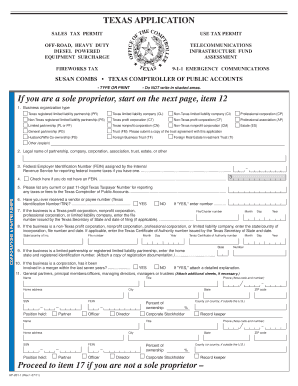

Texas Tax ID Form

What is the Texas Tax ID?

The Texas Tax ID, also known as the tax identification number, is a unique identifier assigned to businesses and organizations operating in Texas. This number is essential for various tax-related purposes, including reporting and paying state taxes. It helps the Texas Comptroller's office track tax obligations and ensure compliance with state tax laws.

Businesses, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), must obtain a Texas Tax ID to operate legally. This number is used for filing tax returns, opening business bank accounts, and applying for business licenses.

How to Obtain the Texas Tax ID

Obtaining a Texas Tax ID involves a straightforward application process. Businesses can apply online through the Texas Comptroller's website or by submitting a paper application. Here are the key steps to follow:

- Determine the type of business entity you are operating.

- Gather necessary information, such as your business name, address, and ownership details.

- Complete the application form, ensuring all information is accurate.

- Submit the application online or send it via mail to the appropriate office.

Once your application is processed, you will receive your Texas Tax ID, which you can use for your business operations.

Steps to Complete the Texas Tax ID Form

Completing the Texas Tax ID form requires attention to detail to ensure accuracy. Here are the steps to follow:

- Begin by entering your business name exactly as it appears on official documents.

- Provide the physical address of your business, including city and ZIP code.

- Indicate the type of business entity you are registering.

- Include the owner's information, such as name, Social Security number, and contact details.

- Review the form for any errors before submission.

Taking the time to complete the form correctly can help avoid delays in processing your application.

Legal Use of the Texas Tax ID

The Texas Tax ID is legally required for businesses to comply with state tax regulations. It serves several purposes, including:

- Filing state tax returns and paying taxes owed to the state.

- Applying for business licenses and permits.

- Opening business bank accounts and establishing credit.

Using the Texas Tax ID correctly ensures that businesses remain compliant with state laws and avoid potential penalties.

Key Elements of the Texas Tax ID

Understanding the key elements of the Texas Tax ID can help businesses navigate their tax responsibilities. Important aspects include:

- Unique Identifier: Each Texas Tax ID is unique to the business and cannot be reused.

- Tax Reporting: The number is used for reporting various taxes, including sales and franchise taxes.

- Compliance: It is essential for maintaining compliance with state tax regulations.

Familiarity with these elements can assist business owners in managing their tax obligations effectively.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for businesses operating with a Texas Tax ID. Key dates include:

- Quarterly Tax Returns: Businesses must file quarterly tax returns by the 20th day of the month following the end of each quarter.

- Annual Franchise Tax Report: This report is typically due on May 15 each year.

- Sales Tax Payments: Sales tax returns are due monthly or quarterly, depending on the business's tax liability.

Marking these dates on your calendar can help ensure timely compliance and avoid penalties.

Quick guide on how to complete texas tax id

Prepare Texas Tax Id effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Texas Tax Id on any device through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Texas Tax Id with ease

- Locate Texas Tax Id and click on Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Texas Tax Id to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Tax ID and why do I need one?

A Texas Tax ID is a unique identifier assigned to businesses by the Texas Comptroller's office for tax purposes. It is essential for various business functions, including opening a bank account, filing taxes, and obtaining necessary permits. Having a Texas Tax ID helps ensure compliance with state tax laws.

-

How can airSlate SignNow help me with my Texas Tax ID documents?

airSlate SignNow simplifies the process of sending and signing documents related to your Texas Tax ID. With our easy-to-use platform, you can electronically sign tax forms and securely manage your documents, ensuring everything is in order for your business compliance needs.

-

What features does airSlate SignNow offer for businesses dealing with Texas Tax IDs?

airSlate SignNow offers features such as electronic signatures, document templates, and cloud storage that can greatly benefit businesses processing Texas Tax IDs. Our platform allows you to streamline document workflows, saving time and reducing errors in managing your tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for Texas Tax ID paperwork?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for your Texas Tax ID paperwork. Our subscription plans cater to various business sizes, ensuring you only pay for the features you need. This investment can save you time and money in the long run.

-

Are there integrations available for airSlate SignNow that help with Texas Tax ID processes?

Absolutely! airSlate SignNow offers integrations with popular business applications that can streamline your Texas Tax ID processes. Whether you're using accounting software or CRM systems, our platform can connect seamlessly to enhance your document management and compliance efforts.

-

How secure is airSlate SignNow when handling Texas Tax ID documents?

Security is a top priority for airSlate SignNow. We utilize industry-leading encryption and security protocols to protect your Texas Tax ID documents from unauthorized access. Our platform is compliant with regulatory standards, ensuring that your sensitive information remains safe.

-

Can I access my Texas Tax ID documents from anywhere using airSlate SignNow?

Yes, airSlate SignNow allows you to access your Texas Tax ID documents from anywhere with an internet connection. Our cloud-based platform ensures that you can manage and sign your documents on-the-go, making it convenient for busy business owners.

Get more for Texas Tax Id

Find out other Texas Tax Id

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe