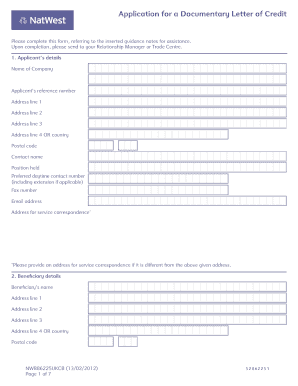

Application of Credit Form

What is the application of credit form?

The application of credit form is a document used by individuals or businesses to apply for credit from financial institutions or lenders. This form typically collects essential information about the applicant's financial history, income, and creditworthiness. It serves as a basis for the lender to assess the risk of extending credit and to make informed decisions regarding loan approvals or credit limits.

How to use the application of credit form

Using the application of credit form involves several steps. First, gather all necessary personal and financial information, such as your Social Security number, employment details, and income sources. Next, fill out the form accurately, ensuring that all required fields are completed. Review the information for accuracy before submitting the form to the lender. Depending on the lender's process, you may be able to submit the form electronically or via traditional mail.

Steps to complete the application of credit form

Completing the application of credit form involves a systematic approach:

- Gather Information: Collect necessary documents, including identification and financial statements.

- Fill Out the Form: Provide accurate details in each section, including personal information and financial history.

- Review: Double-check all entries for errors or omissions.

- Submit: Send the completed form to the lender through the preferred submission method.

Legal use of the application of credit form

The application of credit form is legally binding when completed and submitted correctly. To ensure its legality, it must comply with relevant regulations, including the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA). These laws protect consumers and ensure that lenders provide fair access to credit. Additionally, using a secure platform for electronic submissions can enhance the legal standing of the document.

Key elements of the application of credit form

Several key elements are essential in the application of credit form:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Income sources, monthly expenses, and existing debts.

- Credit History: Previous credit accounts and payment history.

Form submission methods

The application of credit form can typically be submitted through various methods, including:

- Online Submission: Many lenders offer an online portal for electronic submissions, which is often faster and more secure.

- Mail: You can print the completed form and send it via traditional mail to the lender's address.

- In-Person: Some lenders may allow you to submit the form in person at their branch locations.

Quick guide on how to complete application of credit form

Prepare Application Of Credit Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without any hold-ups. Manage Application Of Credit Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Application Of Credit Form seamlessly

- Find Application Of Credit Form and hit Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form navigation, or errors that require new copies of documents to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Application Of Credit Form to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the application of credit form used for?

The application of credit form is used to request credit or financing from lenders or financial institutions. It collects the necessary information about the applicant's financial status, business needs, and creditworthiness. By using this form, businesses can streamline the credit application process and facilitate quicker approvals.

-

How does airSlate SignNow simplify the application of credit form process?

airSlate SignNow simplifies the application of credit form process by allowing users to create, send, and eSign documents online quickly. This eliminates the need for physical paperwork and helps businesses save time and improve efficiency. Additionally, the platform ensures that all parties involved can easily track and manage their applications.

-

What features does airSlate SignNow offer for the application of credit form?

airSlate SignNow offers several features designed to enhance the application of credit form, including customizable templates, electronic signature capabilities, and mobile-friendly access. Users can also utilize workflow automation, which streamlines the approval process by notifying signers at every step. These features contribute to a more organized and efficient credit application experience.

-

Is there a cost to use airSlate SignNow for the application of credit form?

Yes, airSlate SignNow provides cost-effective pricing plans that cater to different business needs when using the application of credit form. Pricing depends on the features required and the number of users. With a variety of plans available, businesses can choose a solution that fits their budget while still benefiting from high-quality eSigning services.

-

Can I integrate airSlate SignNow with other applications for the application of credit form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as CRM systems, accounting software, and cloud storage solutions. This interoperability enhances the functionality of your application of credit form, enabling you to automate and manage your credit processing workflows effectively.

-

What benefits can my business expect from using airSlate SignNow for the application of credit form?

By using airSlate SignNow for the application of credit form, your business can expect improved turnaround times, better document security, and enhanced accuracy in data collection. The platform's user-friendly interface allows for quick adoption, ensuring your team can focus on what matters most—growing your business. Additionally, electronic signatures enhance customer convenience and boost satisfaction.

-

Is the application of credit form compliant with legal standards?

Yes, the application of credit form processed through airSlate SignNow complies with legal standards such as eSignature laws, ensuring that all electronic signatures are valid and enforceable. The platform adheres to stringent security protocols and industry regulations, providing businesses with peace of mind when handling sensitive financial information. This compliance helps mitigate risks associated with credit applications.

Get more for Application Of Credit Form

Find out other Application Of Credit Form

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later