R1331 Form

What is the R1331

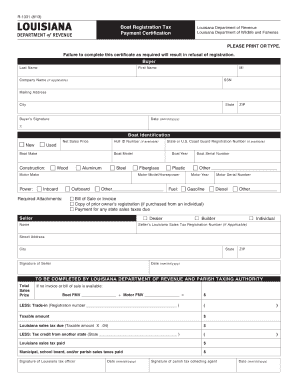

The R1331 form is a specific document used in various contexts, primarily for tax-related purposes. It serves as a declaration or reporting form that individuals or businesses must complete to comply with federal or state regulations. Understanding the purpose and requirements of the R1331 is essential for accurate filing and adherence to legal standards.

How to use the R1331

Using the R1331 form involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal details and financial data relevant to the form. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submission. Depending on the requirements, you may need to submit the form electronically or via mail.

Steps to complete the R1331

Completing the R1331 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation, such as income statements and identification.

- Fill out the form, ensuring all required fields are completed.

- Double-check for any errors or missing information.

- Sign the form electronically if using an eSigning solution, or print and sign if submitting by mail.

- Submit the form according to the specified guidelines.

Legal use of the R1331

The R1331 form must be used in accordance with applicable laws and regulations. This includes adhering to guidelines set forth by the IRS or relevant state authorities. Electronic signatures, when used, must comply with the ESIGN Act and UETA, ensuring that the submitted form is legally binding. It is important to understand the legal implications of the information provided on the form to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the R1331 form can vary based on the specific context in which it is used. Typically, it is important to submit the form by the designated deadline to avoid late fees or penalties. Keep track of important dates, such as the end of the tax year or specific submission dates set by the IRS or state agencies. Staying informed about these deadlines ensures compliance and timely processing of your form.

Who Issues the Form

The R1331 form is typically issued by federal or state tax authorities. In most cases, the Internal Revenue Service (IRS) is responsible for providing the necessary forms for tax reporting. State tax agencies may also issue their own versions of the form, tailored to state-specific requirements. It is essential to obtain the correct version of the R1331 from the appropriate issuing body to ensure compliance with regulations.

Quick guide on how to complete r1331

Complete R1331 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing easy access to the right form and secure online storage. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle R1331 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related operations today.

The easiest method to modify and eSign R1331 with ease

- Find R1331 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign R1331 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is r1331 and how does it relate to airSlate SignNow?

r1331 refers to a specific version of our integration tool that enhances the functionality of airSlate SignNow. This version offers improved features for document management and eSignature workflows, allowing users to operate more efficiently and securely.

-

What are the key features of airSlate SignNow r1331?

The r1331 version of airSlate SignNow includes advanced document routing, real-time tracking, and customizable workflows. These features streamline the signing process and ensure that every document is processed swiftly and accurately.

-

How does pricing work for airSlate SignNow r1331?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes. The r1331 version is available at various tiers, allowing users to select a plan that best fits their needs and budget.

-

Can I integrate airSlate SignNow r1331 with other software?

Yes, airSlate SignNow r1331 supports integrations with numerous third-party applications. This capability allows users to enhance their workflows and automate processes across various platforms seamlessly.

-

What are the benefits of using airSlate SignNow r1331 for businesses?

Using airSlate SignNow r1331 helps businesses reduce turnaround time on documents and improve compliance with eSignature laws. The user-friendly interface also boosts employee productivity by simplifying the signing process.

-

Is airSlate SignNow r1331 secure for sensitive documents?

Absolutely, airSlate SignNow r1331 prioritizes security with encryption and compliance with industry standards. This ensures that sensitive documents remain protected throughout the signing and storage process.

-

How can I get support for airSlate SignNow r1331?

airSlate SignNow offers comprehensive customer support for the r1331 version through various channels, including email, chat, and a dedicated help center. Our support team is available to assist you with any questions or technical issues.

Get more for R1331

Find out other R1331

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online