Trec Financing Form

What is the TREC Financing?

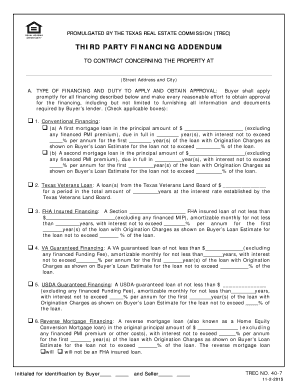

The TREC financing refers to a specific form used in Texas real estate transactions, particularly for third-party financing arrangements. This form is essential for buyers who are securing financing through a lender to purchase a property. It outlines the terms of the financing agreement and ensures that all parties involved understand their obligations. The Texas Real Estate Commission (TREC) governs this form, ensuring it meets legal standards and protects the interests of both buyers and lenders.

How to Use the TREC Financing

Using the TREC financing form involves several steps. First, the buyer must fill out the form accurately, providing details about the property, the financing amount, and the lender's information. Once completed, the form needs to be signed by all parties involved, including the buyer and the lender. It is crucial to review the form carefully to ensure all information is correct and compliant with Texas laws. Once signed, the form can be submitted to the appropriate parties to finalize the financing process.

Steps to Complete the TREC Financing

Completing the TREC financing form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect details about the property, financing terms, and lender information.

- Fill out the form: Accurately input all required information into the TREC financing form.

- Review the form: Check for any errors or omissions that could affect the financing.

- Obtain signatures: Ensure all relevant parties sign the form to validate the agreement.

- Submit the form: Send the completed form to the lender and keep a copy for your records.

Legal Use of the TREC Financing

The TREC financing form is legally binding when executed correctly. To ensure its legal standing, it must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This compliance guarantees that electronic signatures and documents are recognized as valid in Texas. Additionally, using a secure platform for signing and storing the document enhances its legal enforceability.

Key Elements of the TREC Financing

Understanding the key elements of the TREC financing form is vital for all parties involved. Important components include:

- Property description: Clear identification of the property being financed.

- Financing details: Information about the loan amount, interest rate, and repayment terms.

- Parties involved: Names and contact information of the buyer and lender.

- Signatures: Required signatures from all parties to validate the agreement.

Eligibility Criteria

To utilize the TREC financing form, certain eligibility criteria must be met. The buyer must be legally capable of entering into a contract, which typically means being of legal age and sound mind. Additionally, the buyer must have secured financing from a recognized lender. It is also essential that the property being financed meets any specific requirements set forth by the lender or TREC.

Quick guide on how to complete trec financing

Complete Trec Financing effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed documents, enabling users to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle Trec Financing from any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign Trec Financing with ease

- Locate Trec Financing and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred method to send your form via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign Trec Financing to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is TREC third party financing?

TREC third party financing refers to the financing options available through third parties during real estate transactions in Texas. This financing can help buyers obtain the necessary funds to complete a purchase. Using airSlate SignNow, you can streamline the signing process of documents related to TREC third party financing efficiently.

-

How does airSlate SignNow facilitate TREC third party financing?

airSlate SignNow offers a platform for eSigning documents related to TREC third party financing, ensuring that all parties can review and sign necessary agreements quickly. The platform's intuitive interface simplifies the process, enhancing visibility and reducing delays. This allows for a more efficient and effective financing process.

-

What are the benefits of using airSlate SignNow for TREC third party financing?

Using airSlate SignNow for TREC third party financing provides numerous benefits, including reduced paperwork and faster transaction times. It enhances the signing experience for all parties involved, thus improving customer satisfaction. Furthermore, it ensures compliance with TREC regulations during the financing process.

-

Is airSlate SignNow suitable for different types of financing agreements?

Yes, airSlate SignNow is versatile and suitable for various types of financing agreements, including TREC third party financing. Its customizable templates allow users to tailor documents to fit their specific needs. This adaptability makes it an essential tool for agents and clients involved in real estate transactions.

-

What features does airSlate SignNow offer for TREC third party financing documents?

airSlate SignNow provides features such as customizable templates, flexible signing options, and real-time tracking of document status for TREC third party financing documents. These features make the eSigning process smooth and efficient. Users can also store and manage their documents securely within the platform.

-

How does pricing for airSlate SignNow compare for TREC third party financing needs?

airSlate SignNow offers competitive pricing tailored to various business needs, including those that involve TREC third party financing. The pricing structure is straightforward, with options for individual users as well as teams. This cost-effective solution ensures businesses can manage their financing documentation without exceeding their budgets.

-

Can airSlate SignNow integrate with other software for TREC third party financing?

Absolutely, airSlate SignNow integrates seamlessly with many popular software tools, enhancing its utility for TREC third party financing. These integrations allow users to import data and documents directly into the platform, streamlining the financing process. This connectivity further enhances productivity and reduces manual data entry errors.

Get more for Trec Financing

- Kenya scouts association registration form

- Formato de solicitud de beca

- Nys department of labor license and certification unit phone number form

- Plate transfer declaration form

- Hr diagram worksheet form

- Covid judicial release ohio form

- Mock recall template form

- Water assistance program notice of withdrawal form

Find out other Trec Financing

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy