Kansas Tax Exempt Form PDF

What is the Kansas Tax Exempt Form PDF

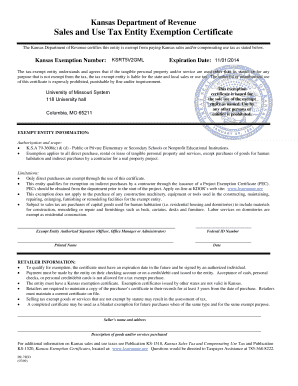

The Kansas Tax Exempt Form PDF is a document used by eligible organizations and individuals to claim exemption from sales tax in the state of Kansas. This form is essential for entities that qualify under specific tax laws, allowing them to make purchases without incurring sales tax. The tax exempt certificate Kansas is typically used by non-profit organizations, government entities, and certain educational institutions. By submitting this form, eligible parties can ensure compliance with state tax regulations while benefiting from tax exemptions on qualified purchases.

How to Use the Kansas Tax Exempt Form PDF

Using the Kansas Tax Exempt Form PDF involves several straightforward steps. First, download the form from a reliable source. Next, fill out the required fields, which may include details about the organization, the reason for exemption, and any relevant identification numbers. Once completed, the form must be signed by an authorized representative of the organization. It is crucial to retain a copy of the form for your records. The completed form can then be presented to vendors at the time of purchase to avoid sales tax charges.

Steps to Complete the Kansas Tax Exempt Form PDF

Completing the Kansas Tax Exempt Form PDF requires careful attention to detail. Follow these steps for a successful submission:

- Download the Kansas Tax Exempt Form PDF from an official source.

- Provide the name and address of the organization seeking the exemption.

- Include the reason for the exemption, referencing the applicable Kansas tax laws.

- Enter any necessary identification numbers, such as the federal tax identification number.

- Ensure the form is signed by an authorized individual within the organization.

- Keep a copy of the completed form for your records.

Legal Use of the Kansas Tax Exempt Form PDF

The Kansas Tax Exempt Form PDF is legally binding when filled out correctly and signed by an authorized representative. It is important to understand that misuse of the form can lead to penalties, including fines or back taxes owed. Organizations must ensure they meet the eligibility criteria set forth by Kansas tax laws to avoid any legal complications. By adhering to the regulations, the form serves as a valid document for claiming tax exemptions on applicable purchases.

Eligibility Criteria for the Kansas Tax Exempt Form PDF

To qualify for the Kansas Tax Exempt Form PDF, organizations must meet specific eligibility criteria. Generally, these include:

- Being a non-profit organization recognized by the IRS.

- Operating as a government entity or agency.

- Being an educational institution that qualifies under state regulations.

- Utilizing the purchased items exclusively for exempt purposes.

It is essential for applicants to review the state guidelines to confirm their eligibility before submitting the form.

Form Submission Methods

The Kansas Tax Exempt Form PDF can be submitted in various ways, depending on the vendor's requirements. Common submission methods include:

- Presenting the completed form in person at the time of purchase.

- Faxing the form to the vendor if they accept faxed documents.

- Sending the form via email if the vendor allows electronic submissions.

Each vendor may have different policies regarding the acceptance of the Kansas tax exempt certificate, so it is advisable to confirm their preferred submission method beforehand.

Quick guide on how to complete kansas tax exempt form pdf

Effortlessly prepare Kansas Tax Exempt Form Pdf on any device

Digital document management has gained popularity among enterprises and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to generate, alter, and eSign your documents quickly without any delays. Manage Kansas Tax Exempt Form Pdf on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to amend and eSign Kansas Tax Exempt Form Pdf with minimal effort

- Find Kansas Tax Exempt Form Pdf and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Mark signNow sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to submit your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Kansas Tax Exempt Form Pdf to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kansas tax exempt form PDF?

The Kansas tax exempt form PDF is a crucial document that allows businesses and individuals to claim sales tax exemptions in the state of Kansas. This form needs to be properly filled out and submitted to qualify for tax exemption status on eligible purchases.

-

How can I fill out the Kansas tax exempt form PDF?

To fill out the Kansas tax exempt form PDF, you can either print it and complete it manually or utilize an electronic signing solution like airSlate SignNow for a more streamlined approach. This digital option allows for easy data entry and ensures that all signatures are captured efficiently.

-

Is there a cost associated with using the Kansas tax exempt form PDF through airSlate SignNow?

airSlate SignNow offers tailored pricing plans that are cost-effective for businesses. Costs may vary depending on the features and number of users, but using the Kansas tax exempt form PDF is included in the standard signing functionalities, providing great value for users.

-

What features does airSlate SignNow offer for managing the Kansas tax exempt form PDF?

airSlate SignNow provides user-friendly features like document templates, real-time tracking, and secure electronic signatures for your Kansas tax exempt form PDF. These features enhance efficiency and ensure compliance, making the signing process quicker and more reliable.

-

Can I integrate airSlate SignNow with other software for handling my Kansas tax exempt form PDF?

Yes, airSlate SignNow offers seamless integrations with various software such as CRM systems, accounting tools, and cloud storage services, enhancing your workflow while managing the Kansas tax exempt form PDF. This connectivity allows for smooth data transfer and improved productivity.

-

What are the benefits of using airSlate SignNow for the Kansas tax exempt form PDF?

Using airSlate SignNow for the Kansas tax exempt form PDF simplifies the document signing process, saves time, and reduces paper usage. It ensures compliance and security for sensitive information, while also allowing you to access and manage your documents from anywhere.

-

How secure is the Kansas tax exempt form PDF when using airSlate SignNow?

airSlate SignNow prioritizes security for your Kansas tax exempt form PDF with advanced encryption technologies and HIPAA compliance measures. This ensures that your documents are protected during transmission and storage, providing peace of mind when handling sensitive tax information.

Get more for Kansas Tax Exempt Form Pdf

Find out other Kansas Tax Exempt Form Pdf

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast