Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas

Understanding the Form T-181 Facultative Reinsurance Agreement

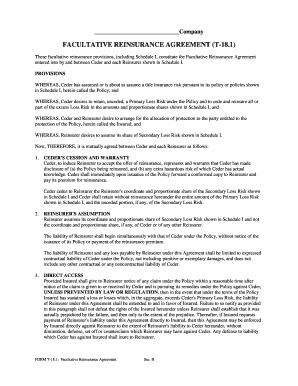

The Form T-181 Facultative Reinsurance Agreement is a crucial document used in the reinsurance industry. This form serves as a formal agreement between a primary insurer and a reinsurer, outlining the terms and conditions under which the reinsurer agrees to accept certain risks. It is essential for managing risk exposure and ensuring that both parties understand their obligations. The form is particularly relevant in the context of facultative reinsurance, where specific risks are transferred on a case-by-case basis rather than through a treaty agreement.

Steps to Complete the Form T-181 Facultative Reinsurance Agreement

Completing the Form T-181 requires careful attention to detail to ensure all necessary information is accurately provided. Here are the steps to follow:

- Gather all relevant information about the risks to be reinsured.

- Fill in the details of the primary insurer, including name, address, and contact information.

- Provide the reinsurer's information, ensuring accuracy to avoid complications.

- Clearly outline the terms of the agreement, including coverage limits, premiums, and any exclusions.

- Include signatures from authorized representatives of both parties to validate the agreement.

Legal Use of the Form T-181 Facultative Reinsurance Agreement

The legal validity of the Form T-181 is contingent upon compliance with relevant laws and regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, making it possible to execute the form digitally. However, it is crucial to ensure that all parties involved have the proper authority to sign the document. Additionally, maintaining a record of the signed agreement is essential for legal purposes and future reference.

Key Elements of the Form T-181 Facultative Reinsurance Agreement

Several key elements must be included in the Form T-181 to ensure its effectiveness and legal standing:

- Identification of Parties: Clearly state the names and addresses of the primary insurer and reinsurer.

- Risk Description: Provide a detailed description of the risks being reinsured.

- Coverage Terms: Outline the specific terms of coverage, including limits and exclusions.

- Premiums: State the premium amounts and payment terms.

- Signatures: Ensure that the form is signed by authorized representatives of both parties.

Obtaining the Form T-181 Facultative Reinsurance Agreement

The Form T-181 can typically be obtained from state insurance departments or industry associations. It may also be available through legal or insurance professionals who specialize in reinsurance. When obtaining the form, ensure that you are using the most current version to avoid any issues with compliance or legal validity.

Examples of Using the Form T-181 Facultative Reinsurance Agreement

Practical scenarios for using the Form T-181 include:

- A property insurer seeking to reinsure a large commercial property risk due to potential high losses.

- A life insurer transferring specific high-value life insurance policies to manage risk exposure.

- An auto insurer looking to cover a particular fleet of vehicles that present a higher risk profile.

Quick guide on how to complete form t 181 facultative reinsurance agreement title basic manual facultative reinsurance agreement form t 181 tdi texas

Complete Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents rapidly without any delays. Manage Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to revise and eSign Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas without hassle

- Obtain Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is facultative reinsurance?

Facultative reinsurance is a type of reinsurance arrangement where insurers can submit individual risks to reinsurers for underwriting. This allows insurers greater flexibility in managing their risk portfolios by selectively transferring certain risks. Understanding facultative reinsurance is crucial for businesses looking to enhance their risk management strategies.

-

How does facultative reinsurance benefit my business?

Facultative reinsurance can signNowly lower the risks associated with large policies by spreading them across multiple insurers. This can result in better financial stability and protection for your business. Additionally, it helps enhance your underwriting capabilities, making your operations more robust.

-

What features does airSlate SignNow offer for managing facultative reinsurance documents?

airSlate SignNow streamlines the signing and management of facultative reinsurance documents, allowing for quick eSigning and document sharing. Our platform offers templates specifically designed for insurance agreements, enhancing overall efficiency. Additionally, all documents are secure and easily accessible, ensuring your sensitive information is protected.

-

How does pricing work for facultative reinsurance through airSlate SignNow?

The pricing for facultative reinsurance varies based on the risks associated with the policy and the coverage limits. With airSlate SignNow, you can manage these costs effectively by utilizing our cost-effective document management solutions. Our platform allows for customizable pricing options tailored to your individual business needs.

-

Can I integrate airSlate SignNow with other software for facultative reinsurance?

Yes, airSlate SignNow offers integrations with various CRM and insurance management software, making it easy to manage facultative reinsurance workflows. This seamless connectivity helps streamline processes, improving overall efficiency and effectiveness in document handling. By integrating these tools, you ensure all your data remains consistent and easily accessible.

-

What types of insurance policies typically use facultative reinsurance?

Facultative reinsurance is commonly utilized in various lines of insurance, including property, casualty, and specialty insurance. Most insurers might employ this strategy for high-value or high-risk policies where the potential loss could be signNow. Understanding these applications can help you make informed decisions regarding your insurance strategies.

-

How can I ensure compliance when using facultative reinsurance?

Compliance in facultative reinsurance is critical, and airSlate SignNow assists with this by providing secure document management and tracking features. Our platform ensures that all eSignatures and document transactions meet industry regulations and standards. Maintaining compliance helps mitigate legal risks and reinforces trust with your clients.

Get more for Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas

Find out other Form T 18 1 Facultative Reinsurance Agreement Title Basic Manual Facultative Reinsurance Agreement Form T 18 1 Tdi Texas

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe