Digital Products and Remote Access Software Exemption Certificate Form

What is the Digital Products and Remote Access Software Exemption Certificate

The Digital Products and Remote Access Software Exemption Certificate is a crucial document that allows businesses to claim exemptions from sales tax when purchasing specific digital products and remote access software. This certificate is typically used in transactions where the buyer is acquiring software or digital services that are not subject to sales tax under certain state laws. Understanding the purpose and scope of this certificate is essential for businesses to ensure compliance with tax regulations while maximizing their financial efficiency.

How to Obtain the Digital Products and Remote Access Software Exemption Certificate

To obtain the Digital Products and Remote Access Software Exemption Certificate, businesses must follow a straightforward process. First, they should check the specific requirements set by their state, as these can vary. Generally, businesses need to complete an application form provided by their state’s tax authority. This form often requires information about the business, including its tax identification number and details about the types of digital products or services being purchased. Once the form is completed, it should be submitted to the appropriate state agency for approval.

Steps to Complete the Digital Products and Remote Access Software Exemption Certificate

Completing the Digital Products and Remote Access Software Exemption Certificate involves several key steps. Begin by gathering all necessary information, including your business details and the specific digital products or services for which you are claiming the exemption. Next, fill out the certificate form accurately, ensuring all required fields are completed. It's important to review the form for any errors before submission. Finally, submit the completed certificate to the vendor or service provider from whom you are purchasing the digital products or software, ensuring that you keep a copy for your records.

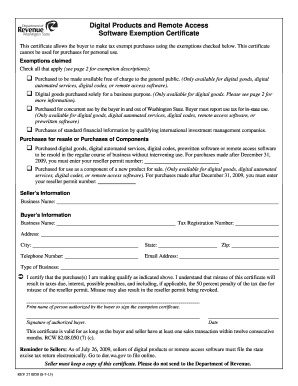

Key Elements of the Digital Products and Remote Access Software Exemption Certificate

The key elements of the Digital Products and Remote Access Software Exemption Certificate include the business's name, address, and tax identification number. Additionally, the certificate must specify the types of digital products or remote access software being purchased. It should also include a statement affirming that the purchase qualifies for exemption under applicable state laws. Properly completing these elements ensures the certificate is valid and can be accepted by vendors during transactions.

Legal Use of the Digital Products and Remote Access Software Exemption Certificate

The legal use of the Digital Products and Remote Access Software Exemption Certificate is governed by state tax laws. Businesses must ensure that the exemption certificate is used only for qualifying purchases to avoid potential legal issues. Misuse of the certificate, such as using it for taxable items, can lead to penalties or fines. Therefore, it is essential for businesses to stay informed about the specific regulations in their state regarding the use of this exemption certificate.

State-Specific Rules for the Digital Products and Remote Access Software Exemption Certificate

State-specific rules for the Digital Products and Remote Access Software Exemption Certificate can vary significantly. Each state has its own tax laws and regulations that define what qualifies as a digital product or remote access software. Businesses should consult their state’s tax authority for detailed guidelines on eligibility criteria, required documentation, and the application process. Understanding these nuances is vital for ensuring compliance and successfully claiming exemptions.

Quick guide on how to complete digital products and remote access software exemption certificate

Prepare Digital Products And Remote Access Software Exemption Certificate effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Handle Digital Products And Remote Access Software Exemption Certificate on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Digital Products And Remote Access Software Exemption Certificate with ease

- Locate Digital Products And Remote Access Software Exemption Certificate and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Digital Products And Remote Access Software Exemption Certificate to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a digital products and remote access software exemption certificate?

A digital products and remote access software exemption certificate is a document that allows businesses to purchase certain digital products and software services without incurring sales tax. This certificate typically applies to products used for remote access, ensuring compliance with local tax regulations while maximizing cost efficiency for your business operations.

-

How can the exemption certificate benefit my business?

Utilizing a digital products and remote access software exemption certificate can signNowly reduce your operational costs by eliminating sales tax on eligible purchases. This benefit not only helps improve your bottom line but also allows your business to allocate more resources to critical areas such as growth and innovation.

-

Are there any costs associated with obtaining the exemption certificate?

Obtaining a digital products and remote access software exemption certificate is typically straightforward and often incurs minimal or no costs. Most jurisdictions provide the necessary paperwork online, which means your business can quickly access and apply for the exemption certificate without signNow expense.

-

What features does airSlate SignNow offer for handling exemption certificates?

airSlate SignNow provides robust features to manage exemption certificates seamlessly. You can easily upload, store, and share your digital products and remote access software exemption certificate with stakeholders, ensuring all transactions are compliant and reducing administrative burdens related to tax processes.

-

How does airSlate SignNow integrate with other business software?

airSlate SignNow offers numerous integrations with popular business applications, making it easier for you to streamline workflows. By connecting with your existing systems, you can facilitate the management of your digital products and remote access software exemption certificates alongside other critical business processes.

-

Can I use airSlate SignNow for international transactions with exemption certificates?

Yes, airSlate SignNow supports international transactions and can accommodate the use of digital products and remote access software exemption certificates where applicable. It’s essential to check the specific regulations of the countries involved to ensure compliance and maximize your tax benefits.

-

How secure is airSlate SignNow when handling sensitive information like exemption certificates?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance protocols to protect sensitive information, including digital products and remote access software exemption certificates, ensuring your data remains confidential and secure throughout the signing process.

Get more for Digital Products And Remote Access Software Exemption Certificate

- Preliminary change of ownership report los angeles county form

- Disclosure of licensee status maryland form

- Hamd skala form

- How to fight dcf in kansas form

- Lien release form washington state

- Affidavit to use the surname of the father sample with answer form

- Lease agreement 34486431 form

- New living trust intake form klein law corporation

Find out other Digital Products And Remote Access Software Exemption Certificate

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document