IFTADieselLayout 1 Tax Ri Form

What is the RI IFTA form?

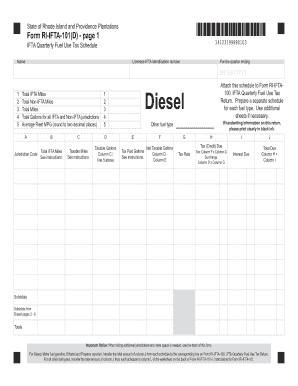

The RI IFTA form, also known as the International Fuel Tax Agreement form, is a tax document used by commercial motor carriers operating in multiple jurisdictions. This form is essential for reporting fuel usage and calculating the tax owed to various states and provinces. The RI IFTA form ensures that the fuel taxes are distributed fairly among the jurisdictions based on the miles driven and fuel consumed. It is a crucial component for compliance with state tax regulations and helps streamline the tax reporting process for interstate trucking operations.

Steps to complete the RI IFTA form

Completing the RI IFTA form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including mileage records and fuel purchase receipts. Next, determine the total miles driven in each jurisdiction and the amount of fuel purchased. This information will be used to calculate the tax owed or the refund due. Fill out the RI IFTA form by entering the required details, ensuring that all calculations are correct. Finally, review the completed form for accuracy before submitting it to the appropriate state agency.

Legal use of the RI IFTA form

The RI IFTA form is legally binding when completed accurately and submitted on time. It must adhere to the regulations set forth by the International Fuel Tax Agreement, which governs fuel tax reporting for interstate carriers. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential for carriers to understand their obligations and ensure that the RI IFTA form is filled out correctly to maintain compliance with state and federal laws.

Filing Deadlines / Important Dates

Filing deadlines for the RI IFTA form are critical for compliance. Typically, the form must be submitted quarterly, with specific due dates for each quarter. For example, the first quarter's filing is usually due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. It is essential to be aware of these deadlines to avoid late fees and ensure that all tax obligations are met in a timely manner.

Required Documents

To complete the RI IFTA form, several documents are required. These include detailed mileage logs for each jurisdiction, fuel purchase receipts, and any previous IFTA returns. Accurate records of miles driven and fuel purchased are crucial for calculating the tax owed. Additionally, any supporting documentation that verifies the information reported on the form may be necessary to ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the RI IFTA form can lead to significant penalties. These penalties may include fines, interest on unpaid taxes, and potential audits by state tax authorities. In some cases, repeated non-compliance can result in the suspension of a carrier's operating authority. It is vital for carriers to understand the importance of timely and accurate submissions to avoid these consequences.

Quick guide on how to complete ifta_diesel_layout 1 tax ri

Complete IFTADieselLayout 1 Tax Ri effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents quickly without any delays. Handle IFTADieselLayout 1 Tax Ri on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign IFTADieselLayout 1 Tax Ri without any hassle

- Obtain IFTADieselLayout 1 Tax Ri and then click Get Form to begin.

- Use the features we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign IFTADieselLayout 1 Tax Ri and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is RI IFTA and how can airSlate SignNow help?

RI IFTA stands for Rhode Island International Fuel Tax Agreement, which streamlines fuel tax reporting for interstate commercial vehicles. airSlate SignNow provides an easy-to-use platform that allows businesses to eSign necessary documents for RI IFTA compliance, ensuring a smooth and efficient reporting process.

-

How much does airSlate SignNow cost for RI IFTA compliance?

airSlate SignNow offers various pricing plans tailored to meet different business needs, making it a cost-effective solution for RI IFTA compliance. By choosing airSlate SignNow, you can save time and resources associated with traditional document handling and eSigning processes.

-

What features does airSlate SignNow offer for RI IFTA document management?

airSlate SignNow provides a range of features designed to enhance RI IFTA document management, including customizable templates, automated workflows, and real-time tracking. These features simplify the eSigning process and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for RI IFTA tasks?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, helping you streamline your RI IFTA tasks. Popular integrations include CRM systems and accounting software, allowing you to manage your documents better and enhance overall operational efficiency.

-

Is airSlate SignNow secure for handling sensitive RI IFTA documents?

Absolutely! airSlate SignNow prioritizes security and compliance, providing end-to-end encryption and secure storage for all your sensitive RI IFTA documents. This ensures that your information remains protected throughout the eSigning process.

-

How quickly can I set up airSlate SignNow for RI IFTA reporting?

Setting up airSlate SignNow for RI IFTA reporting is quick and user-friendly. You can start eSigning your RI IFTA documents within minutes, as our intuitive interface guides you through the initial setup process easily.

-

What benefits does airSlate SignNow provide for companies dealing with RI IFTA?

By using airSlate SignNow for RI IFTA, companies can achieve faster document turnaround times, reduce paperwork, and improve accuracy in tax reporting. The platform enhances workflow efficiency, allowing you to focus more on your core business activities.

Get more for IFTADieselLayout 1 Tax Ri

Find out other IFTADieselLayout 1 Tax Ri

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney