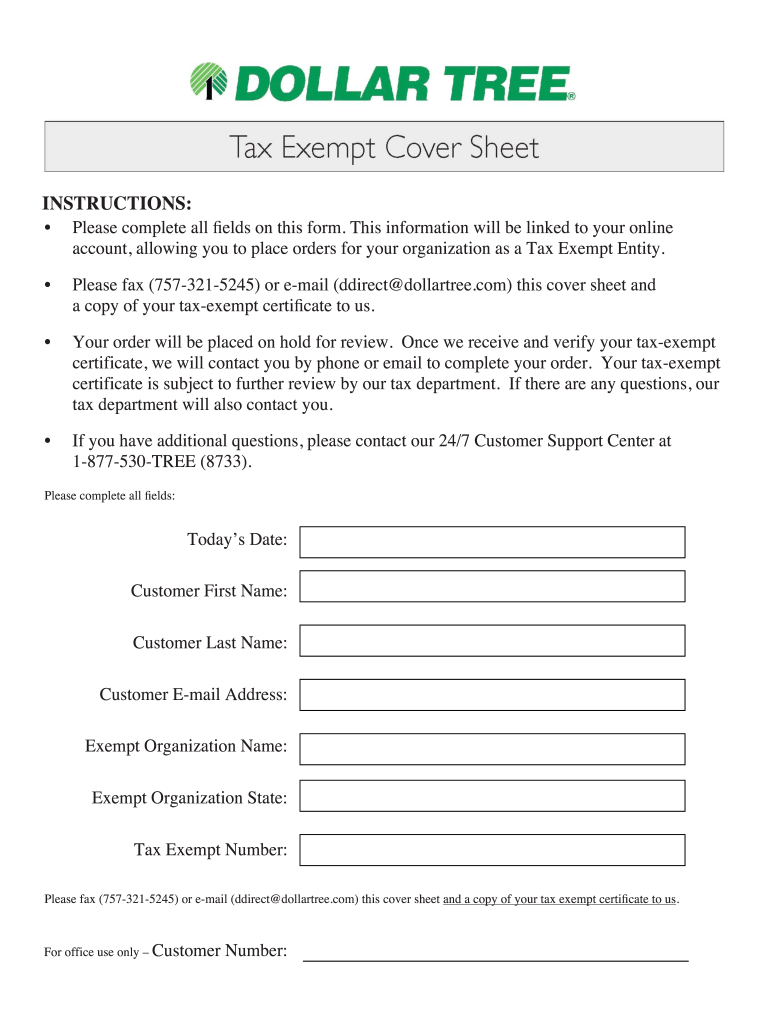

Completing the Dollar Tree tax exempt application involves several key steps:

- Gather required documentation, including proof of non-profit status.

- Fill out the Dollar Tree tax exempt form accurately, ensuring all information is correct.

- Submit the completed form along with any supporting documents to Dollar Tree for review.

- Await confirmation of tax exempt status and receive the tax exempt code.

Legal Use of the Dollar Tree Tax Exempt

Using the Dollar Tree tax exempt status legally requires adherence to specific regulations. Organizations must ensure that the purchases made using the tax exempt code are for qualified purposes related to their mission. Misuse of tax exempt status can lead to penalties, including back taxes owed and potential fines.

Eligibility Criteria

Eligibility for the Dollar Tree tax exempt program typically includes the following criteria:

- The organization must be a registered non-profit, government entity, or educational institution.

- The organization must provide valid documentation proving its tax exempt status.

- Purchases must be made for organizational use and not for personal benefit.

Required Documents

When applying for Dollar Tree tax exempt status, organizations need to provide certain documents, including:

- A completed Dollar Tree tax exempt application form.

- Proof of non-profit status, such as a 501(c)(3) determination letter from the IRS.

- Any state-specific tax exemption certificates, if applicable.

Quick guide on how to complete dollar tree tax exempt

Effortlessly prepare Dollar Tree Tax Exempt on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documentation, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Dollar Tree Tax Exempt on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The most effective method to modify and electronically sign Dollar Tree Tax Exempt effortlessly

- Find Dollar Tree Tax Exempt and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Alter and electronically sign Dollar Tree Tax Exempt to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the dollar tree tax exempt policy?

The dollar tree tax exempt policy allows eligible organizations to make purchases without paying sales tax. To take advantage of this, organizations must provide valid tax-exempt documentation when making purchases at Dollar Tree.

-

How can I obtain a dollar tree tax exempt certificate?

To obtain a dollar tree tax exempt certificate, you need to fill out the appropriate tax-exempt form available on Dollar Tree's website or at your local store. Ensure that your organization meets the qualifications set by Dollar Tree to benefit from this tax exemption.

-

Are there any limitations to the dollar tree tax exempt program?

Yes, the dollar tree tax exempt program has certain limitations. It typically applies only to purchases made for qualified non-profit or governmental organizations, and some products may still be subject to tax even under this policy.

-

Can I use my dollar tree tax exempt status online?

Currently, dollar tree tax exempt purchases can primarily be processed in-store. However, it is best to check Dollar Tree’s online platform for any updates regarding online purchasing capabilities with tax-exempt status.

-

How does airSlate SignNow help with dollar tree tax exempt documentation?

airSlate SignNow streamlines the process of managing dollar tree tax exempt documentation by enabling organizations to securely eSign and store their tax exemption forms. This ensures easy access and better organization of important documents needed for tax-exempt purchases.

-

What features does airSlate SignNow offer for managing tax-exempt documents?

airSlate SignNow offers features such as document templates, real-time collaboration, and automated workflows that simplify managing dollar tree tax exempt documents. These features help organizations efficiently handle the documentation process and maintain compliance.

-

Is airSlate SignNow cost-effective for managing dollar tree tax exempt forms?

Yes, airSlate SignNow provides a cost-effective solution for managing dollar tree tax exempt forms. By streamlining the signing and storage process, organizations can save time and reduce administrative costs associated with tax documentation.

Get more for Dollar Tree Tax Exempt

Find out other Dollar Tree Tax Exempt

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement