W9 Fillable Form

What is the W-9 Fillable?

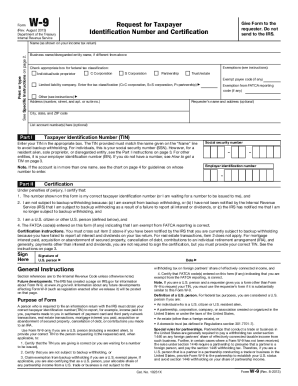

The W-9 fillable form is an official document used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized by individuals and businesses to provide their taxpayer identification information. This information is essential for entities that need to report income paid to contractors, freelancers, and other non-employees. The form captures details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number or an Employer Identification Number.

How to Use the W-9 Fillable

Using the W-9 fillable form is straightforward. First, access the form through a trusted platform that offers digital document solutions. Once you have the form, fill in the required fields accurately. Make sure to double-check your entries for correctness, as any errors could lead to complications with tax reporting. After completing the form, you can save it digitally and send it to the requesting party via email or other electronic means. This process ensures that your information is securely transmitted and easily accessible for future reference.

Steps to Complete the W-9 Fillable

Completing the W-9 fillable form involves several key steps:

- Access the form: Obtain the W-9 fillable form from a reliable source.

- Provide your name: Enter your full legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a business name, include it in the designated field.

- Enter your address: Fill in your current mailing address.

- Taxpayer Identification Number: Provide your TIN, which can be your Social Security number or Employer Identification Number.

- Sign and date: Add your signature and the date to validate the form.

Legal Use of the W-9 Fillable

The W-9 fillable form is legally binding when completed correctly. It serves as a declaration of your taxpayer information, which the IRS uses for various reporting purposes. When you submit this form, you are certifying that the information provided is accurate and that you are not subject to backup withholding. It is crucial to understand that submitting a W-9 with false information can lead to penalties and legal consequences, making accuracy essential.

IRS Guidelines

The IRS provides specific guidelines for completing the W-9 fillable form. It is important to adhere to these guidelines to ensure compliance with tax regulations. The IRS recommends that the form be filled out in its entirety and that all information is current and correct. If there are any changes to your personal or business information, a new W-9 should be submitted to reflect those updates. Additionally, keep in mind that the form should be provided to the requester and not submitted directly to the IRS.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the W-9 fillable form can result in significant penalties. If you do not provide a W-9 when requested, or if you provide inaccurate information, you may be subject to backup withholding. This means that the payer is required to withhold a percentage of your payments for tax purposes. Furthermore, providing false information can lead to fines and other legal repercussions, emphasizing the importance of accuracy and compliance.

Quick guide on how to complete w9 2019 fillable

Complete W9 Fillable effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly and without delays. Manage W9 Fillable on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign W9 Fillable without stress

- Obtain W9 Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign W9 Fillable while ensuring excellent communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a W9 2019 fillable form?

A W9 2019 fillable form is a tax document used in the United States for taxpayers to provide their correct taxpayer identification information. Using airSlate SignNow, you can easily create and fill out the W9 2019 fillable form online, ensuring all information is accurate and compliant with IRS requirements.

-

How can I access the W9 2019 fillable form using airSlate SignNow?

To access the W9 2019 fillable form with airSlate SignNow, simply sign up for an account and navigate to the templates section. From there, you can search for the W9 2019 fillable form, customize it as needed, and start filling it out directly from your device.

-

Is there a cost to use the W9 2019 fillable form on airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. While creating a W9 2019 fillable form can be done for free, additional features like eSignatures and document management may require a subscription to access their full functionalities.

-

What features does airSlate SignNow offer for the W9 2019 fillable form?

airSlate SignNow provides several useful features for the W9 2019 fillable form including user-friendly editing tools, electronic signatures, secure document storage, and easy sharing options. These features streamline the process of completing and managing your W9 forms efficiently.

-

Can I save my W9 2019 fillable form for future use?

Yes, you can save your completed W9 2019 fillable form on airSlate SignNow for future reference. This allows you to quickly access and modify it as needed, saving time and ensuring that all required updates are made promptly.

-

Is the W9 2019 fillable form compliant with IRS regulations?

Yes, the W9 2019 fillable form created using airSlate SignNow complies with IRS regulations. The platform is regularly updated to reflect any changes in tax laws, ensuring your form remains valid and meets all necessary legal requirements.

-

Can I integrate airSlate SignNow with other applications while using the W9 2019 fillable form?

Absolutely! airSlate SignNow supports seamless integrations with various productivity and accounting applications. This suggests that you can easily connect your W9 2019 fillable form with tools like Google Drive or Dropbox, enhancing your document management experience.

Get more for W9 Fillable

- Wced resignation forms

- Johnstone warranty claim form

- Paycheck plus 29513013 form

- Parts of speech matching worksheet form

- Hyresavtal form

- Funding request template form

- Report of suspected adverse reaction to medicines or vaccines reporting problems form

- Application for the purpose of residence of 39european blue card39 ind form

Find out other W9 Fillable

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer