Fixed Deposit Receipt Format PDF

Understanding the Fixed Deposit Receipt Format PDF

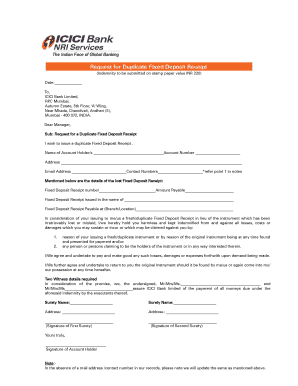

The Fixed Deposit Receipt Format PDF is a standardized document used to acknowledge the creation of a fixed deposit account. This format typically includes essential details such as the depositor's name, account number, deposit amount, interest rate, and maturity date. It serves as proof of the deposit and is crucial for both the depositor and the financial institution. Having a clear understanding of this format ensures that all necessary information is accurately captured, preventing any potential issues in the future.

How to Use the Fixed Deposit Receipt Format PDF

Using the Fixed Deposit Receipt Format PDF involves several straightforward steps. First, download the PDF from a reliable source or the financial institution's website. Next, fill in the required information, ensuring accuracy in details such as personal identification and deposit specifics. Once completed, it is advisable to save a copy for personal records. This document can then be submitted to the bank, either in person or through an online submission system, depending on the institution's procedures.

Steps to Complete the Fixed Deposit Receipt Format PDF

Completing the Fixed Deposit Receipt Format PDF requires careful attention to detail. Begin by entering your personal information, including your name and contact details. Next, input the deposit amount and select the interest rate offered by the bank. Ensure that the maturity date aligns with your investment goals. After filling in all sections, review the document for any errors before saving or printing it. This careful approach helps maintain the integrity of the information provided.

Legal Use of the Fixed Deposit Receipt Format PDF

The Fixed Deposit Receipt Format PDF holds legal significance as it serves as a binding agreement between the depositor and the financial institution. It is essential that the document is filled out accurately to ensure that it is recognized in legal contexts. Compliance with applicable regulations, such as those outlined by the ESIGN Act, ensures that electronic signatures and documents are valid and enforceable. Understanding these legal implications can help protect your rights as a depositor.

Key Elements of the Fixed Deposit Receipt Format PDF

Key elements of the Fixed Deposit Receipt Format PDF include the depositor's name, account number, deposit amount, interest rate, and maturity date. Additional information may include the bank's name, branch details, and any terms and conditions associated with the deposit. Each of these elements plays a vital role in ensuring that the receipt serves its purpose as proof of the deposit and outlines the terms of the investment.

Examples of Using the Fixed Deposit Receipt Format PDF

Examples of utilizing the Fixed Deposit Receipt Format PDF can vary based on individual circumstances. For instance, a person may use this document to verify their investment when applying for a loan or to track their financial portfolio. Additionally, businesses may require the receipt for accounting purposes or to demonstrate liquidity. Understanding these practical applications can enhance the value of maintaining accurate records of fixed deposits.

Quick guide on how to complete fixed deposit receipt format pdf

Effortlessly complete Fixed Deposit Receipt Format Pdf on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to quickly create, modify, and electronically sign your documents without delays. Handle Fixed Deposit Receipt Format Pdf on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The simplest way to modify and electronically sign Fixed Deposit Receipt Format Pdf with ease

- Find Fixed Deposit Receipt Format Pdf and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the risk of losing or misplacing files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Fixed Deposit Receipt Format Pdf to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an India duplicate deposit?

An India duplicate deposit refers to a specific type of financial transaction where a bank deposit is replicated for record-keeping or other purposes. This process ensures that businesses maintain accurate financial documentation and can facilitate easier audits. Understanding India duplicate deposits is crucial for companies managing their accounts effectively.

-

How can airSlate SignNow streamline the process of managing India duplicate deposits?

airSlate SignNow simplifies the documentation process related to India duplicate deposits by allowing businesses to easily create, send, and eSign necessary documents. This efficient workflow minimizes the time spent on paperwork and reduces the risk of errors. With airSlate SignNow, businesses can manage their deposit records seamlessly.

-

What are the pricing options for using airSlate SignNow for India duplicate deposits?

airSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. These plans are cost-effective and provide access to features that simplify managing India duplicate deposits. Carefully reviewing the pricing structure will help you choose the best option for your organization's needs.

-

Can airSlate SignNow integrate with other financial software for India duplicate deposits?

Yes, airSlate SignNow seamlessly integrates with various financial software systems that are essential for handling India duplicate deposits. This integration allows for synchronization of data, ensuring that deposits are tracked accurately across platforms. Streamlining your document workflow enhances operational efficiency.

-

What features does airSlate SignNow offer for document management related to India duplicate deposits?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning options specifically beneficial for managing India duplicate deposits. These features empower businesses to handle their documents efficiently and maintain compliance with legal standards. The user-friendly interface enhances the overall experience.

-

How can eSigning help expedite the process of India duplicate deposits?

eSigning with airSlate SignNow can signNowly expedite the process of handling India duplicate deposits by allowing stakeholders to sign documents electronically, eliminating the need for in-person meetings. This quickens the approval process and increases productivity. Digitally managing your deposits ensures timely and accurate financial transactions.

-

Are there any security measures in place for managing India duplicate deposits with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to India duplicate deposits. With comprehensive encryption, secure cloud storage, and strict access controls, your financial information is safeguarded from unauthorized access. This ensures your sensitive data is managed securely.

Get more for Fixed Deposit Receipt Format Pdf

Find out other Fixed Deposit Receipt Format Pdf

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT