Limited Liability Company Ks Form

What is the Limited Liability Company KS

A Limited Liability Company (LLC) in Kansas is a popular business structure that combines the benefits of both corporations and partnerships. It provides limited liability protection to its owners, known as members, shielding them from personal liability for the company's debts and obligations. This means that personal assets are generally protected in case the business faces legal issues or financial troubles. Additionally, an LLC offers flexibility in management and taxation, allowing members to choose how they wish to be taxed—either as a corporation or as pass-through entities, where profits and losses are reported on personal tax returns.

How to obtain the Limited Liability Company KS

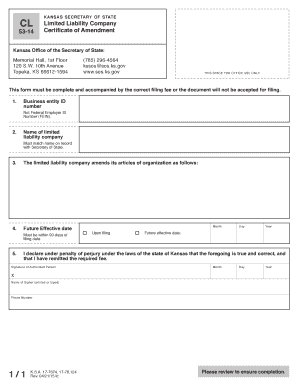

To form a Limited Liability Company in Kansas, you must complete several steps. First, choose a unique name for your LLC that complies with Kansas naming requirements. Next, designate a registered agent who will receive legal documents on behalf of the company. After that, you need to file the Articles of Organization with the Kansas Secretary of State, which can be done online or by mail. There is a filing fee associated with this process. Once your LLC is approved, you may also consider creating an Operating Agreement, although it is not legally required in Kansas. This document outlines the management structure and operating procedures of your LLC.

Steps to complete the Limited Liability Company KS

Completing the Limited Liability Company KS involves a series of clear steps:

- Choose a unique name for your LLC that includes "Limited Liability Company" or an abbreviation like "LLC."

- Select a registered agent who is a resident of Kansas or a business entity authorized to conduct business in the state.

- Prepare and file the Articles of Organization with the Kansas Secretary of State, including necessary details such as the LLC name, registered agent information, and the duration of the LLC.

- Pay the required filing fee, which can vary depending on the method of submission.

- Consider drafting an Operating Agreement to outline the management and operational structure of your LLC.

Legal use of the Limited Liability Company KS

The legal use of a Limited Liability Company in Kansas involves adhering to state laws and regulations governing LLCs. This includes maintaining proper records, filing annual reports, and adhering to tax obligations. An LLC must operate in compliance with both state and federal laws, which may include obtaining necessary licenses and permits depending on the nature of the business. Additionally, members should ensure that the LLC's activities align with its stated purpose in the Articles of Organization to maintain its legal standing.

Key elements of the Limited Liability Company KS

Several key elements define a Limited Liability Company in Kansas:

- Limited Liability Protection: Members are not personally liable for business debts.

- Flexible Management: LLCs can be managed by members or designated managers.

- Pass-Through Taxation: Income is typically taxed at the individual level, avoiding double taxation.

- Fewer Formalities: Compared to corporations, LLCs have fewer ongoing compliance requirements.

State-specific rules for the Limited Liability Company KS

Kansas has specific rules that govern the formation and operation of Limited Liability Companies. These rules include the requirement for a registered agent, the necessity of filing Articles of Organization, and compliance with state tax regulations. Additionally, Kansas requires LLCs to file an annual report, which includes updated information about the business and its members. It's important for LLC owners to stay informed about any changes in state laws that may affect their business operations.

Quick guide on how to complete limited liability company ks

Easily prepare Limited Liability Company Ks on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to generate, modify, and electronically sign your documents promptly without any hold-up. Manage Limited Liability Company Ks on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Limited Liability Company Ks effortlessly

- Find Limited Liability Company Ks and click Get Form to begin.

- Make use of the provided tools to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and electronically sign Limited Liability Company Ks to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a limited liability company ks?

A limited liability company ks is a business structure that combines the advantages of both a corporation and a partnership. It provides personal liability protection to its owners while allowing for flexible management and tax benefits. Forming a limited liability company ks can be a strategic move for entrepreneurs in Kansas.

-

How do I form a limited liability company ks?

To form a limited liability company ks, you need to file Articles of Organization with the Kansas Secretary of State. It involves choosing a unique name that complies with state guidelines and appointing a registered agent for your LLC. Once your application is processed, you'll be able to operate your limited liability company ks legally.

-

What are the benefits of a limited liability company ks?

The benefits of a limited liability company ks include limited liability protection, pass-through taxation, and the flexibility to structure management and profits. Additionally, owners can make use of various tax deductions that are not available to corporations. This structure is especially favorable for small business owners in Kansas.

-

What are the costs associated with setting up a limited liability company ks?

Establishing a limited liability company ks typically involves a filing fee for the Articles of Organization, which is around $160. There may also be additional costs for obtaining permits or licenses depending on your specific business. Overall, it's a cost-effective option for many entrepreneurs.

-

Can a limited liability company ks have multiple members?

Yes, a limited liability company ks can have multiple members, making it a suitable choice for partnerships. Members can be individuals or other business entities, and the LLC structure allows for shared management responsibilities. This flexibility is a key advantage of forming a limited liability company ks.

-

What features does airSlate SignNow offer for limited liability company ks?

airSlate SignNow provides advanced eSignature features tailored for limited liability company ks, allowing businesses to send, sign, and manage documents seamlessly. Its user-friendly platform helps teams maintain compliance with legal standards while enhancing workflow efficiency. Plus, it's a cost-effective solution for managing documents in any organization.

-

How can airSlate SignNow integrate with my limited liability company ks?

airSlate SignNow can integrate seamlessly with various business applications used by your limited liability company ks, such as CRMs, cloud storage platforms, and productivity tools. This integration streamlines your workflows by enabling you to manage documents without switching between multiple applications. It enhances collaboration and improves overall productivity.

Get more for Limited Liability Company Ks

Find out other Limited Liability Company Ks

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF