Tax Directive Form

What is the Tax Directive Form

The tax directive form is a crucial document used in the United States to guide the withholding of taxes on various income types. It provides instructions to employers or payers on how much tax to withhold from an individual's earnings. This form is particularly important for those with multiple income sources or specific tax situations, such as self-employed individuals or retirees. By utilizing this form, taxpayers can ensure that the correct amount of tax is withheld, helping to avoid underpayment or overpayment issues during tax season.

How to use the Tax Directive Form

Using the tax directive form involves several straightforward steps. First, individuals must gather relevant financial information, including income details and any applicable deductions. Next, they should fill out the form accurately, providing necessary personal and financial data. Once completed, the form should be submitted to the employer or payer, who will use it to adjust tax withholding accordingly. It is essential to review the form periodically, especially if there are changes in income or personal circumstances, to ensure that withholding remains accurate.

Steps to complete the Tax Directive Form

Completing the tax directive form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including previous tax returns and income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Provide details about your income sources, including wages, dividends, and other earnings.

- Indicate any deductions or credits you expect to claim, which can affect your withholding.

- Review the form for accuracy before submitting it to your employer or payer.

Legal use of the Tax Directive Form

The tax directive form is legally binding, meaning that both the taxpayer and the employer or payer must adhere to the instructions provided. It is essential to ensure that the information on the form is accurate and truthful to avoid potential legal issues or penalties. The form must comply with IRS regulations, which govern how tax withholding should be conducted. Misuse or falsification of the form can lead to significant consequences, including fines or audits by tax authorities.

Who Issues the Form

The tax directive form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. Employers and payers may also provide their versions of the form, tailored to specific circumstances or requirements. It is important for taxpayers to use the correct form issued by the appropriate authority to ensure compliance with tax regulations. Keeping updated with any changes in tax law is essential, as it may affect the issuance and requirements of the tax directive form.

Required Documents

To complete the tax directive form accurately, several documents may be required. These include:

- Previous year’s tax return, which provides insight into your tax situation.

- W-2 forms from employers, detailing income and taxes withheld.

- 1099 forms for any freelance or contract work, showing other income sources.

- Documentation for any deductions or credits you plan to claim, such as receipts or statements.

Quick guide on how to complete tax directive form

Complete Tax Directive Form effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Directive Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and electronically sign Tax Directive Form with ease

- Find Tax Directive Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Tax Directive Form and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

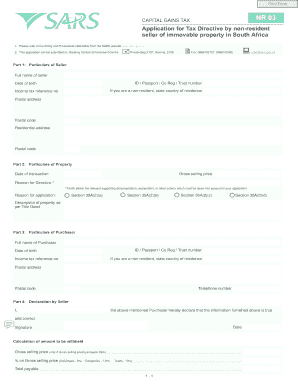

What is a tax directive form?

A tax directive form is a document issued by the South African Revenue Service (SARS) that provides specific tax instructions for individuals or businesses. It is essential for ensuring the correct interpretation and application of tax directives, making it crucial when managing payroll and tax obligations.

-

How can airSlate SignNow help with tax directive forms?

airSlate SignNow streamlines the process of sending and eSigning tax directive forms, ensuring timely completion and compliance. Our platform allows you to manage and store these forms securely, enhancing your workflow efficiency and reducing errors associated with manual handling.

-

Is there a cost associated with using airSlate SignNow for tax directive forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features necessary for managing tax directive forms, making it a cost-effective solution for both small businesses and large enterprises.

-

What features does airSlate SignNow offer for managing tax directive forms?

airSlate SignNow provides features such as customizable templates for tax directive forms, real-time tracking, and automated notifications. These functionalities help businesses efficiently manage their document workflows while ensuring compliance with tax regulations.

-

Can I customize tax directive forms in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize tax directive forms according to their specific requirements. This includes adding branding elements, logos, and modifying text fields to suit individual or business needs.

-

Does airSlate SignNow integrate with other software for tax directive forms?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easy to incorporate tax directive forms into your existing workflow. Integrations with platforms like CRM or accounting software ensure a streamlined process from document creation to signing.

-

What benefits does airSlate SignNow provide for eSigning tax directive forms?

Using airSlate SignNow for eSigning tax directive forms simplifies the signing process, saving time and reducing paperwork. The platform's electronic signature capability ensures the legality and security of your forms, which enhances compliance with tax regulations.

Get more for Tax Directive Form

Find out other Tax Directive Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors