Cift 620 Form

What is the Cift 620

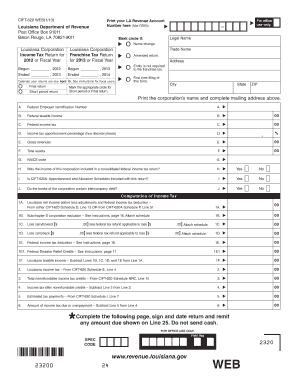

The Cift 620 is a specific form used in the state of Louisiana, primarily for tax purposes. It is designed for businesses to report certain financial information to the state. This form is crucial for ensuring compliance with state tax regulations and helps businesses maintain accurate records of their financial activities. Understanding the purpose and requirements of the Cift 620 is essential for any business operating in Louisiana.

How to use the Cift 620

Using the Cift 620 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense reports. Next, fill out the form with precise details regarding your business's financial activities. Once completed, review the form to ensure accuracy before submitting it to the appropriate state agency. Proper use of the Cift 620 helps avoid potential penalties and ensures compliance with Louisiana tax laws.

Steps to complete the Cift 620

Completing the Cift 620 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents.

- Fill in your business information at the top of the form.

- Report your income and expenses in the designated sections.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

By following these steps, you can ensure that your Cift 620 is completed correctly, minimizing the risk of errors.

Legal use of the Cift 620

The Cift 620 must be completed in accordance with Louisiana state laws to be considered legally valid. This includes adhering to deadlines for submission and ensuring that all reported information is truthful and accurate. Failure to comply with these legal requirements can result in penalties, including fines or additional scrutiny from tax authorities. Understanding the legal implications of using the Cift 620 is crucial for maintaining your business's good standing.

Filing Deadlines / Important Dates

Timely filing of the Cift 620 is essential to avoid penalties. The specific deadlines can vary based on the type of business and the fiscal year. Generally, businesses should be aware of the following key dates:

- Annual filing deadline: Typically due on the 15th day of the fourth month following the end of the fiscal year.

- Extensions: Businesses may apply for an extension, but must still pay any taxes owed by the original deadline.

Staying informed about these deadlines helps ensure compliance and avoids unnecessary penalties.

Required Documents

To complete the Cift 620, you will need several key documents. These include:

- Income statements detailing your business revenue.

- Expense reports that outline all business-related expenditures.

- Any previous tax returns that may provide context for your current filing.

Having these documents readily available will streamline the completion of the Cift 620 and help ensure accuracy in your reporting.

Quick guide on how to complete cift 620

Effortlessly prepare Cift 620 on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate format and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Access Cift 620 on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Cift 620 with ease

- Obtain Cift 620 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal standing as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Cift 620 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form cift 620 and how can it be used?

Form cift 620 is a specific document format designed for efficiently processing and managing forms online. With airSlate SignNow, users can create, send, and eSign the form cift 620 seamlessly, ensuring that all critical information is captured and managed effectively.

-

How much does it cost to use airSlate SignNow for form cift 620?

airSlate SignNow offers a range of pricing plans that cater to different business needs, including features for handling form cift 620. By choosing the right plan, businesses can efficiently manage their eSigning needs at a cost-effective rate that suits their budget.

-

What features does airSlate SignNow provide for managing form cift 620?

airSlate SignNow includes a variety of features such as customizable templates, automated workflows, and real-time tracking that enhance the management of form cift 620. These features help streamline the signing process, reduce errors, and increase overall efficiency.

-

Can I integrate other tools with airSlate SignNow for form cift 620?

Yes, airSlate SignNow offers integrations with many popular applications, enabling you to work with form cift 620 effortlessly alongside your existing tools. This capability ensures that your workflow is efficient and your document management process is streamlined.

-

What are the benefits of using airSlate SignNow for form cift 620 eSigning?

Using airSlate SignNow for form cift 620 eSigning provides signNow benefits, including faster turnaround times, enhanced security, and reduced paperwork. These advantages lead to improved productivity and ensure that your business remains compliant with legal standards.

-

Is it easy to send and eSign form cift 620 with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy to send and eSign form cift 620 documents. Its intuitive interface allows users to navigate the signing process effortlessly, even for those who are not tech-savvy.

-

What support does airSlate SignNow offer for form cift 620 users?

airSlate SignNow provides excellent customer support for users working with form cift 620. Dedicated resources, including tutorials, FAQs, and responsive customer service, are available to aid users in any queries or issues they may encounter.

Get more for Cift 620

Find out other Cift 620

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself