Ca5610 Form to Print

What is the CA5610 Form?

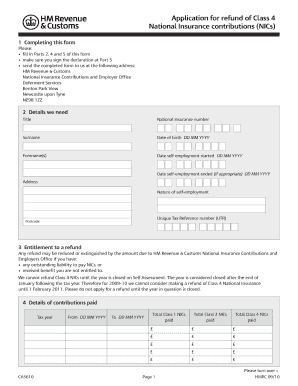

The CA5610 form is a crucial document for individuals in the United Kingdom who wish to claim a refund of their National Insurance contributions. This form is specifically designed for those who have overpaid their contributions or are eligible for a refund due to changes in their employment status or other qualifying criteria. Understanding the purpose of the CA5610 form is essential for ensuring that you can navigate the refund process smoothly.

Steps to Complete the CA5610 Form

Completing the CA5610 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your National Insurance number, personal details, and any relevant employment history. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to double-check your entries for any errors before submission. Finally, submit the form through the designated channels, whether online or by mail, depending on your preference.

Eligibility Criteria for the CA5610 Form

To qualify for submitting the CA5610 form, individuals must meet specific eligibility criteria. Typically, this includes having made National Insurance contributions that exceed the required amount for a given tax year or having circumstances that warrant a refund, such as a change in employment status. It is advisable to review your contribution history and consult the relevant guidelines to determine your eligibility before proceeding with the application.

Required Documents for the CA5610 Form

When preparing to submit the CA5610 form, certain documents are essential to support your application. These may include proof of your National Insurance contributions, identification documents, and any correspondence related to your employment history. Having these documents ready will facilitate a smoother application process and help ensure that your claim is processed efficiently.

Form Submission Methods for the CA5610

The CA5610 form can be submitted through various methods, allowing flexibility based on individual preferences. Options typically include online submission through designated government portals, mailing a printed copy of the form to the appropriate office, or in-person submission at local offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Legal Use of the CA5610 Form

The CA5610 form is legally recognized as a valid means for claiming refunds of National Insurance contributions in the UK. Proper completion and submission of this form ensure compliance with relevant tax laws and regulations. It is essential to follow all guidelines and requirements to maintain the legal standing of your application and avoid potential issues in the refund process.

Filing Deadlines for the CA5610 Form

Being aware of filing deadlines for the CA5610 form is crucial for ensuring that your application is submitted on time. Typically, there are specific timeframes within which claims must be made, often aligned with the end of the tax year. Missing these deadlines could result in delays or denial of your refund request, so it is advisable to keep track of important dates and plan accordingly.

Quick guide on how to complete ca5610 form to print

Complete Ca5610 Form To Print effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Ca5610 Form To Print on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign Ca5610 Form To Print without hassle

- Locate Ca5610 Form To Print and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Ca5610 Form To Print and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are UK national insurance contributions?

UK national insurance contributions are payments made by workers and employers to qualify for certain benefits and the state pension. They are essential for funding various social security benefits in the UK, including the NHS and unemployment support. Understanding how these contributions work can signNowly impact your financial planning.

-

How do UK national insurance contributions affect my business?

Businesses in the UK are required to pay national insurance contributions for their employees, impacting payroll costs. Proper management of these contributions is crucial to avoid penalties and ensure compliance with HMRC regulations. Using airSlate SignNow can help your business streamline document management related to payroll and national insurance.

-

How can airSlate SignNow help with managing UK national insurance contributions?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending documents related to payroll and UK national insurance contributions. This helps businesses save time and reduce errors in the paperwork process. By integrating seamless eSigning capabilities, you can ensure timely submissions and compliance.

-

Are there specific features in airSlate SignNow for UK national insurance contributions?

Yes, airSlate SignNow includes features that cater to managing payroll documents and associated workflows efficiently. The platform allows for secure signing, automatic reminders, and document storage, ensuring you easily access information regarding UK national insurance contributions when needed. This streamlines the process for accountants and HR departments alike.

-

What are the benefits of using airSlate SignNow for managing UK national insurance contributions?

The key benefits of using airSlate SignNow include enhanced efficiency, reduced paperwork, and improved compliance with UK national insurance contributions regulations. Companies can avoid costly delays and errors associated with traditional methods by adopting a digital solution. Additionally, the platform provides a secure environment for sensitive payroll documents.

-

Is there integration support for calculating UK national insurance contributions within airSlate SignNow?

While airSlate SignNow primarily focuses on document management and eSigning, it can integrate with various payroll software that calculates UK national insurance contributions. This compatibility helps streamline your business processes, ensuring that all necessary information is readily available and properly documented. It enhances accuracy and compliance with HMRC requirements.

-

What pricing plans does airSlate SignNow offer for businesses concerned about UK national insurance contributions?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, ensuring affordability regardless of your needs regarding UK national insurance contributions management. Each plan includes essential features to help manage payroll documentation effectively, and potential customers can request a demo or free trial to see how it fits their requirements.

Get more for Ca5610 Form To Print

Find out other Ca5610 Form To Print

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors